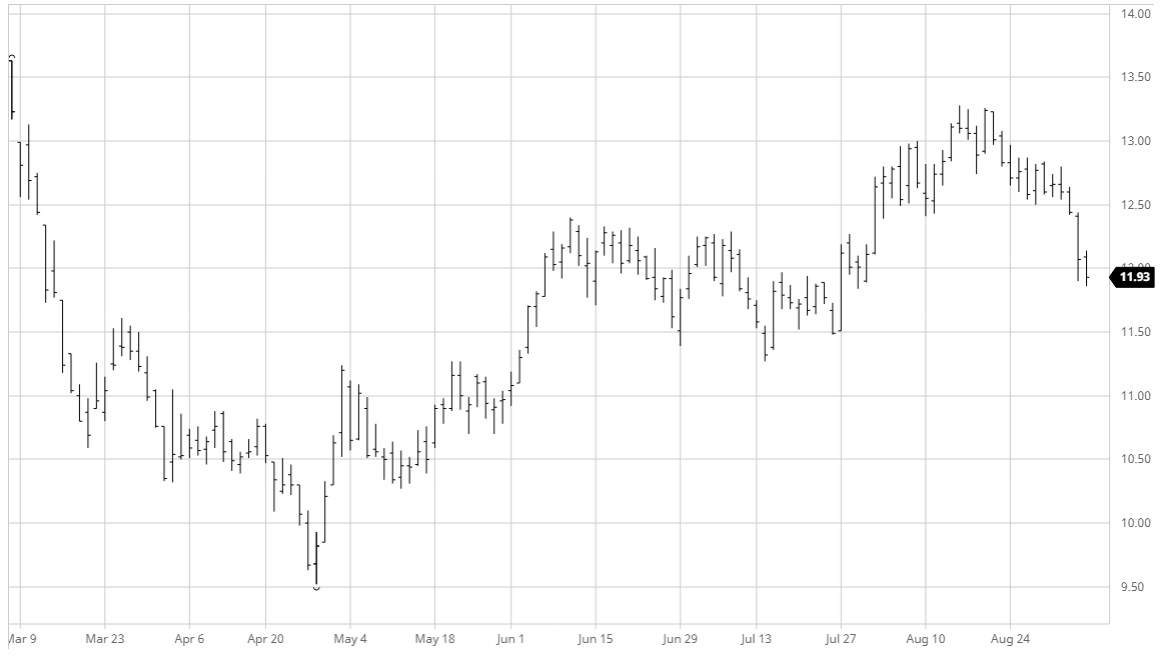

The sharp losses incurred yesterday brought in some early buying from consumers, encouraged by the lowest levels seen for the market since late July. This support enabled Oct’20 to push upward a little to a morning high of 12.14, however as so often is the case following a fall once the consumer requirements had been covered so the market struggled to find any other significant buying. What followed was another look beneath 12c although the selling lacked yesterday’s vigour and despite breaking to a new recent low as we reached mid-afternoon there was sufficient scale buying on show to prevent values from haemorrhaging once again. Today’s low at 11.86 and the former low at 11.84 will now provide light initial support with more meaningful support not seen until the 11.50 area, with a look towards this level seeming more likely given we recorded a psychologically weak settlement at 11.93.

Oct – Sugar No.11

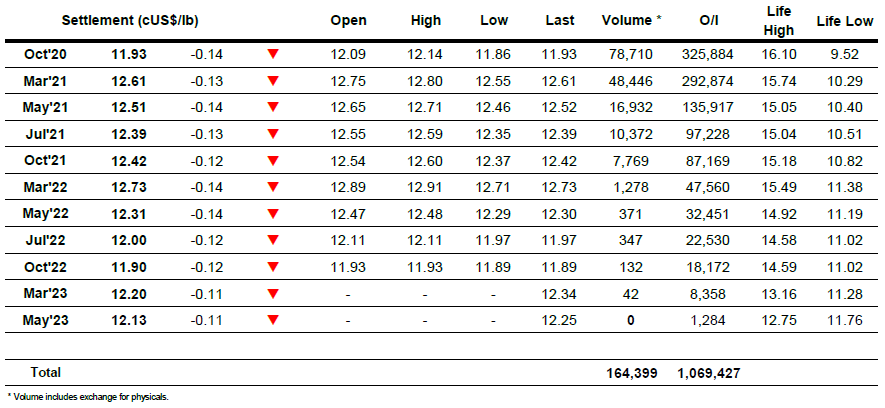

ICE Futures U.S. Sugar No.11 Contract

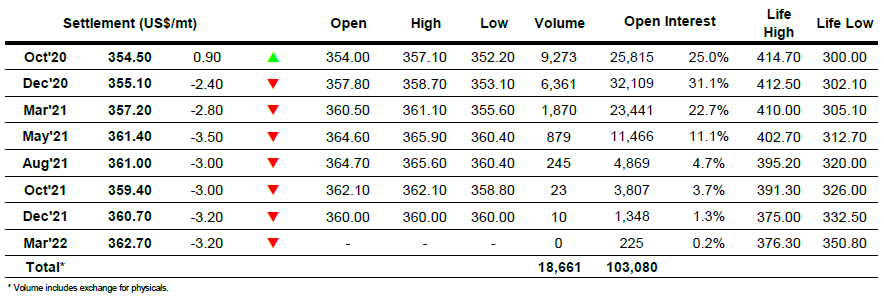

ICE Europe White Sugar Futures Contract