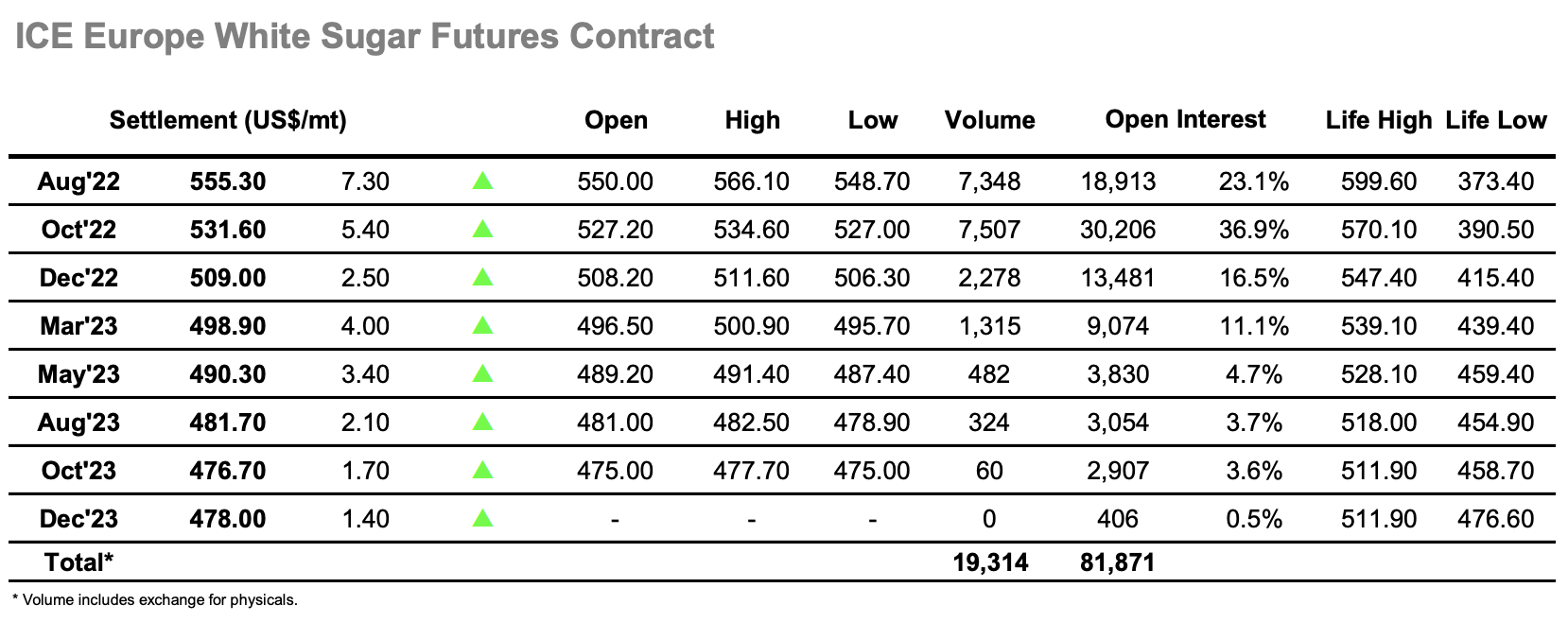

Returning from the three-day weekend the market saw initial hedge lifting take Oct’22 values higher to 18.29 before easing back to spend a period consolidating the teens once the necessary cover had been taken. Sentiment however remains negative, as has been the case for several weeks, and Friday’s COT report bore this out in showing that the net spec long is now just 12.955 lots, a reduction of more than 46,000 lots over the week. Rather than just long liquidation the numbers showed that a large part of this change was the addition of new shorts as concerns grow throughout the commodity complex, with the true net figure following last Friday’s movements likely to be nearer to flat. Though the market held its own through the morning, it was back under pressure once the Americas traders joined the fray, selling once again coming into Oct’22 to send the value down towards 18.00. Initial support was soon broken to show a 17 handle at the front of the board for the first time since early March, and while scale buying kept things orderly the influence of significantly weaker grains and energy sectors amid recession concerns drew further selling. Oct’22 recorded a session low at 17.71 during the final hour before some end of day profit taking took the price up by a few pips to settle at 17.80. Overall, the market remains technically vulnerable to further losses and unless the macro turns around significantly it is proving difficult to see where a sustainable rally is generated at the present time.