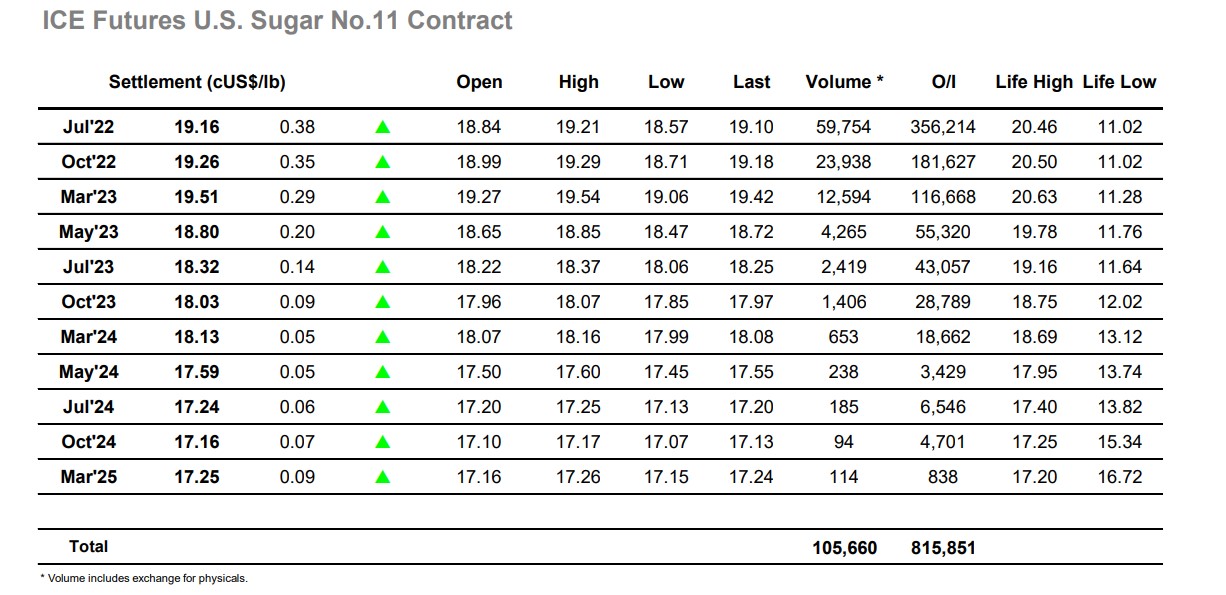

A negative start to the session saw Jul’22 pushed back down into the support area during the first hour, though having reached 18.57 the stronger scale support proved sufficient to slow the selling and allow for some consolidation. Day traders then proceeded to cover back some short and with the recent range now showing few resting orders a steady climb ensued all the way to 18.96 before stalling. This immediately provided an outside day to follow up yesterdays inside day, with the highest levels since Monday providing an opportunity for the specs to continue higher should they desire to follow the crude price higher, as many in the market feel they should. Through the early part of the afternoon there was simply no reaction with the price drifting back to mid-range, until when it seemed that we would head quietly into the weekend a burst of buying appeared to send the price quickly beyond 19.00. Specs were buoyed by this action and additional buying followed in to extend the move to 19.21, while the flat price interest gave the spreads a welcome boost and Jul/Oct’22 rallied to -0.07 points. The performance was sufficient to encourage some traders to carry longs through the weekend, a positive settlement at 19.16 providing hope that further progress can be made and pull opinion away from the fundamental view should the macro and geopolitical situation remain onside.