Sugar #11 Mar’22

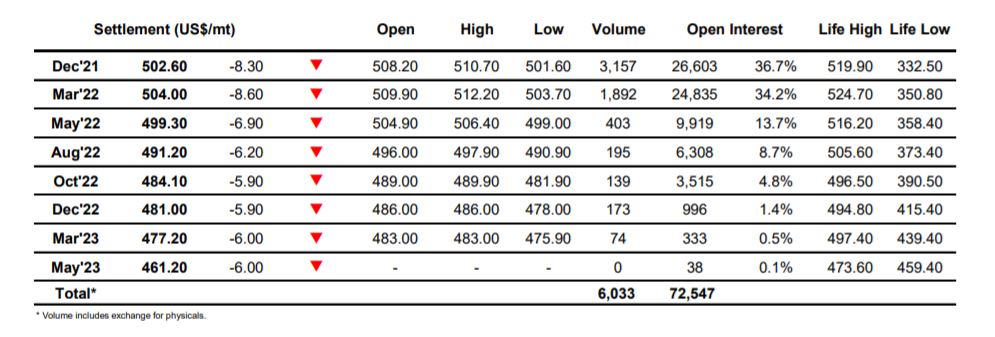

Aggressive opening selling was soon put behind us and the market settled into a very tight range near to unchanged levels where we edged along quietly for some three hours ahead of the US morning. The arrival of the wider spec community then brough selling to the fore as longs acquired on the rally last Thursday/Friday were frantically liquidated back out leading March’22 to dump some 40 points to 19.69 before stabilising. In a low news environment we are constantly looking towards the macro in the hope of something to break us out of the 19.45/20.38 band which has held for some 3 weeks now, but though fresh impetus was gained through news that Opec was maintaining its production schedule and so leading crude prices to rally the recovery was short-lived. Another tip out from day traders sent March’22 back to the bottom of the range with further exploration of the lower end during the latter stages seeing a daily low at 19.63. There was some light MOC buying which ensured settlement at 19.69 and though we are now exploring the lower end of the range again there will be some scale buying to work through if we are to break out of the ongoing range.

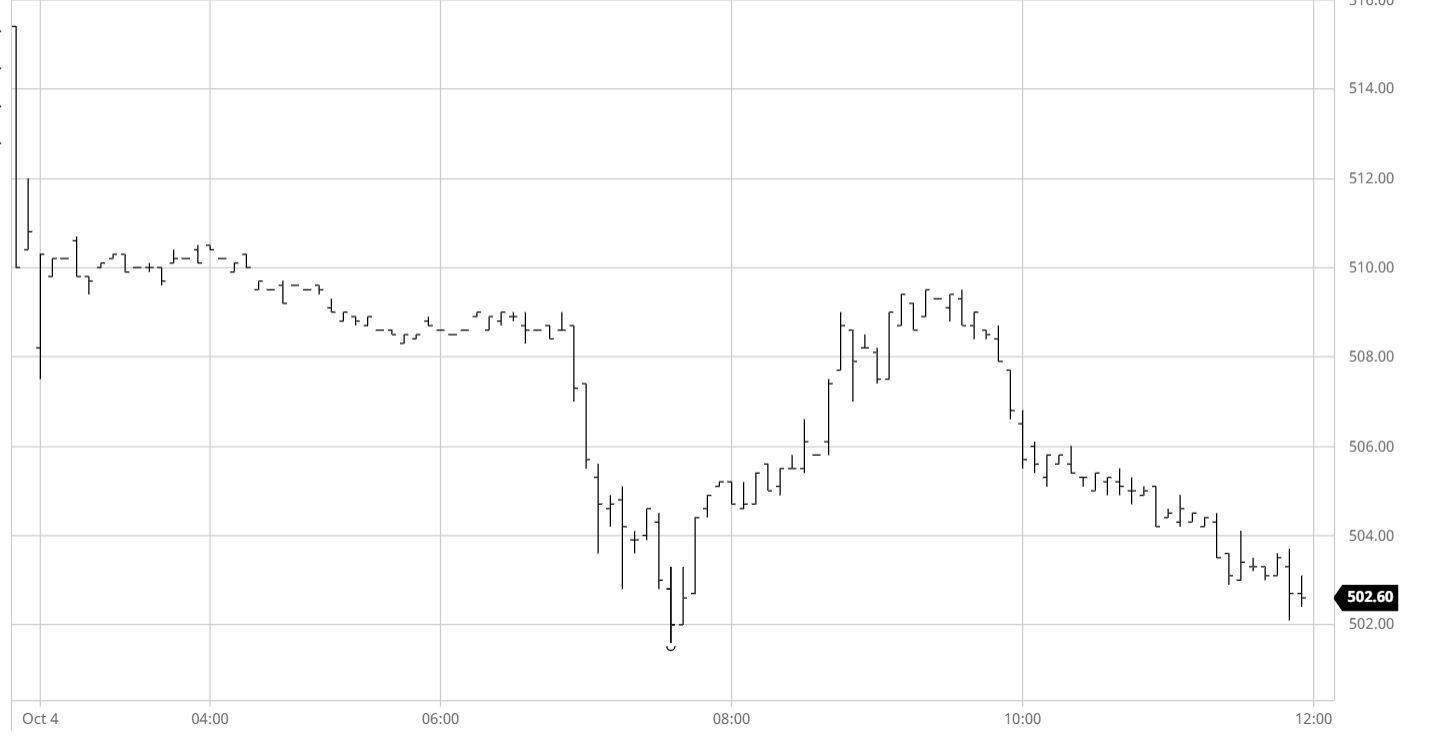

Sugar #5 Dec21

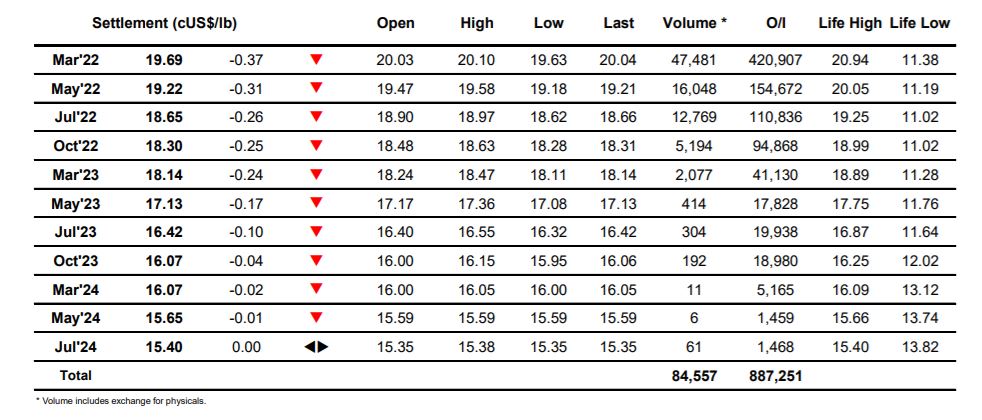

Dec’21 spiked briefly lower on the opening and though the market then calmed with a period spent holding back near to unchanged levels it was unconvincing and the longer the morning drew out so prices began to creep lower once more. The move will have been a disappointment to those bulls who have been attempting to reinvigorate the upside and clearly the late pullback on Friday did more than superficial damage as the afternoon brough further spec long liquidation into the sugar sector, knocking the price back to $501.60. This put us back in line with last Thursdays low from which the two day surge had launched and cements the view that without some major news there is no obvious way to escape the range bound stalemate. A macro move back towards unchanged did follow on the back of news that Opec is maintaining its production schedule and the resultant crude rally, however our own lack of bullish news then pulled things back into the range. More pressure was applied as we worked into the final hour though whites stood up better to this than No.11 with the outcome being a firming of the white premiums as March/March’21 reached back to $72 from a morning low at $68. The close saw selling which left Dec’21 settling at $502.60 with another exploration of the recent support now anticipated.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract