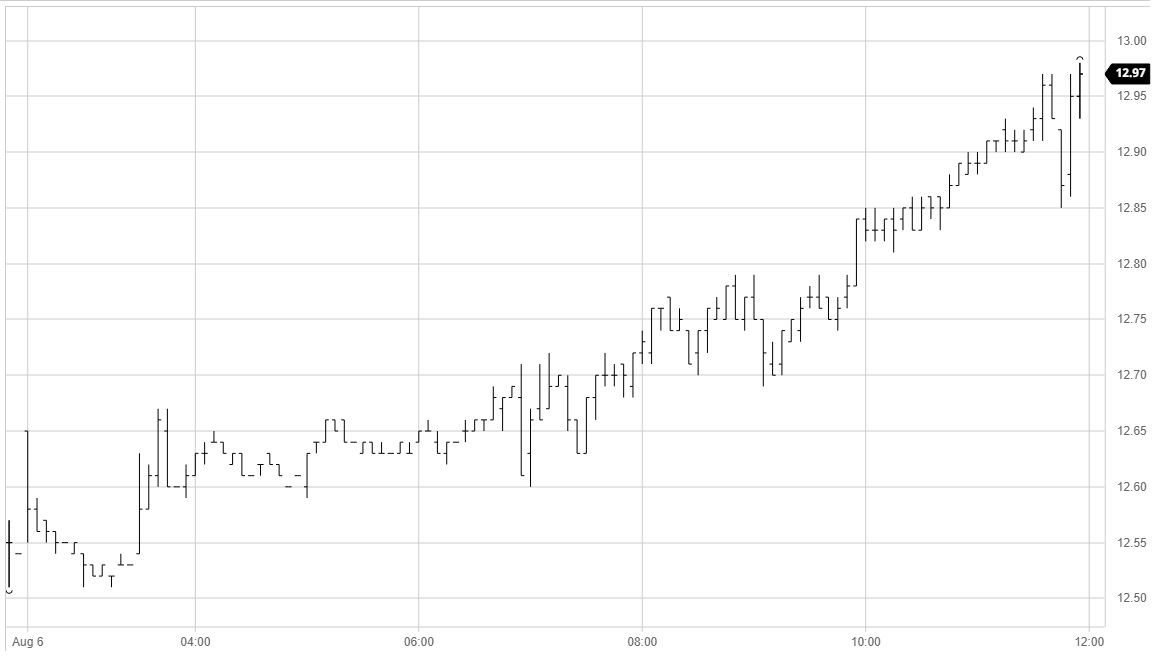

An initial bounce was quickly sold into and the market briefly retreated into negative territory, however that proved to be the low point as we then set about eradicating yesterday’s sell-off. Steady progress was made as buying eased the market upward throughout the morning with the sell side proving as limited as the buy side had yesterday within the confines of the weekly range. A little turbulence was seen as US based traders came online and it seemed that there was still some spec position management taking place through this period as the market struggled to maintain its footing for a while. The momentum then resumed and this drew both spec buying to the outright alongside some solid spread buying with the market now building a sufficient head of steam to start thinking of challenging the recent 12.96 high. Stronger producer selling at the higher levels made things more challenging as expected but that did not deter the buyers who ultimately pushed to a session high 12.98 late on in amongst some position squaring from day traders. This sets the tone nicely for a technical push to a 13 handle tomorrow and the impressive recoveries from declines this week suggests further that we are beginning to cement further into a higher range with dips starting to be seen as buying opportunities rather than reversals.

SB Oct – Sugar No.11

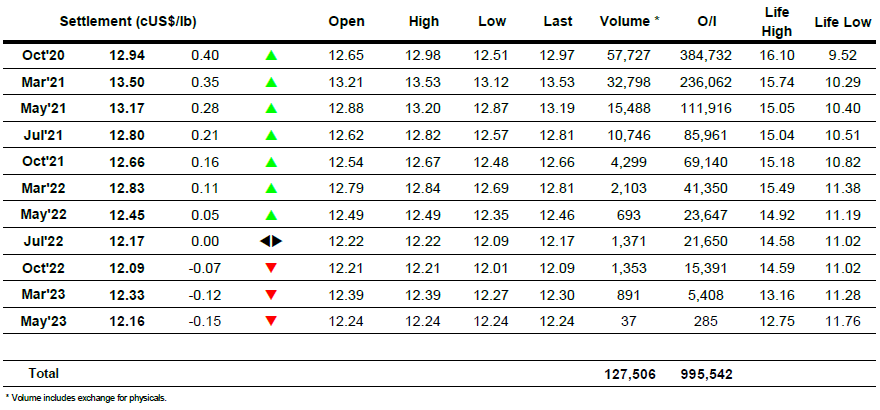

ICE Futures U.S. Sugar No.11 Contract

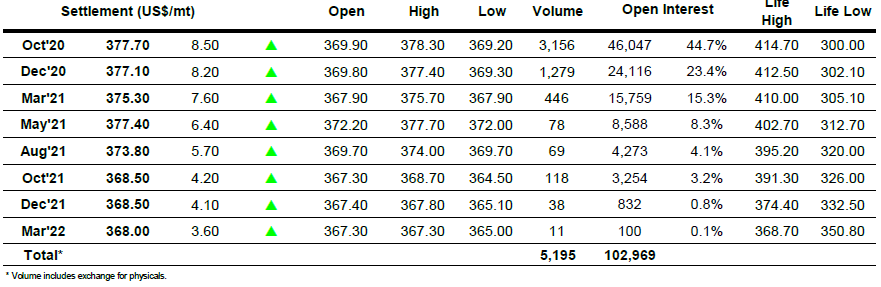

ICE Europe White Sugar Futures Contract