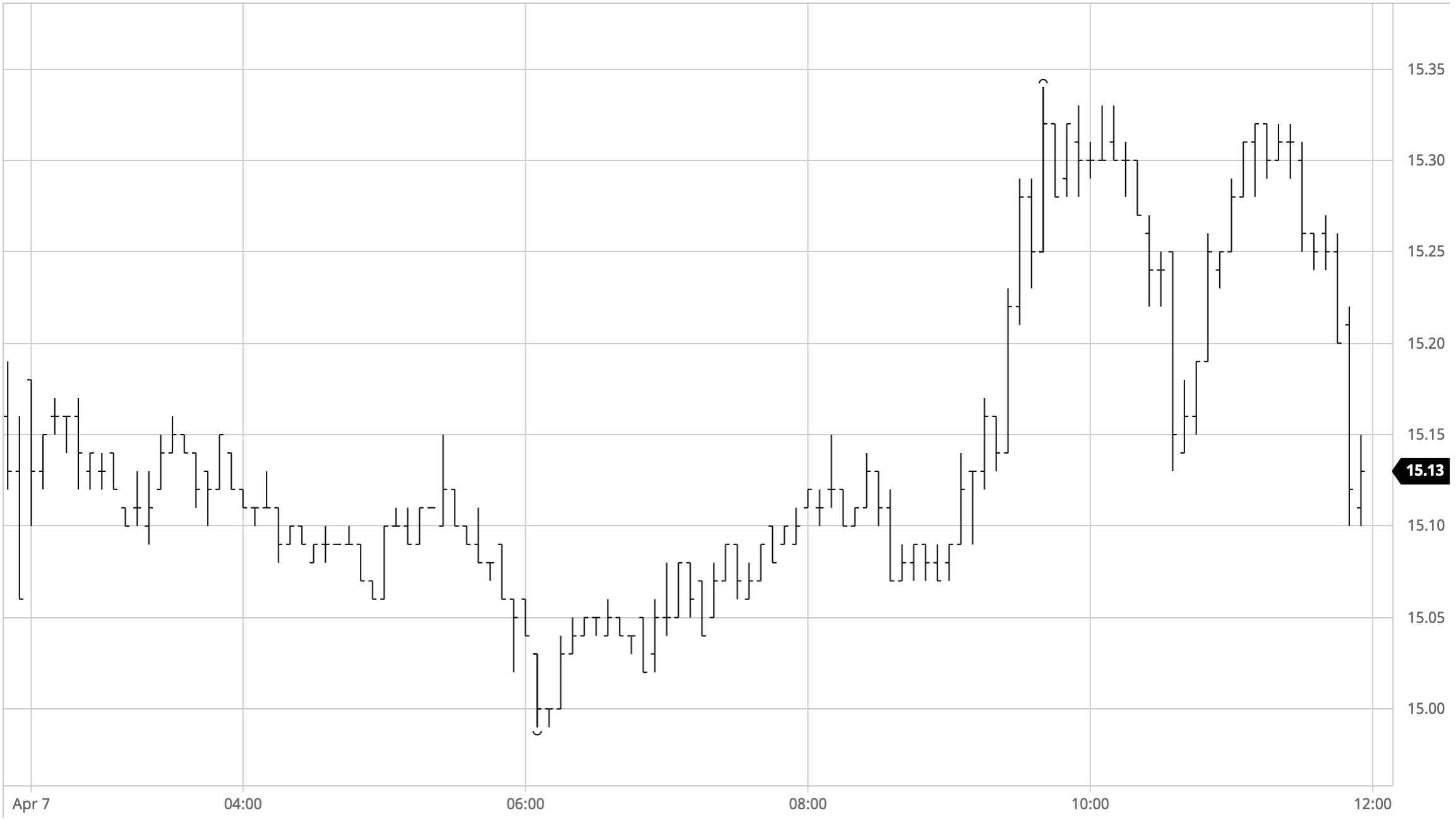

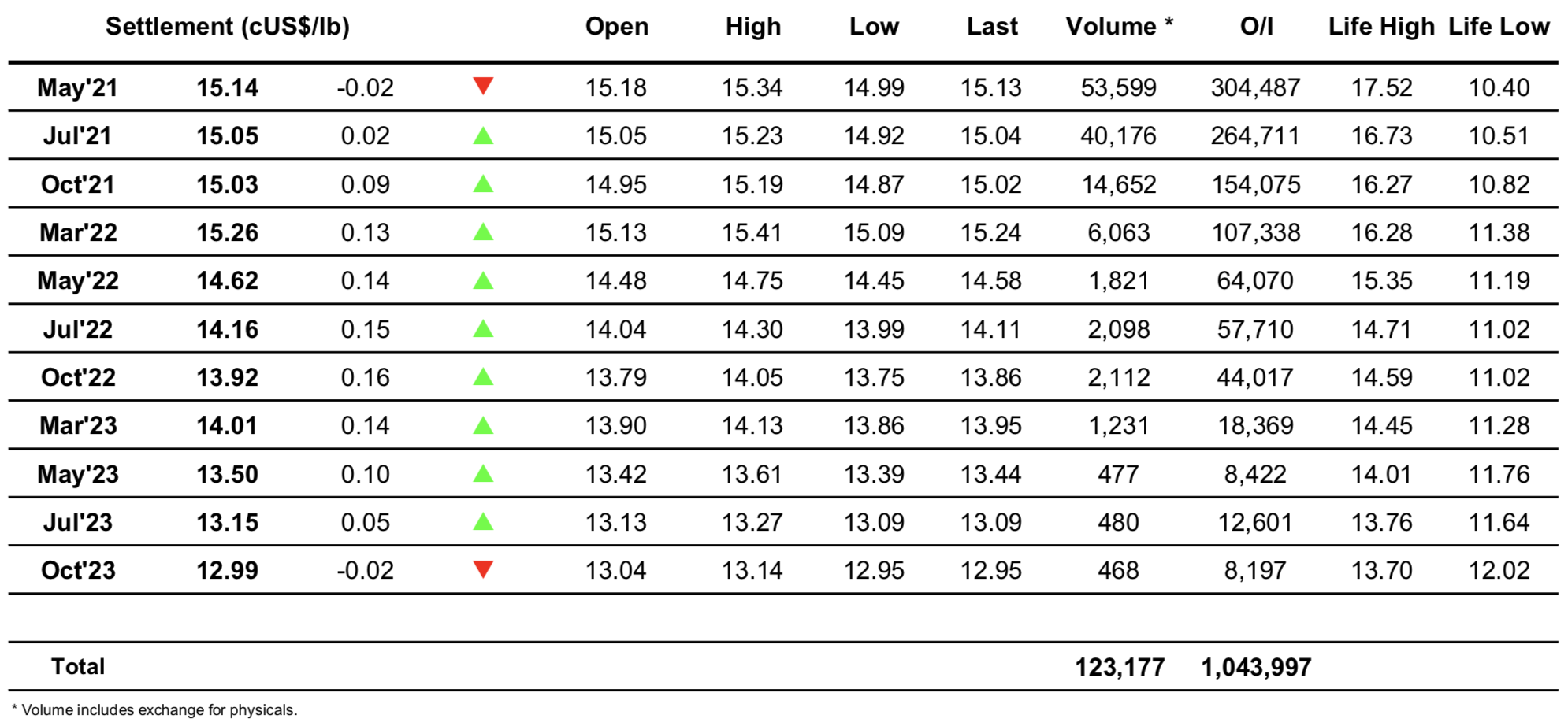

Sugar #11 May’21

Having hauled the front month back above 15c yesterday the market looked to consolidate the recovery with the first three hours of the session spent holding a narrow trading band between 15.18 and 15.06. While this provided a very slow, boring backdrop it is a sign of the stability needed to continue building some kind of base from which to rebuild and the longs will not have been upset that the spec selling seems to have retreated for the moment. A brief push lower followed to break this range however having seen a low at 14.99 we soon returned to the stable environment of the morning range, enjoying the calm before the full force of the index roll unleashes into the May/Jul’21 spread tomorrow. It was only during the final third of the day that things became a little more interesting with specs reacting as we broke out above 15.18 to push the long side and draw some support from algo’s as we pushed on to reach 15.34. To follow this we saw some very choppy action as specs sold out longs in the thin environment and then almost immediately turned buyer once again, leaving the price near to session highs soon after touching back to 15.13. Through all of this there was more limited movement for the spreads with May/Jul’21 a touch weaker and trading into 0.08 points later in the afternoon as some initial rolling takes place ahead of tomorrow. There was one final twist for the flat price which saw another wave of position squaring during the final stages that sent the price as low as 15.10 on the call with settlement above this at 15.14. All in all this leaves the situation little changed and how this is interpreted in terms of where we go next will likely be determined by ones position with both cases being presentable.

Sugar #5 May’21

As we move closer to next week’s May’21 expiry we are increasingly seeing Aug’21 pick-up the majority of the volume, though this morning buyers were few and far between as the price dragged lower to the $423.00 area against the weight of pressure in the May/Aug’21 spread. It was only in this area that we actually found some underlying interest and what followed was several hours of tedious sideways action during which time the volume remained confined to the spread where ongoing fund rolling sent May’21 to a -$1.50 to the Aug’21. May’21 open interest has reduced to 22,141 lots and todays large volume will no doubt put another dent in that figure, making the numbers appear very orderly with six more sessions remaining until expiration. Midway through the afternoon we saw the screen finally come to life as spec buying emerged in conjunction with the No.11 to send Aug’21 surging above $427 and back into credit in an effort to continue the momentum that was being built yesterday. A corrective dip proved to be very short lived and a second wave of buying followed as we entered the final hour to record a new high at $428.10 and in so doping haul white premium values away from their daily lows. A final round of long liquidation ahead of the close sent values back into deficit, leaving Aug’21 ending at $425.20 to take some of the shine off of the day, while May/Aug’21 settled at -$1.30 having traded to -$2.50 shortly before.

May/May’21 was significantly weaker today due to the impact of the spread roll, reaching a narrowest at $88 before edging back out to the $90 area later in the afternoon. Closing values saw the nearby values remain weaker overall with May/May’21 at $90.00, Aug/Jul’21 ending at $93.50 while Oct/Oct’21 was marginally firmer changed at $89.50.

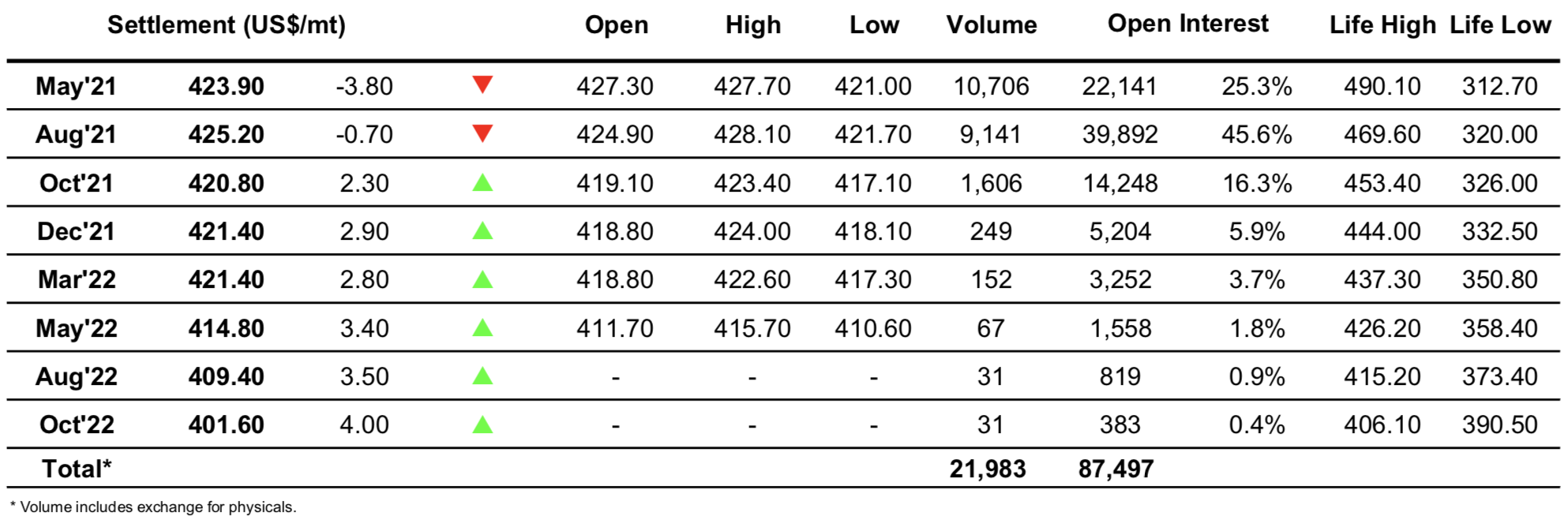

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract