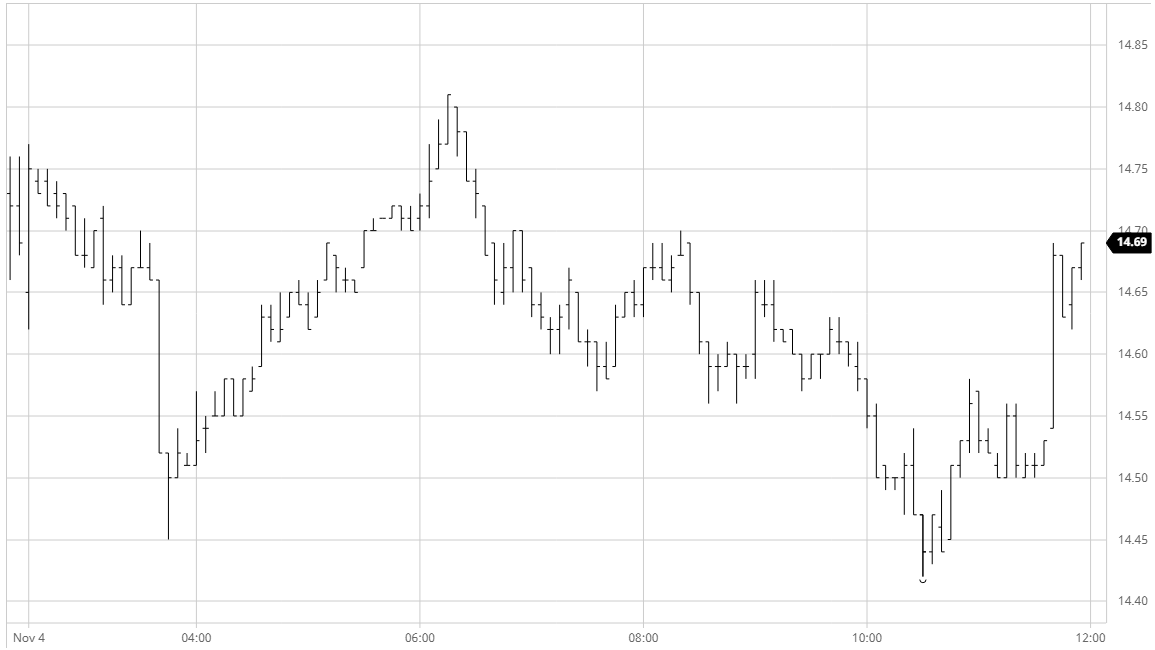

Mar 21 – Sugar No.11

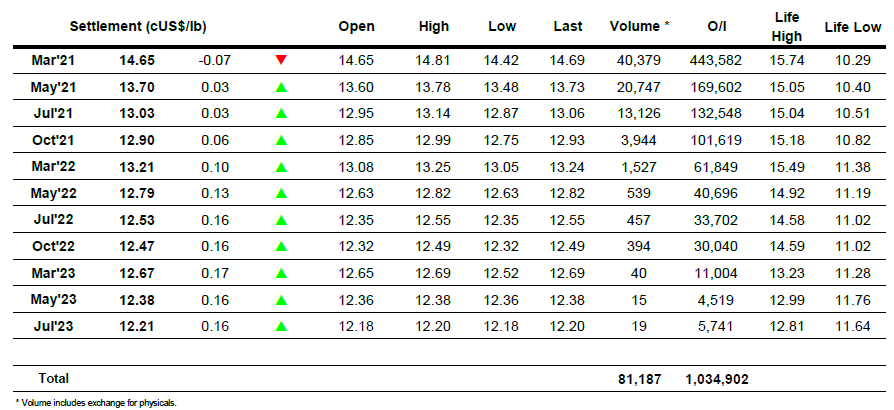

A mixed opening saw March’21 trading either side of unchanged however with buying proving very limited we soon started to edge downward on very light volume. Slipping beneath the opening low triggered some light spec liquidation which sent us quickly down to 14.45 on just 2,000 lots of volume, however as the selling eased we soon reversed and began a recovery which led March’21 to a session high 14.81 by the end of the morning. Uncertainty over the outcome of the US election was providing some mixed movement across the wider macro world and we seemed content to do our own thing with values easing back into the range to drift on continuing low volumes. Negative March’21 spread movement which saw the March/May’21 differential back to 0.93 points was not helping the bulls and by late afternoon the lack of buying interest led prices to slide with the front month down to 14.42. We continued at the lower end of the range until the final 20 minutes when some defensive buying arrived to push March’21 up from 14.54 to 14.69 on less than 800 lots. These gains were maintained into the call leaving values rather neutral with March’21 only a few points lower while the rest of the board showed modest gains.

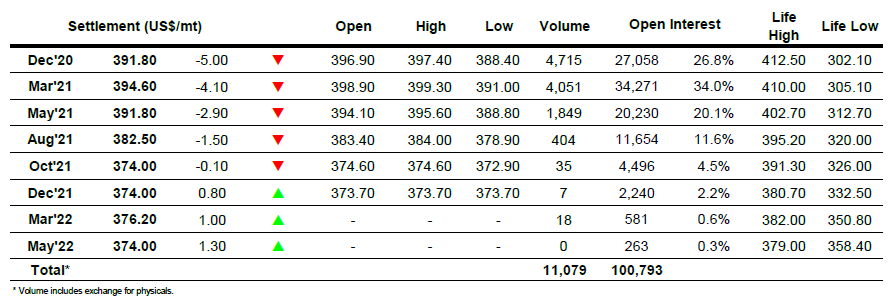

Dec 20 – Sugar No. 5

The day began with nearby values near to unchanged levels however we soon began to slide as uncertainty over the outcome of the US Presidential elections led to some weakness across the macro. In truth there was very little selling behind the slide and it was more a lack of buying combining with apathy which led prices down to $ 392.50 for March’21 before stabilising as some light buying interest finally emerged. Despite the recovery the market consistently lagged behind the No.11 and this resulted in 2021 white premium values narrowing back inwards over the course of the day, seeing lows of $71 for March/March’21, $89.50 for May/May’21 and $94 for Aug/Jul’21. It seems for much of a long afternoon that the day would conclude weakly however a sharp rally during the final 30 minutes pulled values away from the lows, though not by nearly enough to reverse all of the earlier losses, instead simply leaving prices in the middle of the range and facing continuing uncertainty over the near term direction.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract