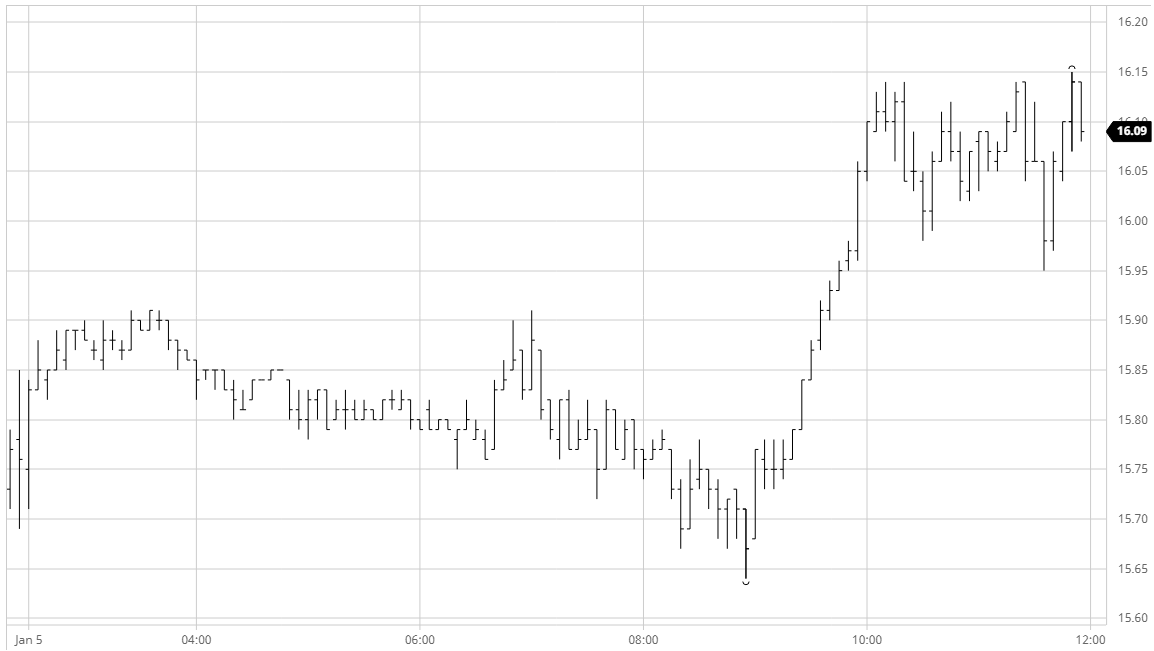

Sugar #11 Mar ’21

Following a few brief lower prints we were quickly on the front foot once again with early buying helping the March’21 contract up to the 15.90 area. In far calmer conditions than were seen yesterday a morning of quiet consolidation ensued, initially near to this 15.90 are though gradually we eased back to sit nearer to unchanged levels. The arrival of US based specs saw a small amount of new buying enter into the market however it had a limited impact with some overhead selling now beginning to build as a weaker USDBRL above 5.30 encouraged producers to try and take advantage of the better pricing levels on offer, a factor which weighed the market down until mid-afternoon, though it was notable that the specs were merely standing back from buying more rather than lightening the load. Everything then changed in quick time as specs made a concerted effort to push upwards once again, initially pushing on quite easily to work above the morning highs and then upping the volume a little to smash beyond 16c for the second successive day and reach a marginal new contract high mark of 16.14. Whether the move was purely technical or buoyed by newswire stories of Alveans positive fundamental outlook was by the by, however what became quickly obvious was that there was little desire to push outside of the nearby prompts with only March’21 and May’21 recording more than single digit gains while 2022 positions were struggling to pull back to overnight levels. This widened spread values sharply with March/May’21 reaching 0.98 points, March/Jul’21 seeing 1.59 points while March’21/March’22 traded to 1.54 points, while the flat price remained well poised ahead of the highs as we approached the closing stages. A final push of MOC buying printed March’21 to a marginal new high at 16.15, ending the day with another very strong technical positive despite the fact that two weeks of near constant gains leaves near term indicators increasingly overbought.

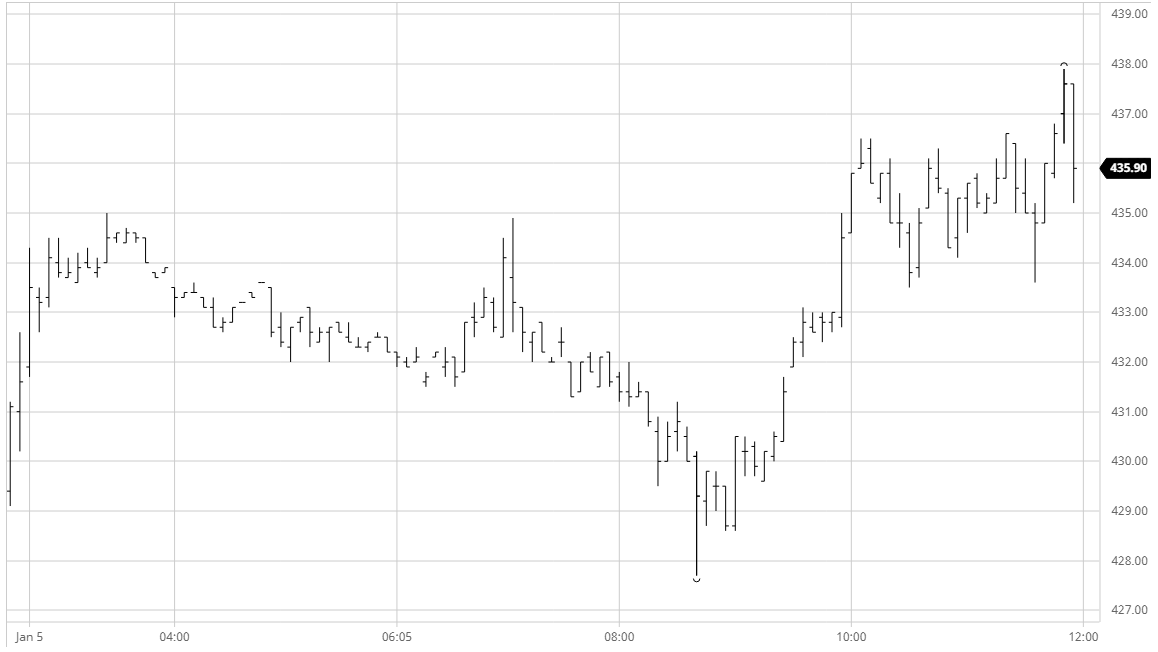

Sugar #5 Mar ’21

The very strong start to the year shows no sign of abating and this morning there was immediately buying on show for the nearby whites contracts which took March’21 up to trade $435.00 during the early stages. The pace of increase slowed with selling emerging at the higher levels and this enabled values to consolidate and enjoy a period of relative calm, easing back towards unchanged levels and taking stock of the wider situation. An unsustained move back to the morning highs as US traders began their day seemed to signal a degree of fatigue and with buyers less visible the market pulled back further to a mid afternoon low mark at $427.70. It is well documented that specs generally do not go down without a fight and questions as to the merit of the current move were soon answered as buyers returned to the foreground, swiftly pushing away from these lows and recording a swing of almost $9 to reach a new daily high at $436.50 soon afterwards. Despite the positivity that this brings to the technical picture this mark remained some $2.60 shy of yesterdays contract high, though that should not diminish from what was becoming another strong performance. The gap to yesterdays high was narrowed with a push to $437.90 during the closing stages and we settled just 0.60c below the highs to maintain the strong technical start to the year.

· Spreads today saw some reasonable movement once again though not enough to break beyond the parameters seen yesterday with March/May’21 widening from $9.50 to $11.00. White premiums were far more volatile, particularly the March/March’21 which worked out towards $85 at one stage before pushing back towards $80 as No.11 found strength during the afternoon. May/May’21 meanwhile ranged between $93 and $89.50 while Aug/Jul’21 moved from $94.50 to $91 during the afternoon.

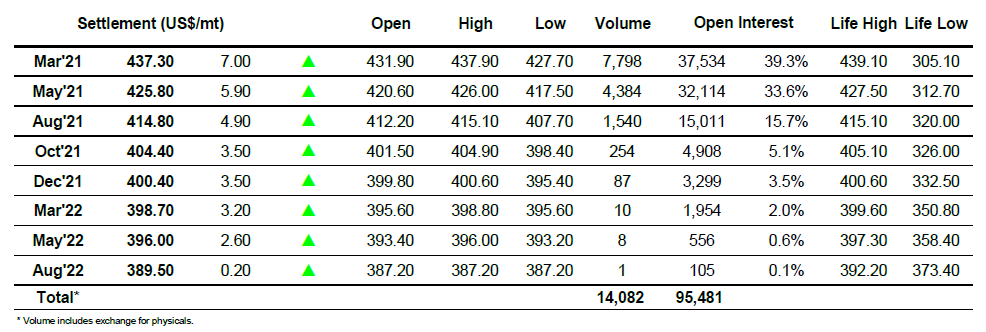

ICE Futures U.S. Sugar No.11 Contract

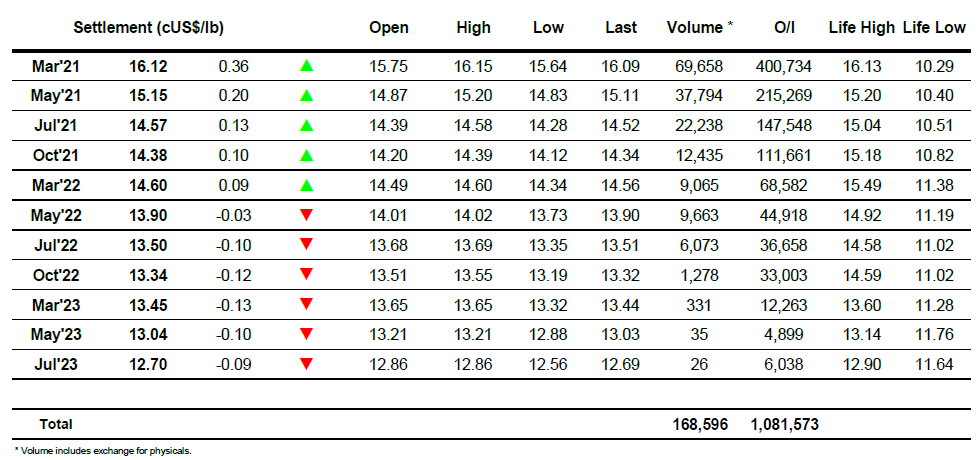

ICE Europe White Sugar Futures Contract