Sugar #11 Jul’21

The positive performance yesterday has given the spec longs a boost and with plenty of positive talk around the potential for the wider commodity sector to rise as the world gradually recovers from what we hope was the worst of the pandemic the market continued positively this morning. The little buying that we saw was led by day traders/algo’s and in the very thin environment that we are currently seeing it had a very positive impact as Jul’21 pushed quickly above 17.50 on just a few thousand lots of volume before pausing to hold at the upper levels. This start provided a strong platform from which to continue however despite holding the higher levels for several hours and extending to 17.56 we presently lack the more sizable trade or fund buying required to move ahead in a sustainable way and so as the day jobbers liquidated we found ourselves falling all the way back to opening levels. As with the outright prompts we saw only small volumes for spreads too, Jul/Oct’21 having seen a modest volume of 6,000 lots with just two hours remaining on a 5 point range with the value having extended to 0.09 points on the rally before easing back to unchanged. We continued to flit within the lower end of the days range for a while before gathering new momentum during the final hour as support arrived in reaction to surging softs values elsewhere (Coffee and Cocoa). This took the Jul’21 to a new daily high at 17.58 as we moved into the close with another positive settlement achieved at 17.53. The Jul’21 contract high mark at 17.79 is now firmly back in focus and while questions remain as to how much more the funds will want to add to their long holding events elsewhere in the commodity sector suggest that a challenge of this level is likely.

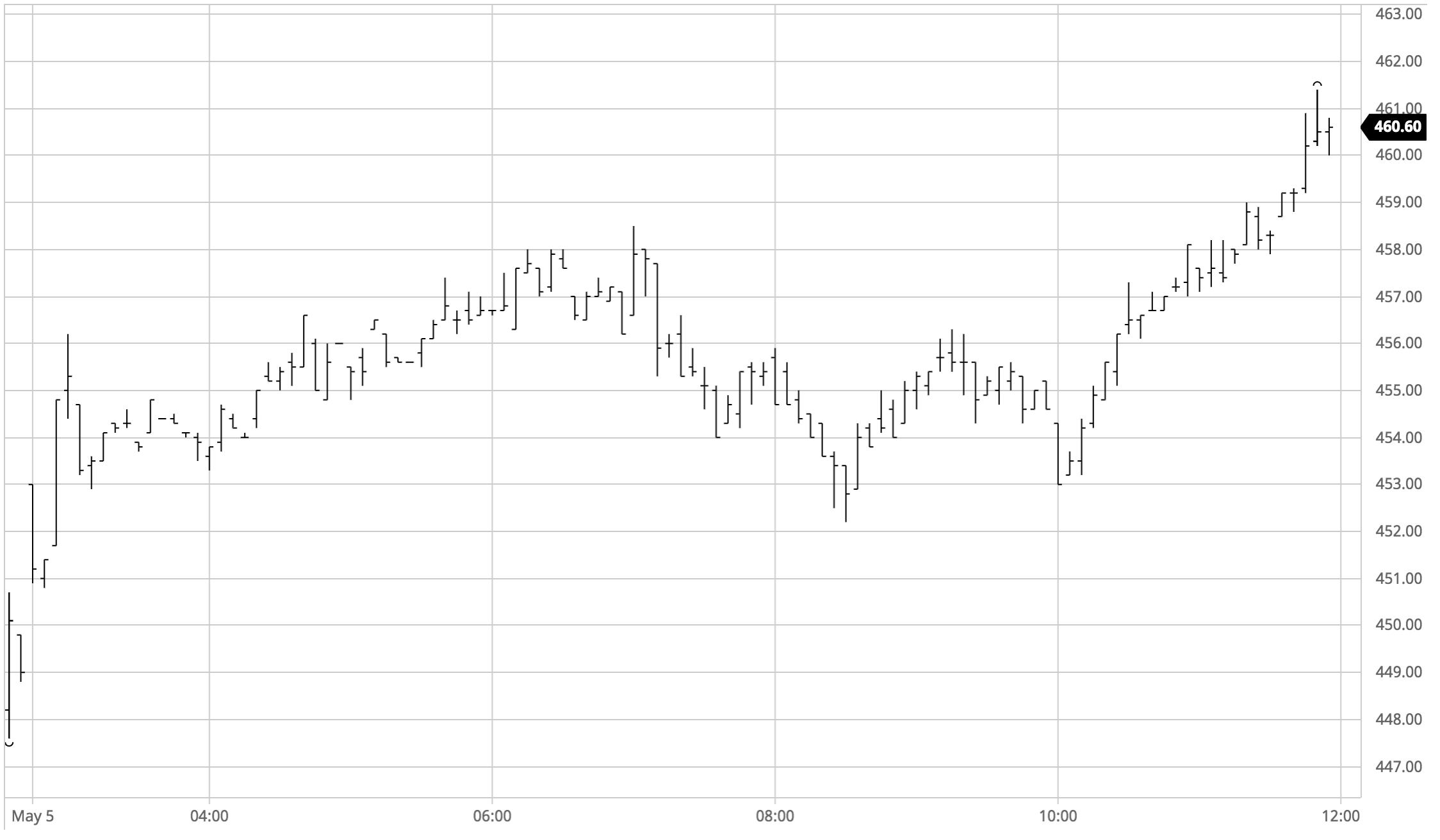

Sugar #5 Aug’21

Having started to pull away from recent lows yesterday we saw Aug’21 continuing to edge upward this morning as steady buying pushed the price upwards to reach $458.00 as we passed noon. The flat price rally continues to come in contrast to the spread and white premium direction, though with regard the Aug/Jul’21 it did at least return near to overnight levels as we reached the highs having earlier slipped to $70 as we failed to keep pace with the movement in No.11. A spike to a new session high $458.50 followed as US traders came online however this marked the end of the recovery with an easing in the buying from specs/day traders allowing values to slide back into the range once more. Volumes remain very light which is proving counter productive as it appears to be deterring some of the trade involvement and this leads to continuing swings in value with the afternoon seeing a slide back to $452.20 before the upward trend resumed. White premiums were finally cheap enough to be attracting some buying that enabled Aug/Jul’21 to recover to $75 during the afternoon, giving the flat price an extra shot in the arm as new session highs were registered during the final hour. These highs along with strength elsewhere in the softs sector combined to bring additional buying to the market during the latter stages, resulting in a session high at $461.40, while a settlement just beneath this at $460.80 provides the technical support to try and continue upwards.

· White premium values maintained their recovery through to the end of the session and closed positively at $74.50 for Aug/Jul’21, $79.50 for Oct/Oct’21 and at $80.25 for March/March’22.

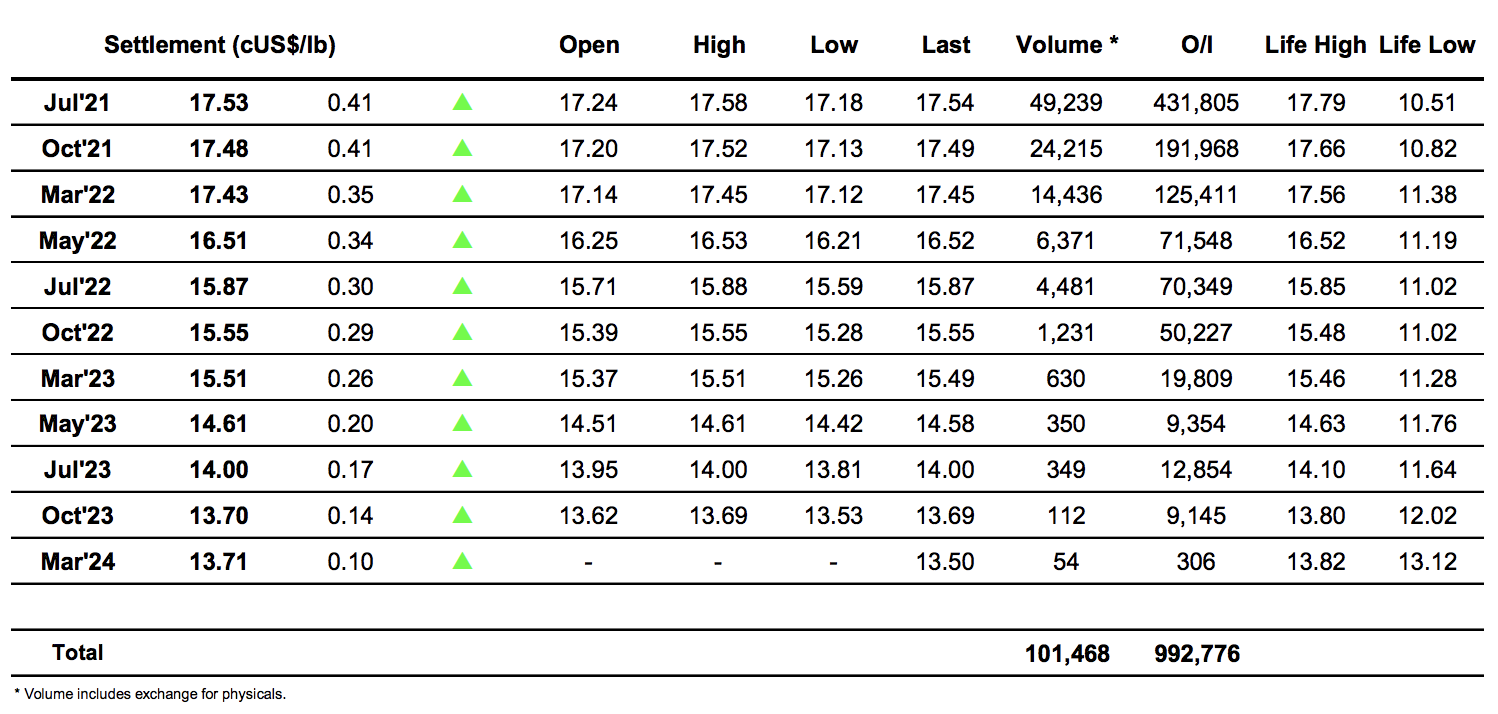

ICE Futures U.S. Sugar No.11 Contract

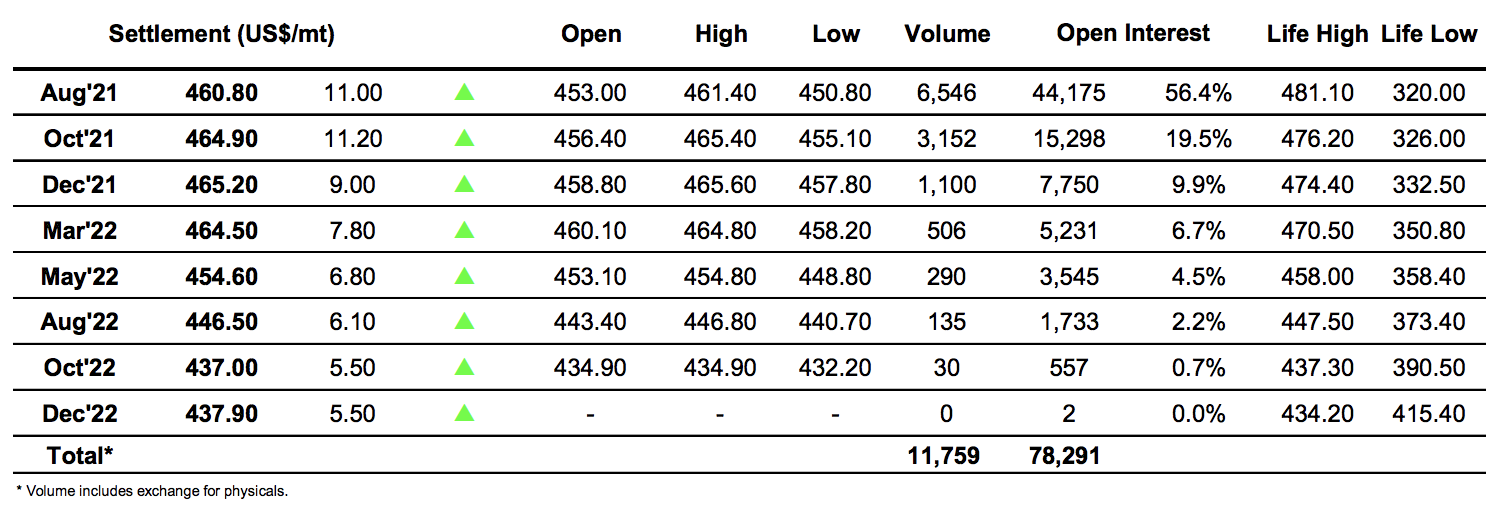

ICE Europe Whites Sugar Futures Contract