Sugar #11 May’22

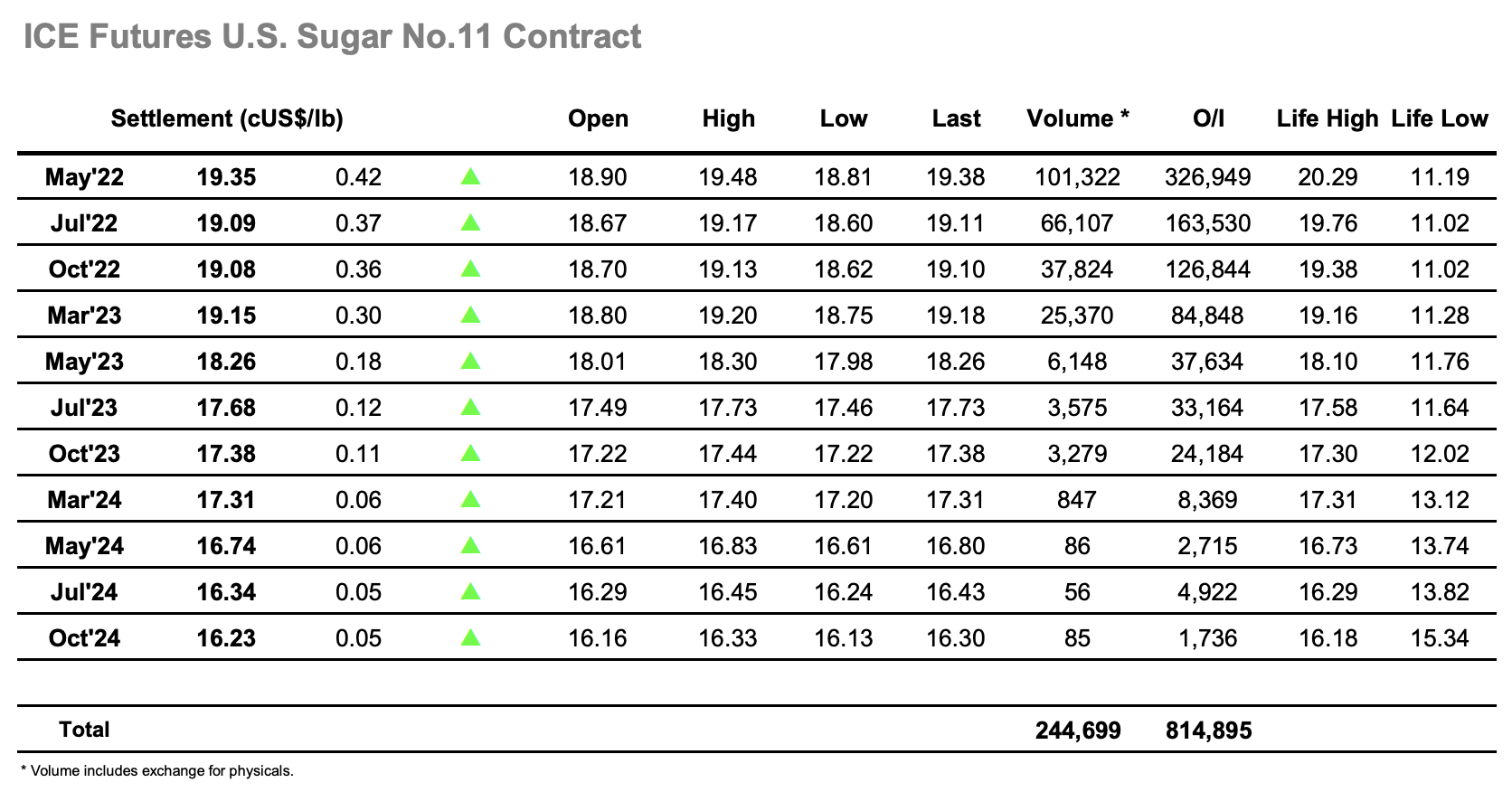

Following three days of significant gains the market was somewhat quieter this morning with May’22 consolidating quietly either side of 18.90, though there was no sign that prices would retreat very far with steady buying in place from specs despite the continuing presence of overhead producer scale orders. All was calm until the afternoon when the start of the Americas day brought far more sizable spec/fund interest out which quickly led to a push through 18.98 resistance and on to 19.15. The technical picture was now leading the move in conjunction with the macro, and over the course of the following hours May’22 maintained a steady trajectory to target the December high mark at 18.47, topping out a single point above this mark at 18.48 and creating a new short-term double top for the technicians. Having gained almost two cents over the week (Monday’s low was 17.58) against a backdrop of fundamental nervousness it was understandable that a good deal of pre-weekend profit taking emerged from smaller traders ahead of the weekend, sending the price back to 19.18 in the process. This pullback damaged the nearby spreads which had been showing some positivity earlier in the day, and though buying returned for the close to leave May’22 heading into the weekend at 19.35 the May/Jul’22 was short of its highs at 0.26 points. The geopolitical situation is such that it is tough to predict the next move. Having rallied so rapidly to cover the past 3-month range this week the market is well into overbought territory and should ordinarily be expected to cool for the near term at least, however these are not normal times and so such predictions are dangerous, and it seems the only certainty is that it will continue to be volatile.