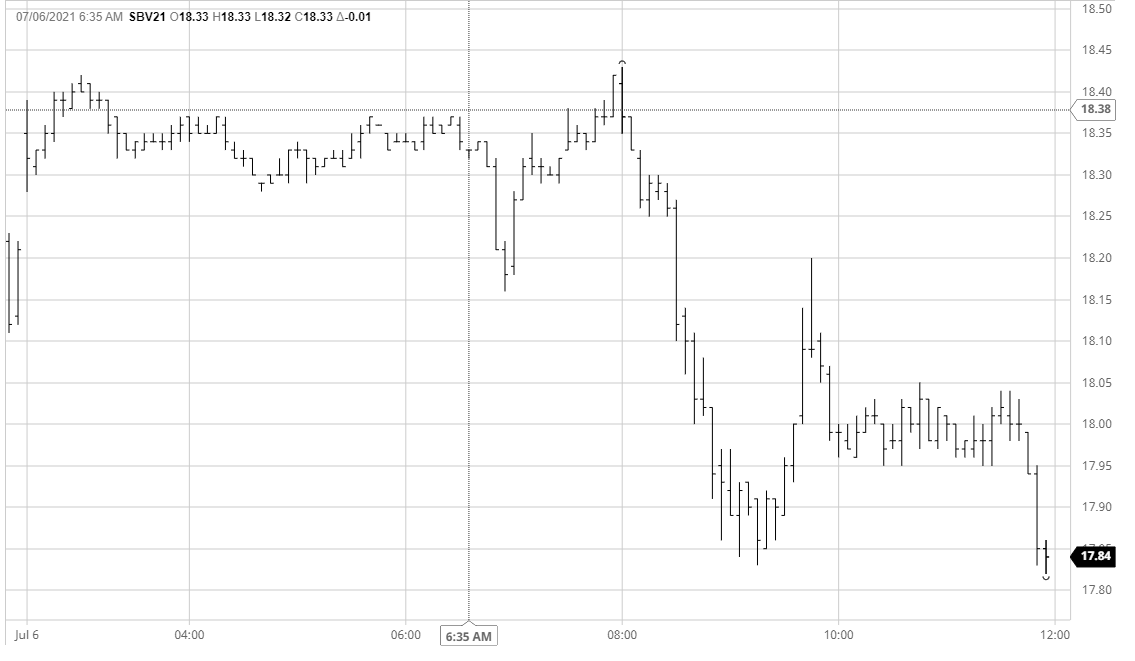

Sugar #11 Oct’21

Returning from the long weekend the market started positively, buoyed by the recent technical strength and the continuation upward by London whites yesterday. Oc’21 reached as high as 18.42 on the initial push while down the board we saw many contracts recording fresh lifetime highs, with the only thing preventing the spot month from joining them being the fall in the Oct’21/March’22 spread which is now back beneath -0.20 points once more. A calm morning ensued and aside from a brief dip as US traders came online this was maintained through to early afternoon with a marginal new daily high at 18.43 recorded. Ordinarily one would have anticipated a continuation to test further north however instead with some macro pressure beginning to emerge we saw some sharp spec long liquidation which plunged the front month back down through 18c. This was initially picked back up but the recovery could not be sustained and the price settled in the vicinity of 18c moving towards the close. With nearby spreads slumped to new daily lows the close brought with it another wave of spec selling that sent the price down to 17.82 while Oct’21/March’22 extended its losses to -0.34 points. Settlement was only just above the lows at 17.87 and with cries of key reversal following a second sharp pullback from the 18.40’s in just three days there are questions to answer as to whether further cooling is required.

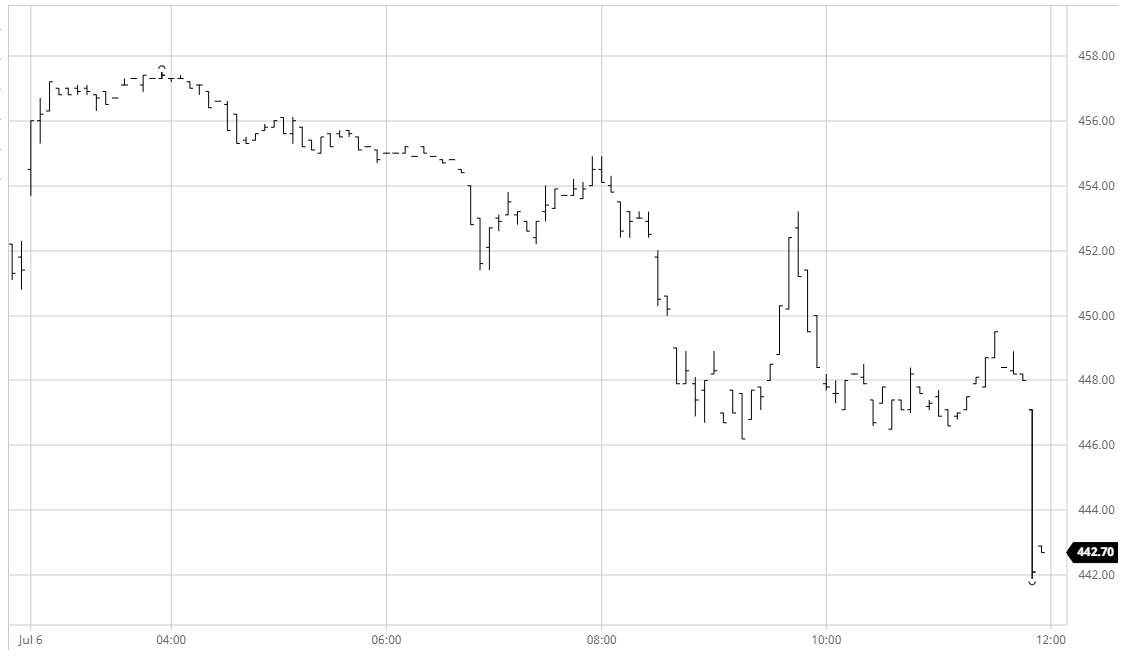

Sugar #5 Oct’21

Building upon yesterdays solid performance we saw the nearby prompts consolidating gains during early trading, and while values edged back away from the highs approaching noon the relative gains over the past two days ensured that white premium values were a little firmer than on Friday. Specs will have been looking to continue upwards however there was a sharp change in direction during the afternoon as macro concerns influenced recent longs into some liquidation which against the vacuum of the recent range saw Oct’21 plunge to the $469 area before finding any noteworthy support. The decline also impacted the Aug’21 which eases towards expiry with another day of spread dominated volume seeing the Aug/Oct’21 back in the -$25 area having tried to push up a little on the morning strength. Levelling out following the mid afternoon plunge the market endeavoured to hold the lower $470’s until a burst of MOC selling sent us to a new daily low at $467.60 in amongst which a settlement value was established at $469.20.

A better day from the white premium saw strong gains at the front of the board with Oct/Oct’21 settling at $75.20, while looking into 2022 there were more modest gains which left March/March’22 ending at $78.20 while May/May’22 closed at $89.10.

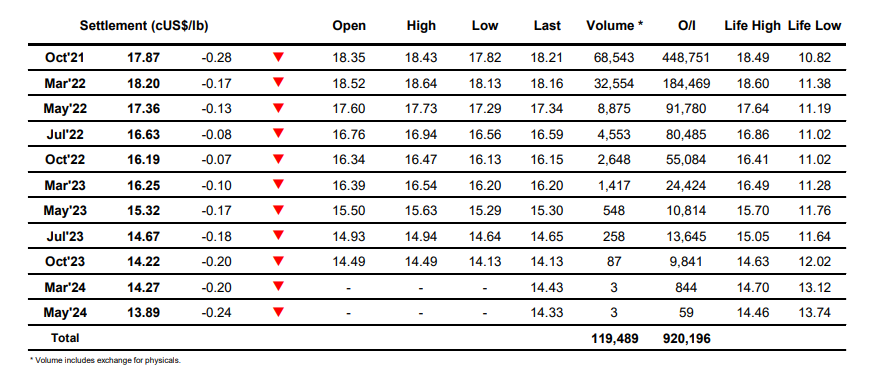

ICE Futures U.S. Sugar No.11 Contract

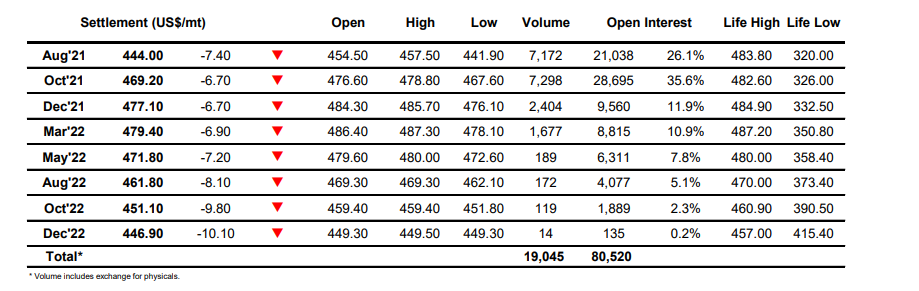

ICE Europe Whites Sugar Futures Contract