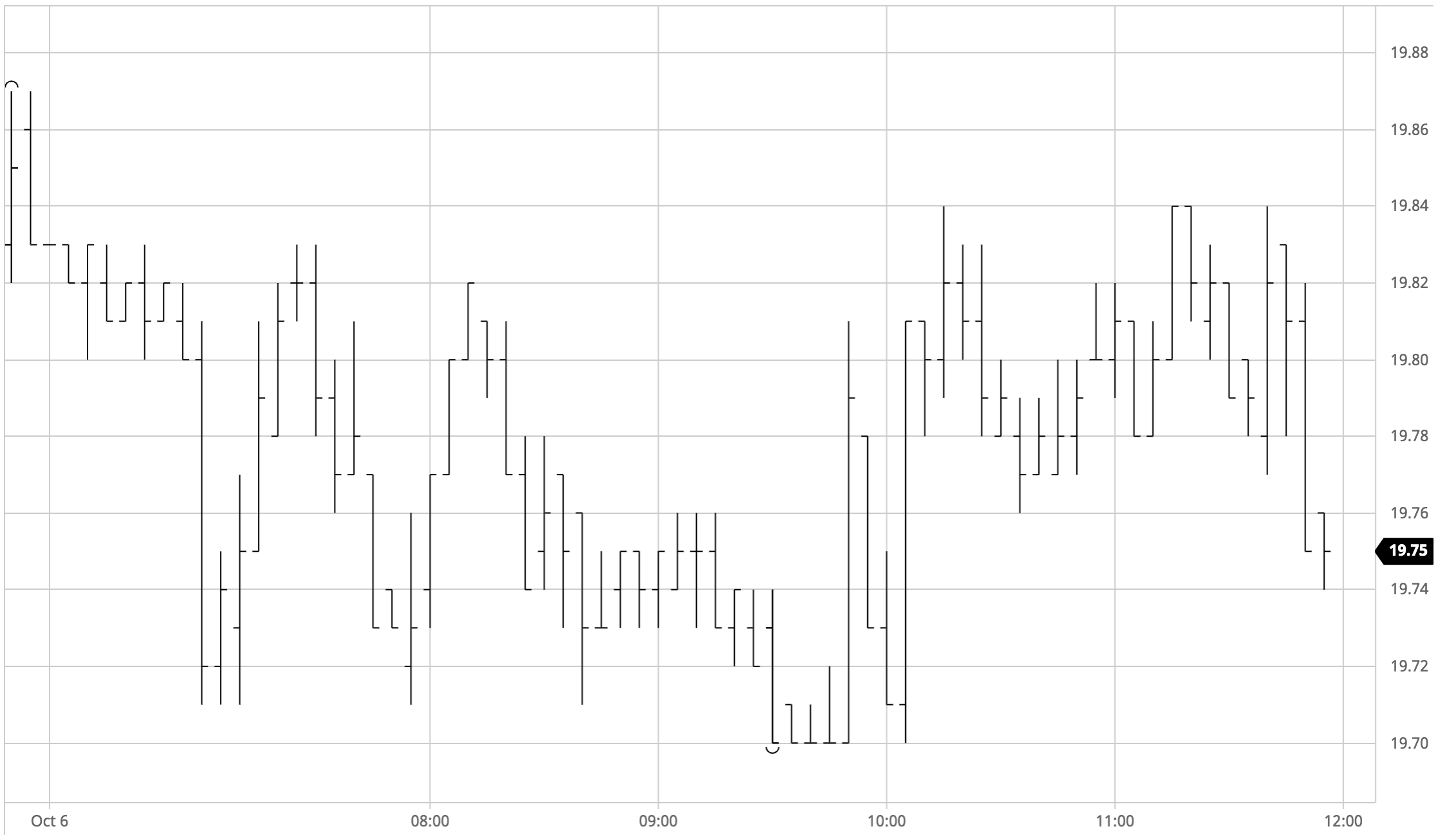

Sugar #11 Mar’22

A dip to 19.65 during the first 30 minutes was soon put behind us as some light buying emerged to pull March’22 back into the low 19.80’s. While recent sessions have seen some volatile movement within the current broad range today by contrast saw a rather more settled approach with many of the day traders seemingly reluctant to get burnt again by the continuing swings. This led to a prolonged period within a tight band where the only glimmer of interest arrived through a small burst of selling which pushed back towards 19.70 for today’s 1pm / US morning interest. While the selling lowered the parameters in which we sitting there was no further reaction leading to a long period spent mostly between 19.70/19.80. With so little volume on show away from the front of the board we saw the market direction impact upon spread values, leading March/May’22 to contract to 0.41 points while May/Jul’22 eased in to 0.52 points. More substantial buying had built up beneath 19.70 through the afternoon and this provided the basis to push back into the low 19.80’s, however with no great impetus from the specs the range prevailed right through to the close with March settling at 19.77 to conclude an inside day.

Sugar #5 Dec21

A lower opening was soon gathered up and in very low volume the market settled into a sideways pattern to trade either side of unchanged levels. As the day progressed the market most certainly did not and we settled into a tight band at the front of the board on very low flat price volumes, Dec’21 failing to escape from a $506.40/$509.10 band for more than six hours. The one glimmer of strength was provided by further buying of Dec’21/March’22 which extended yesterdays recovery to a $1 premium with very little resistance being encountered along the way. Such was the tedium of the day that an upside extension to $509.90 almost felt like excitement, though in such continuing low volume it was of course anything but. The closing stages failed to build on any promise that we may push further north with a slow inside day concluding at $508.50.

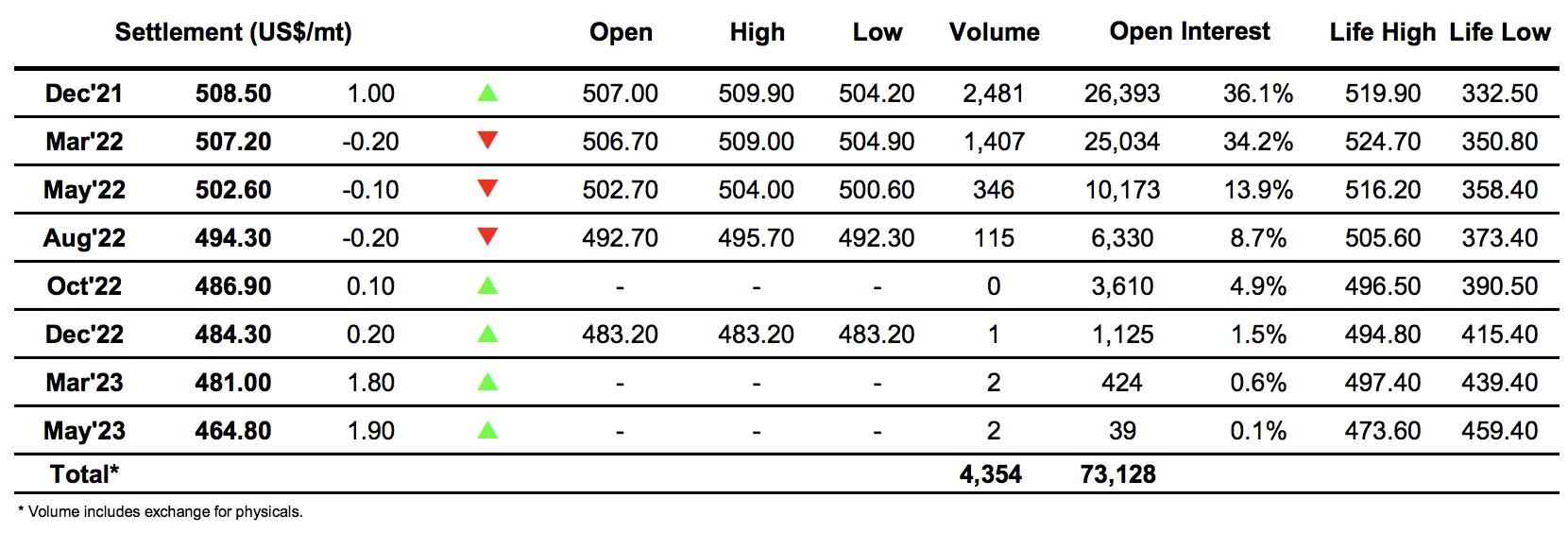

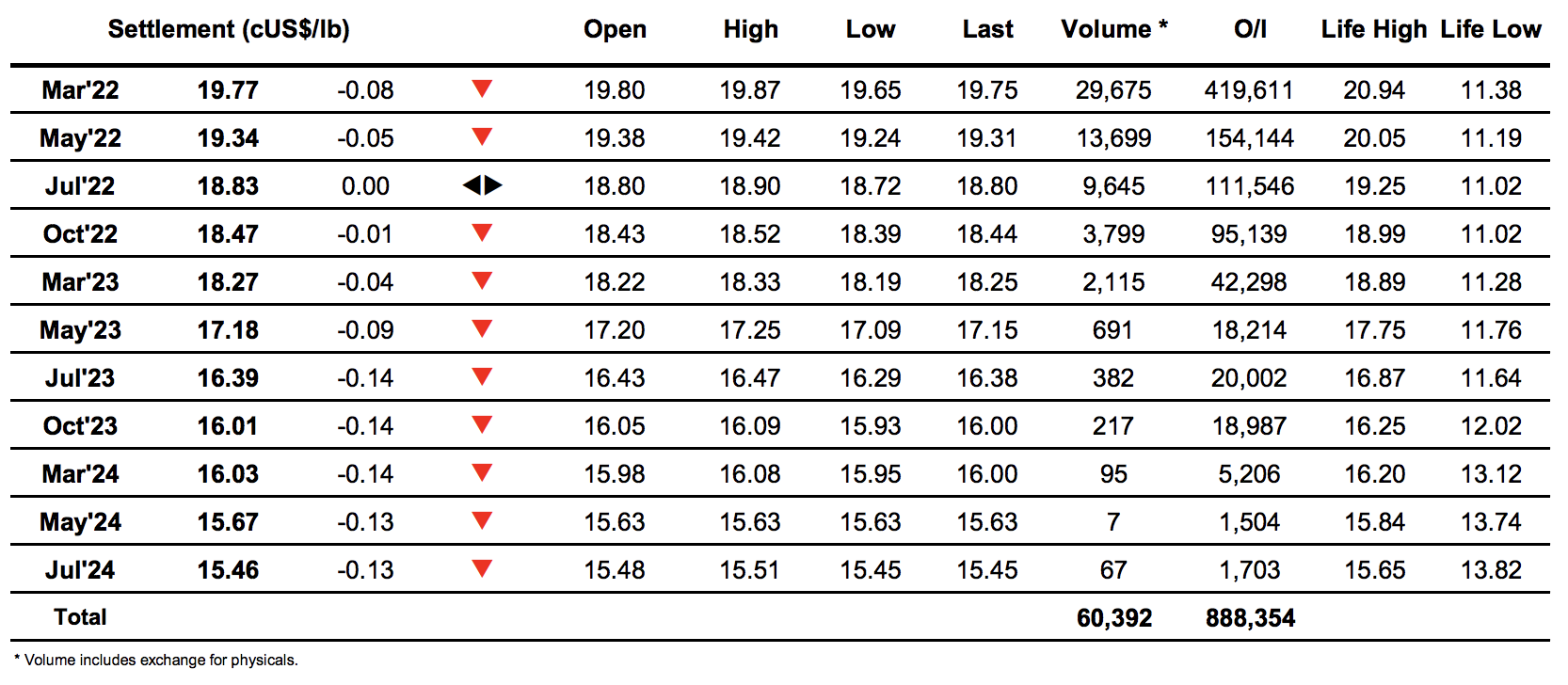

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract