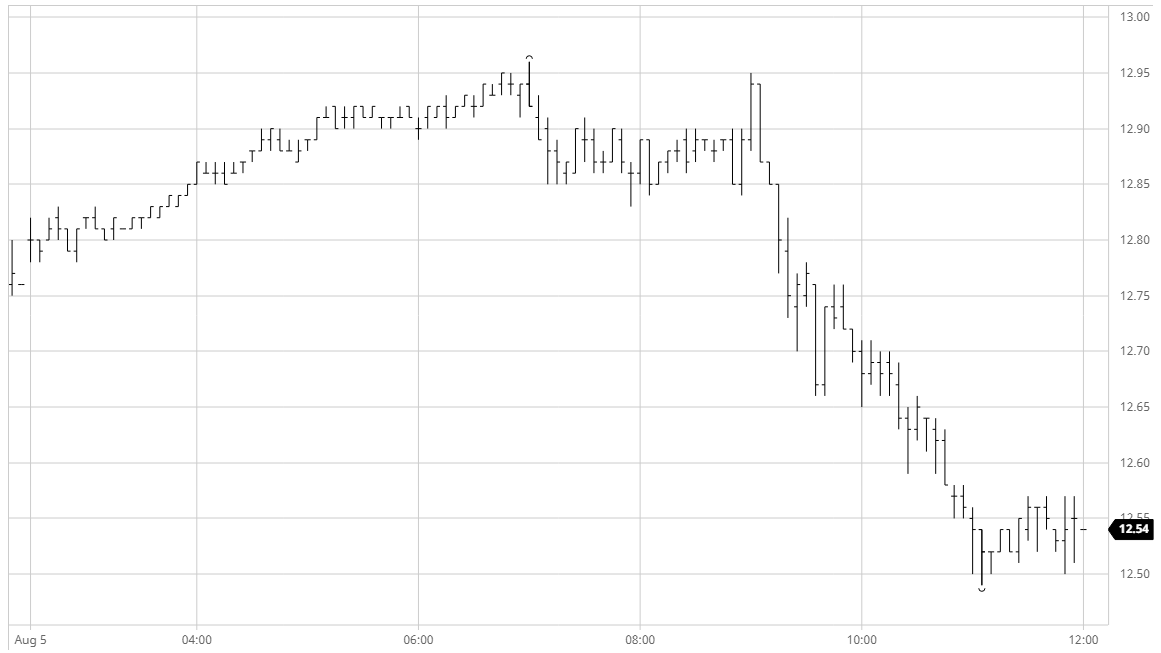

A calm start to the day saw nearby values edge to new recent highs with a firmer macro picture preventing the morning selling that has been seen over the past couple of sessions. The recent macro support has been limited to the influx of buying to softs on the back of USD weakness, but the shocking explosion in Beirut yesterday has clearly raised regional tensions with solid buying seen for both crude and precious metals. Scale selling continues to emanate from producers above the market but the slow steady morning buying gradually worked through this to place Oct’20 at 12.96 by mid-session and seemingly poised to look above 13c toward the small 13.15/13.17 gap. The US morning failed to bring the expected uptick in fund buying however and having fallen back into the morning range the failure to make new highs on a second push instead sparked some long liquidation that sent the front month quickly back into the 12.60’s and in so doing illustrated the lack of buying when the funds step back. The rest of the macro remained firm but sugar is behaving in a contrarian manner currently so to remain at the bottom of the range was somehow apt, placing its performance very near the bottom of the commodity basket for the day. Pressure continued to be applied into the final hour as we traded to 12.49 and though the decline was stemmed during the final hour we remained at the bottom end of the range going out. While negative on the day the market remained well above the former 12.25/12.40 resistance and Monday’s 12.39 low mark, so while the performance was not great for the longs we could simply be establishing into a higher range rather than representing a more significant failure.

SB Oct – Sugar No.11

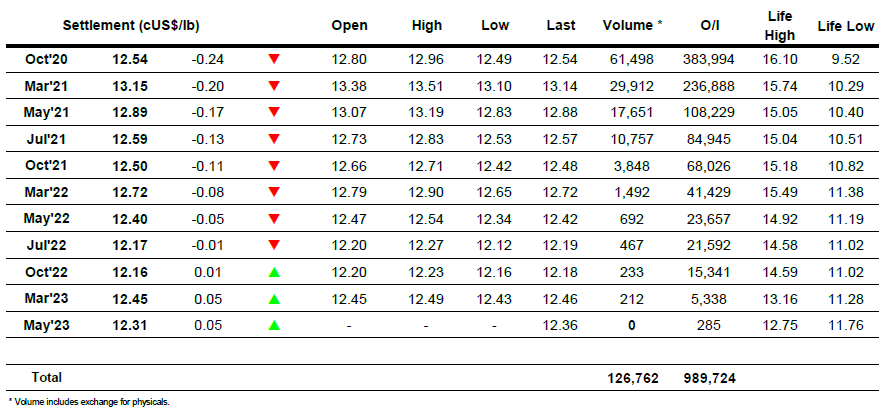

ICE Futures U.S. Sugar No.11 Contract

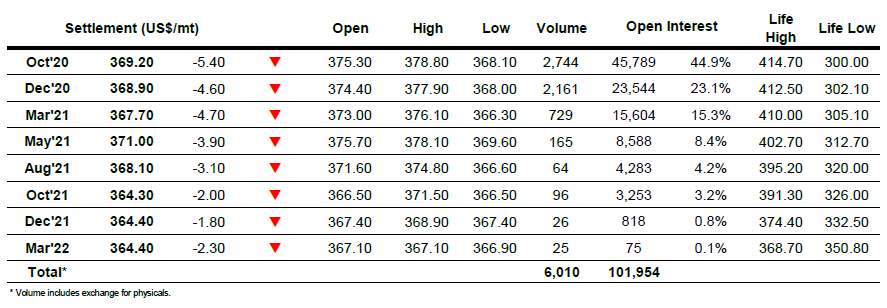

ICE Europe White Sugar Futures Contract