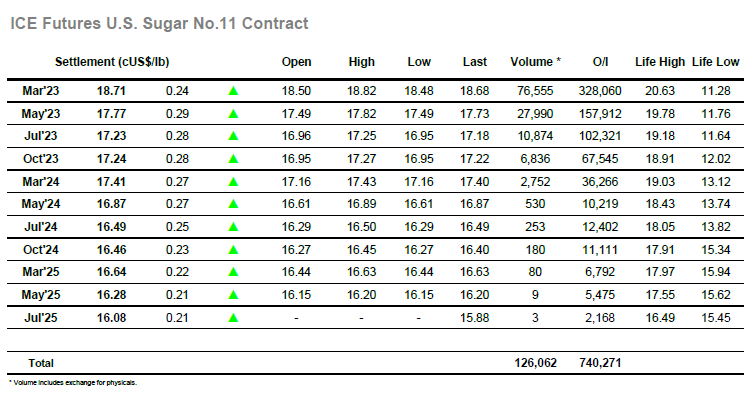

In keeping with the positivity of this week’s recovery we saw buying for the opening to immediately bump the market up to new weekly highs and consolidate in the 18.60’s. Scale selling was in place however the volumes were not prohibitive to the positive movements and with specs appearing to join the macro direction for the first time in a few days the market saw steady progress. Buying continued to flow in once the Americas day got underway and despite a small blip as day traders flipped out of some longs the move took March’23 to a high at 18.82. The higher levels were seeing more depth to the producer pricing and so another round of day trader liquidation followed on pre-weekend position squaring to send prices back into the range once again. Spreads were only seeing moderate volumes and minimal movement and so the final say of the week was left to the flat price as longs attempted to push back to the highs before throwing in the towel late on, leaving March’23 to settle at 18.71. Tonight’s COT is anticipated to show only modest change from last week due to the movements covered by the report, and while they have likely added more longs since the harder work will start from here if we are to break from the range and push through the heavier selling expected to be placed at 19c and beyond.

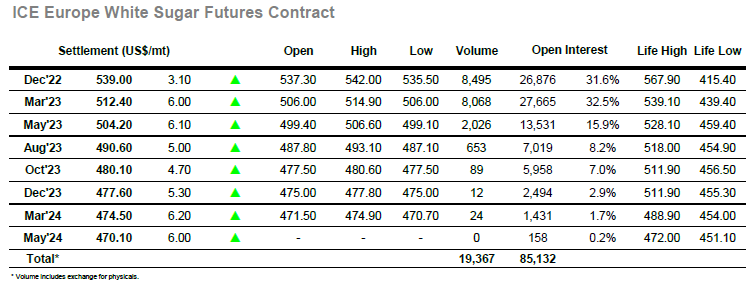

The day started positively with Dec’22 punching up to $540.00, however things soon settled, and the quieter nature of recent days resumed with prices edging along quietly in the upper $530’s. Volume again centred around the Dec’22/March’23 spread where spec rolling was applying pressure and sent the differential in to $27, limiting the Dec’22 gains while March’23 pushed ahead through $510.00. The afternoon brought no change to this scenario with prices continuing sideways for a few hours more, until the strength of No.11 and the wider macro drew in some spec buying to March’23 which took the front two prompts to $542.00 (Dec’22) and $514.90 (March’23). These levels were not sustained, and some sharp correction followed as liquidation appeared to send Dec’22 back towards the morning lows once again. The final hour remained choppy as longs looked to dress the market to a positive close, and we head into the weekend with Dec’22 at $539.00 and March’23 at $512.40.