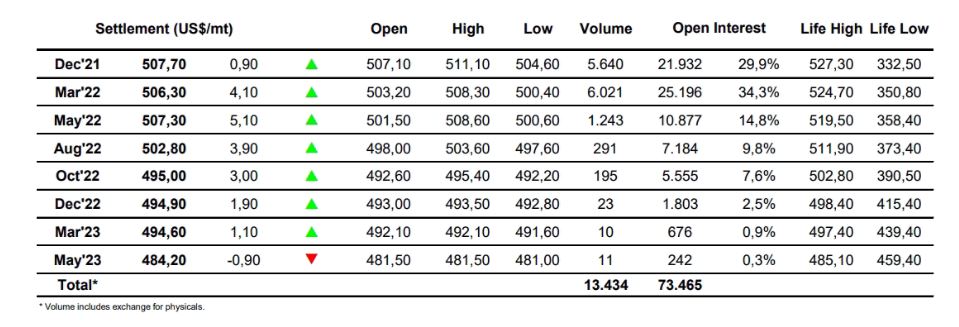

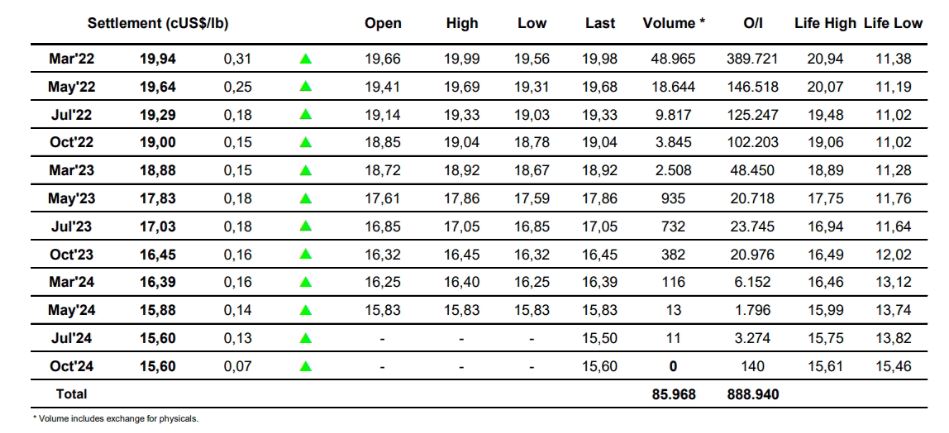

Sugar #11 Mar ’22

Morning volume was against incredibly light and the first three hours of trading saw a mere 12 point range as we struggled to move far from unchanged values. Yesterday’s performance was quite decent in the face of the selloff that the energy sector saw during the afternoon, and the positive desire of the small specs and day traders was reaffirmed as the arrival of US traders saw prices begin to edge upward once more. Though the macro was mixed we were seeing crude recover back some of the ground lost on its retreat last night, and it seemed to be this providing the impetus for March;’22 to climb beyond initial 19.86 resistance and on through the limited selling to reach 19.98. There was also supportive buying for March/May’22 as it extended out to a daily high 0.36 points while May/Jul’22 was similarly firm in reaching 0.37 points. A small retreat from the highs took place against some profit taking however in the main the buyers seemed content to hold on to their longs in the hope that a positive end to the week can provide a platform to push beyond 20c next week. Closing activity backed this up as we touched 19.99 on the post-close after settlement had been made at 19.94, leaving all eyes on the macro to see whether it can provide the continuing support we will likely require.

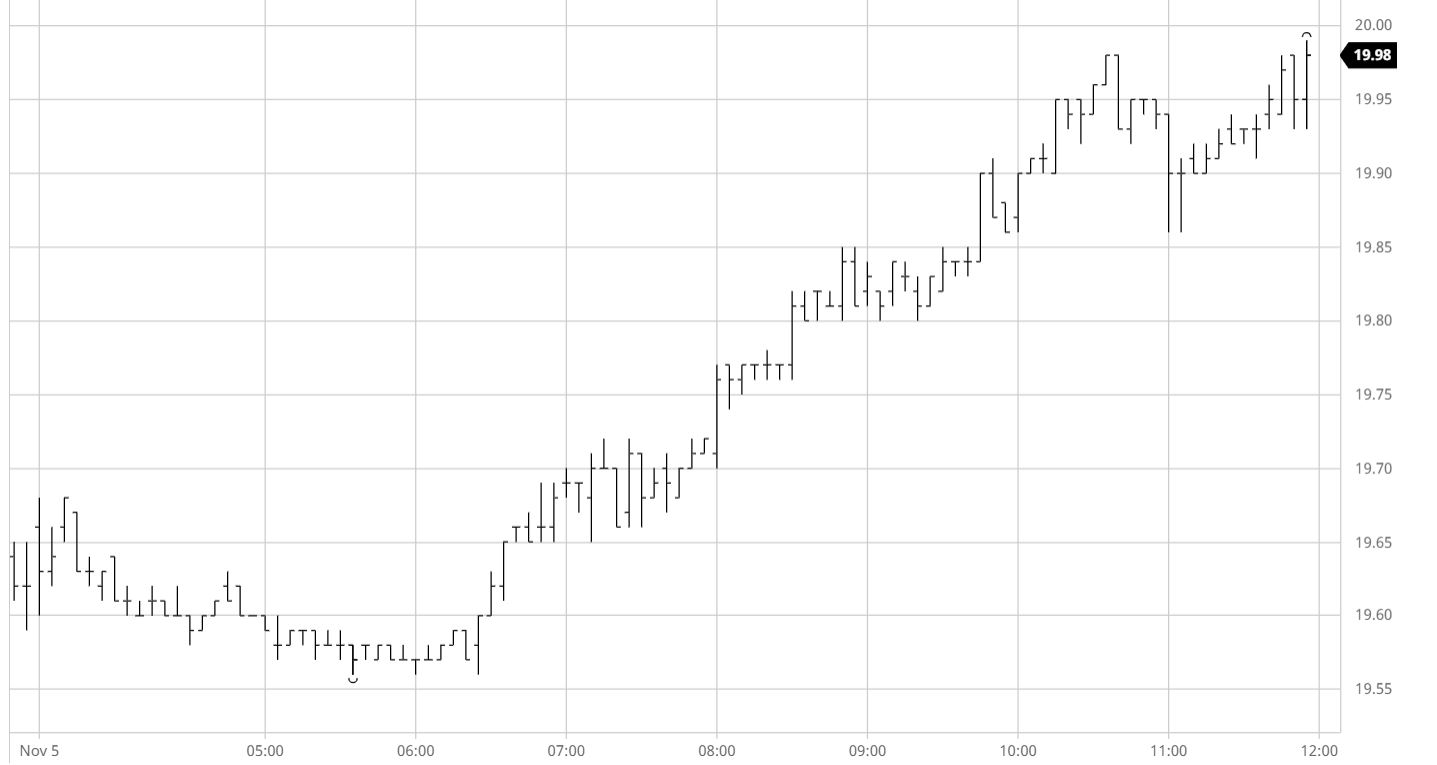

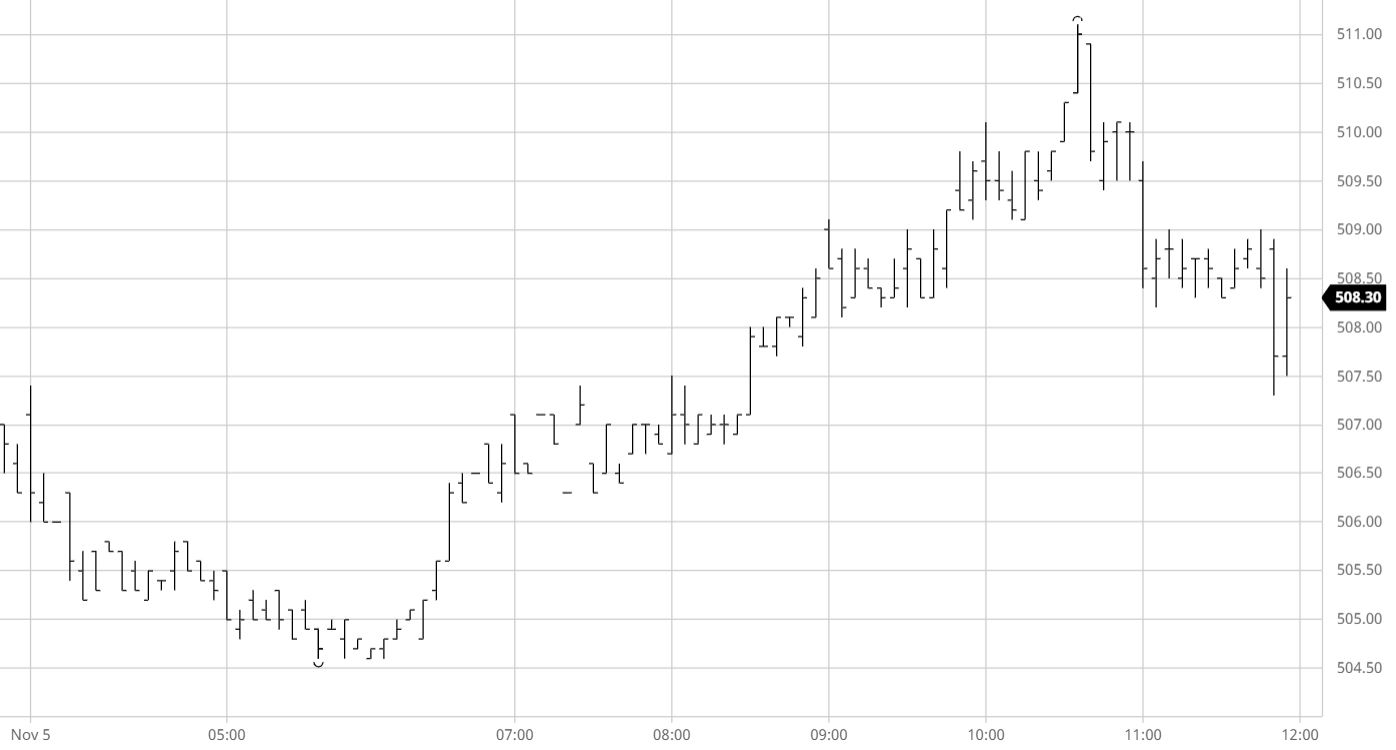

Sugar #5 Mar22

Whites continue to struggle to find any direction in the current low news / low volume environment and again today it found itself looking towards the wider macro for signals as morning trading left the price drifting aimlessly in front of $500.00. The only exception to this is the Dec’21/March’22 spread where direction is being dictated by the impending Dec’21 expiry where as we moved through the day selling sent the differential further down as specs roll forward their long holding. This was in contrast to a rising flat price that broke out of its morning range and was being pulled upward by No.11 buying, though the pace of increase was slower meaning that white premium values narrowed to show March/March’22 near to $67.00. The rally exceeded yesterday’s highs however we again stopped short of last weeks $509.50 mark, with some pre-weekend long liquidation following in and taking us back from the highs entering the final hour. Dec’21/March’22 recorded a narrowest trade at $1.30 late in the afternoon while the flat price ended the day quietly at the upper end of the range to leave March’22 settling at $506.30.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract