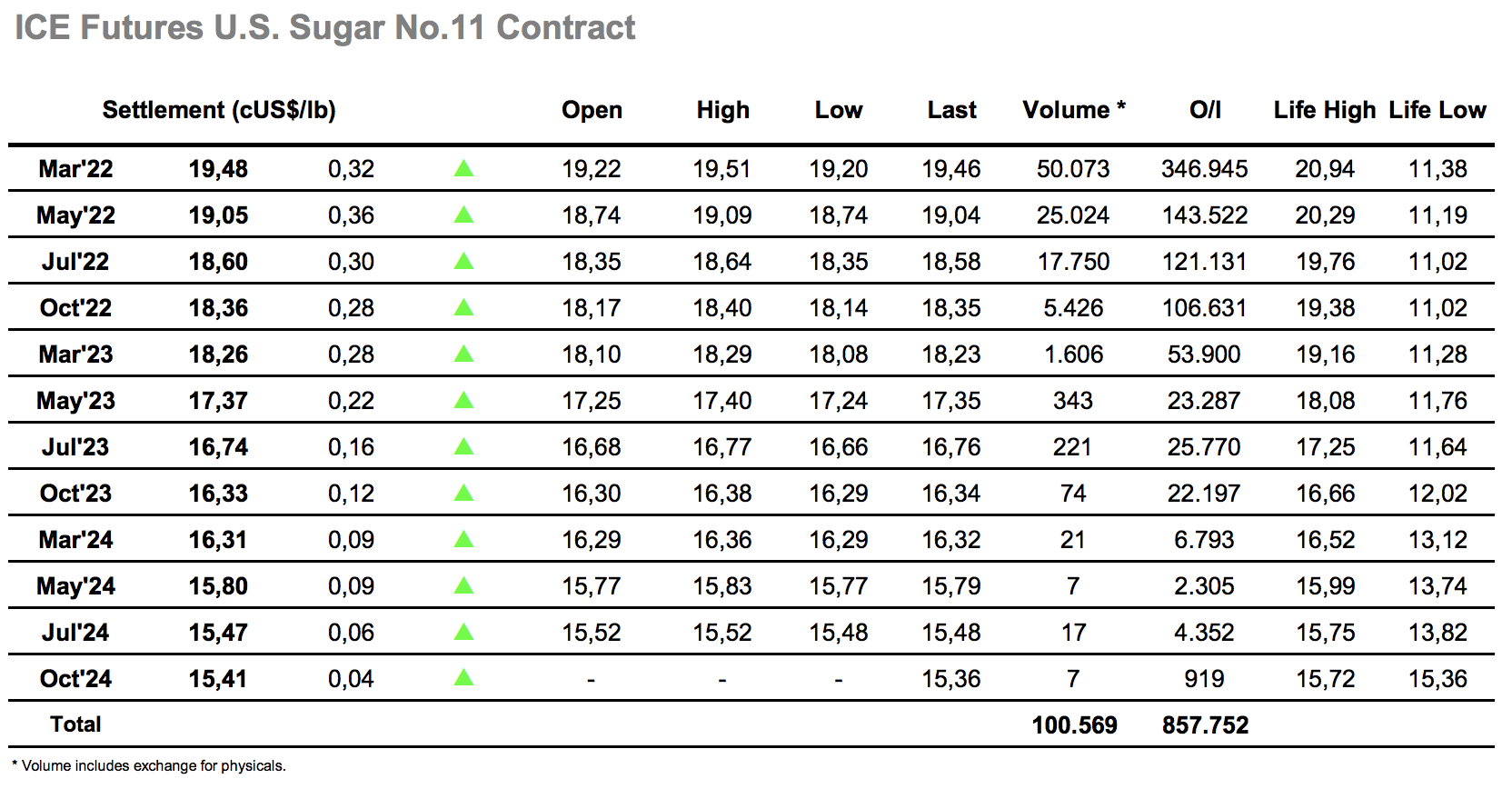

Sugar #11 Mar ’22

The past two days have seen the market start to mount a recovery following the recent collapse due to concerns over the Omicron variant, finding buying alongside the wider macro to pull back above 19.00. The recovery has no doubt been aided by a sharp decline in the net spec long, potentially leaving the position nearer to 120,000 lots long only prior to the recovery, meaning that selling is currently rather light. This morning saw a continuation of the pattern as the market built upon a higher start to move into the 19.30’s where a period of consolidation ensued on low volume. There was a small dip as the US-day commenced however it was quickly picked up with the afternoon becoming one of slow but ongoing recovery, extending up into the 19.40’s against a more mixed macro background which saw equities / energy remain positive but some weakness elsewhere in the softs/ags sector. There was a small weakening of the March/May’22 spread as it narrowed back to 0.43 points, but despite this the flat price was making new highs and nudging into the heavier selling placed at 19.50 as we approached the close. The block of selling placed at 19.50 was filled as we moved into the close and a marginal new high at 19.51 was registered before settling at 19.48 and slipping back into the low 19.40’s on the post as day trader positions were squared off. To the upside we now find 50% retracement of the recent movement providing first resistance at 19.58 and whether we can move beyond this and towards 20c once again likely depends upon the appetite of specs to reinstate recently liquidated longs.

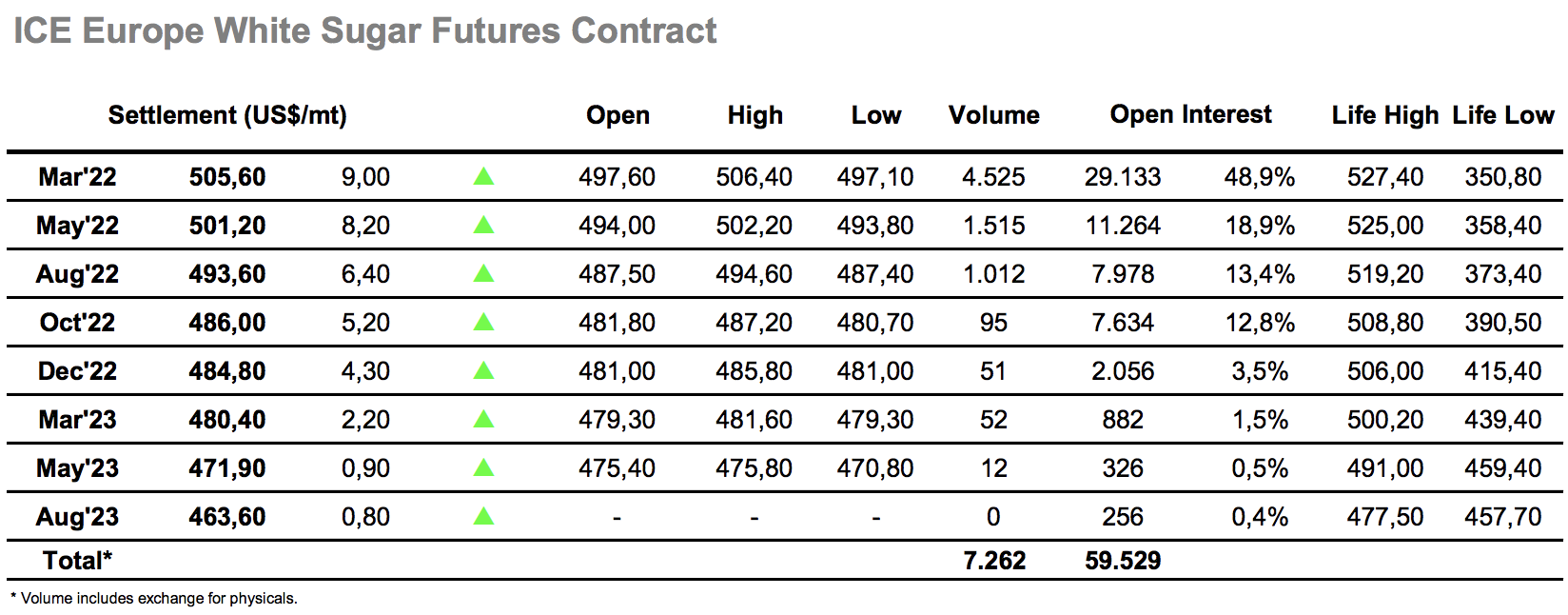

Sugar #5 Mar ’22

The past couple of sessions have seen signs of recovery with the market having responded to the macro improvement and pulled away from the 4-month lows that were recorded last week. A continuation of this situation this morning led March’22 to commence a little firmer and leaving an overnight gap we saw the price accelerate ahead through $500 before stalling. A subsequent pullback through the opening low almost filled the aforementioned gap ($496.90 – $497.10 remains unfilled) and ahead of Americas based traders joining the fray activity remained calm. With very little selling around to provide resistance the market proceeded to climb gradually upward through the afternoon, progressing to a high at $505.00 to mark a 50% retracement of the recent $527.40/$482.50 move, while March/May’22 continued its own recent recovery in reaching $4.80. Further new highs were recorded at 506.40 as we worked through the final hour, in the process widening the March/March’22 white premium back out to $76, and we settled positively at $505.60 with longs looking to continue the rebuilding over the coming days.