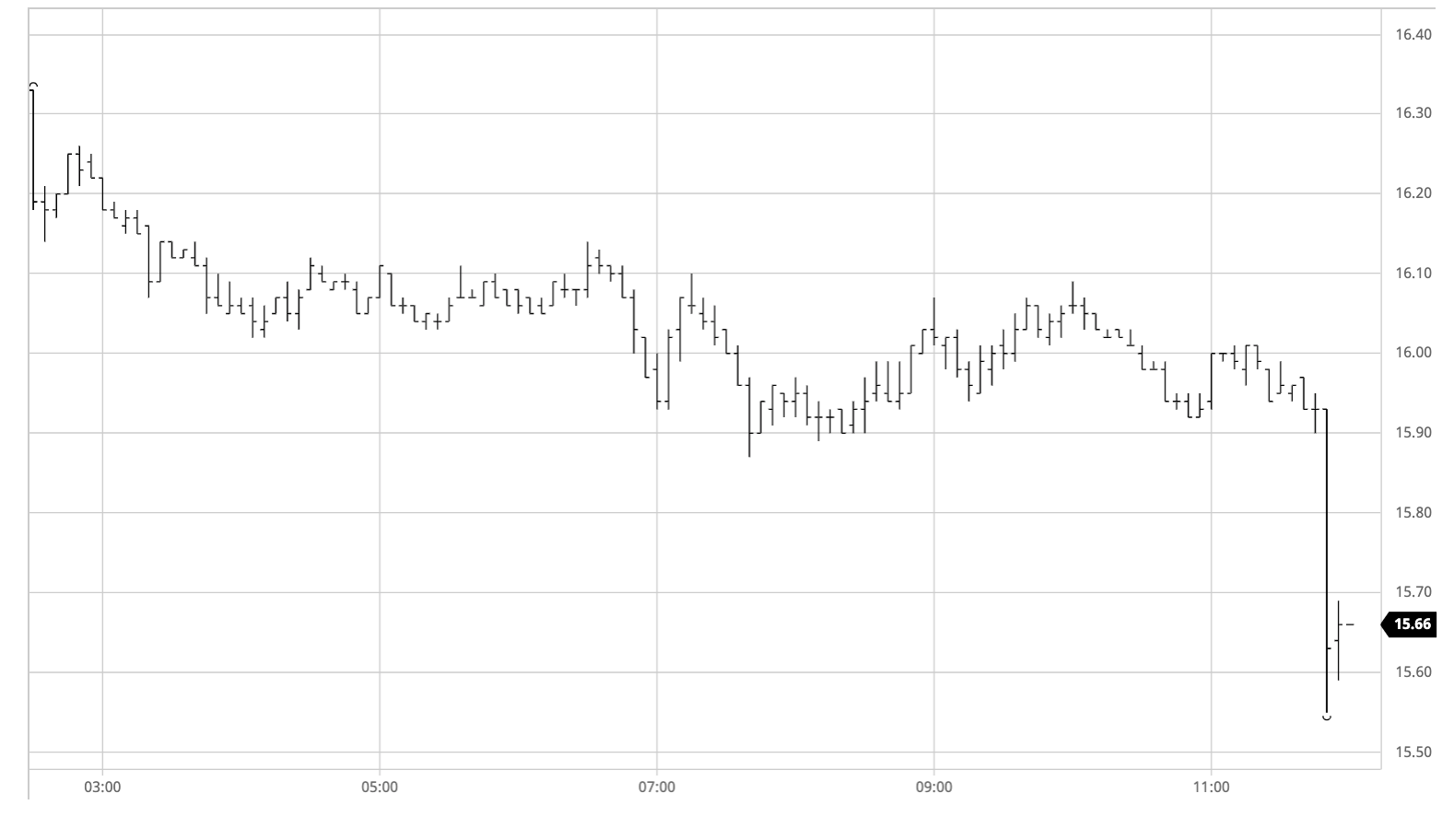

Sugar #11 Mar ’21

There was some early selling on show which pushed March’21 down from an initial 16.33 to 16.14 and this set the tone for a calmer day for the front month as we became largely confined to a range either side of 16c. Specs were clearly taking a back seat following a huge volume of buying over recent sessions however with the broader macro picture remaining positive there was little reason to sell out longs despite the continuing overhead producer selling which provides resistance for 2021 and 2022 positions. It was a different story for the spreads however with March/May coming under early pressure from which it never recovered, the opening high mark of 1.03 was never seen again and it was not long before the differential had fallen back to the 0.90 area. A little more pressure was exerted upon the market as the US morning got underway but despite various forays into the 15.90’s each move was picked back up with the longs seeming determined to maintain the psychological factor of the 16c mark. This philosophy held well until the final 10 minutes when the range was broken in the most spectacular way as falling through the earlier 15.87 low led to a cascade of sell stops being triggered down to 15.55 on a 5 minute volume of 14,300 lots. This also sent the nearby spread values further through the floor with March/May’21 trading a daily low at 0.78 points and while the flat price saw some late buying filter in to be trading at 15.66 as we went out, the lower settlement value of 15.60 will suddenly raise many questions as to whether we can regain the traction of the recent move, the answer to which can only lie in the hands of the funds.

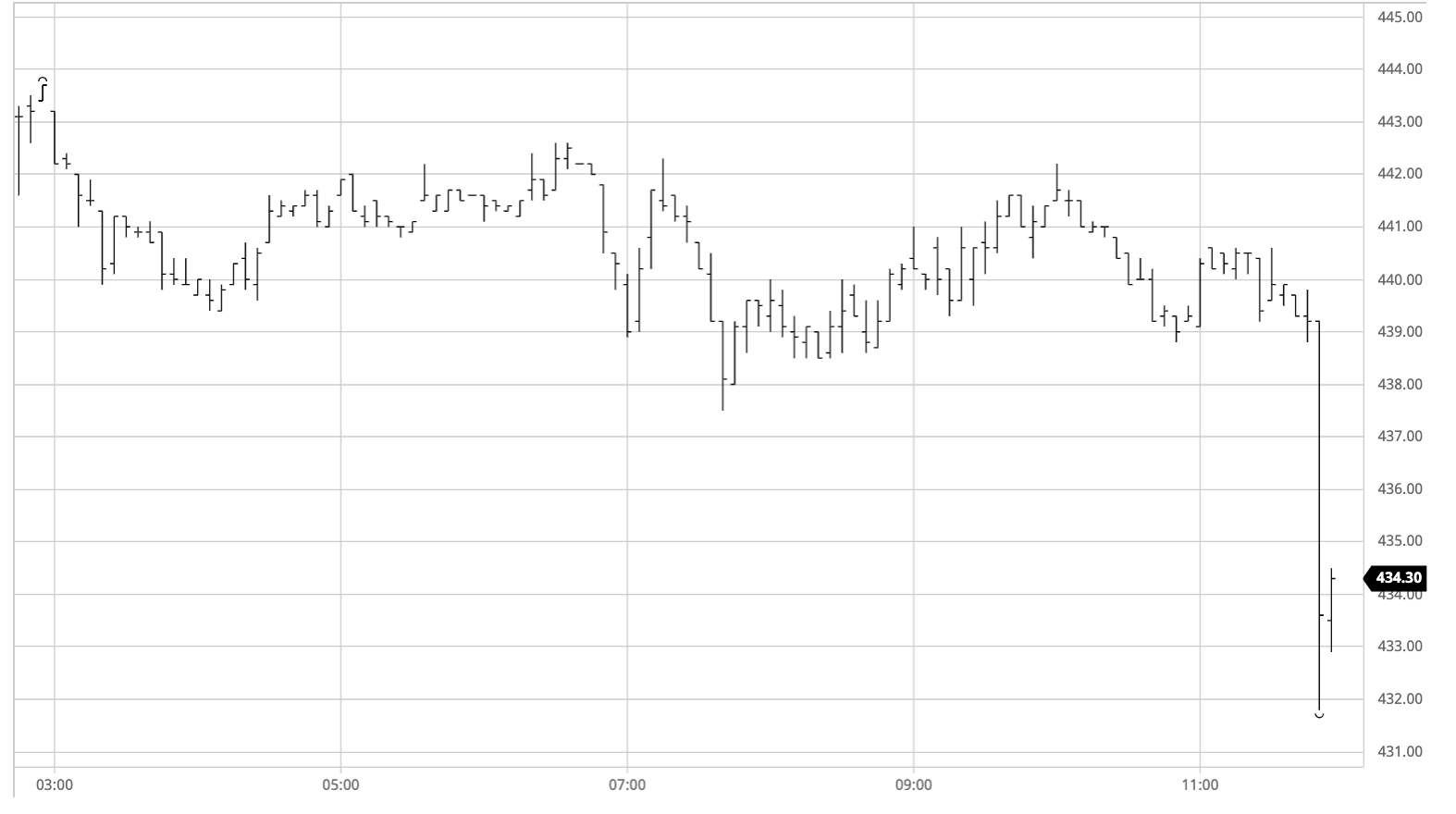

Sugar #5 Mar ’21

The day got off to a relatively muted start with some light early selling sending prices a little lower, and in quiet early conditions the March’21 contract slipped downwards to the $440 area. Despite the early losses the overall mood remains positive towards the market (and commodities generally) and buying slowly started to filter back in which led us back up to $442.50 by mid-session, though we stopped shy of challenging the opening highs. Despite some good volume for the March/May’21 spread which remained steady either side of $14 and a reasonable flow into the outrights the market remained resolutely rangebound for long periods, and when we did break fresh ground it was to the downside with a brief spike down to $437.50 though it was quickly gathered up. With the pattern continuing through the afternoon we seemed set to complete an inside day, however the final 10 minutes brough some fireworks as a break of the daily lows led to some long liquidation through stops, taking March’21 to $431.80. Buyers scrambled at the death to leave final trades some $3 above the lows however questions will now be asked as to the desire of specs to push back upwards in the first real test of their bullish credentials seem for a while.

White premiums were again firm on the day with nearby whites outperforming the No.11 to send March/March’21 out by around $3 to $88, before the late volatility saw the value briefly printing above $90. May/May’21 worked its way up to $95 where selling was encountered while the Aug/Jul’21 also nudged into some selling in the $95 area.

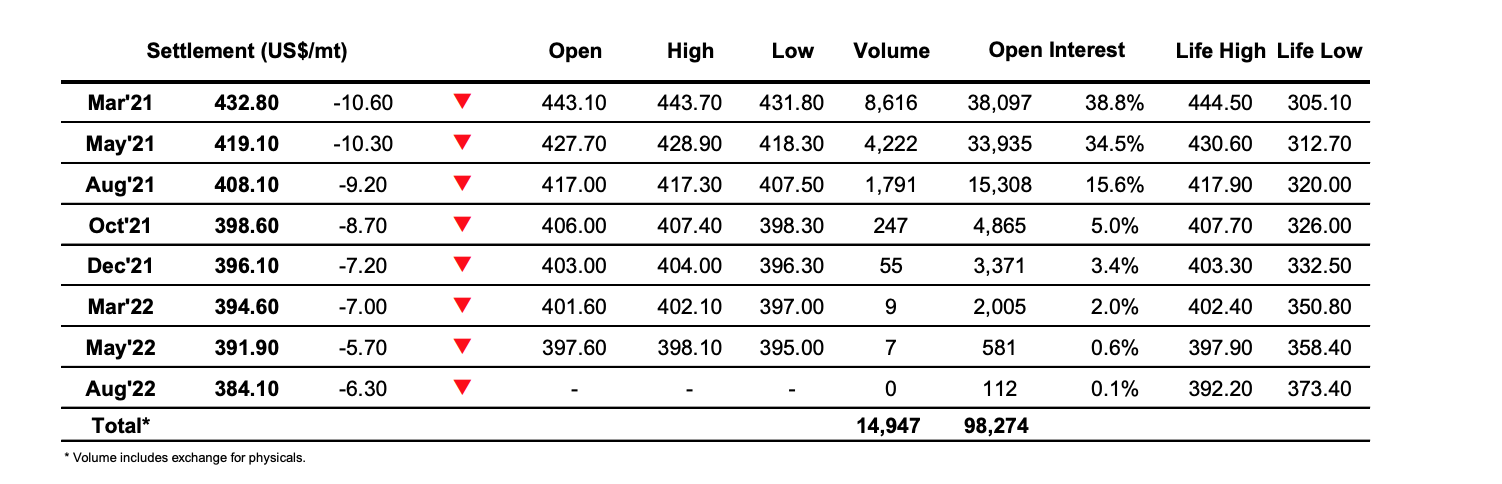

ICE Futures U.S. Sugar No.11 Contract

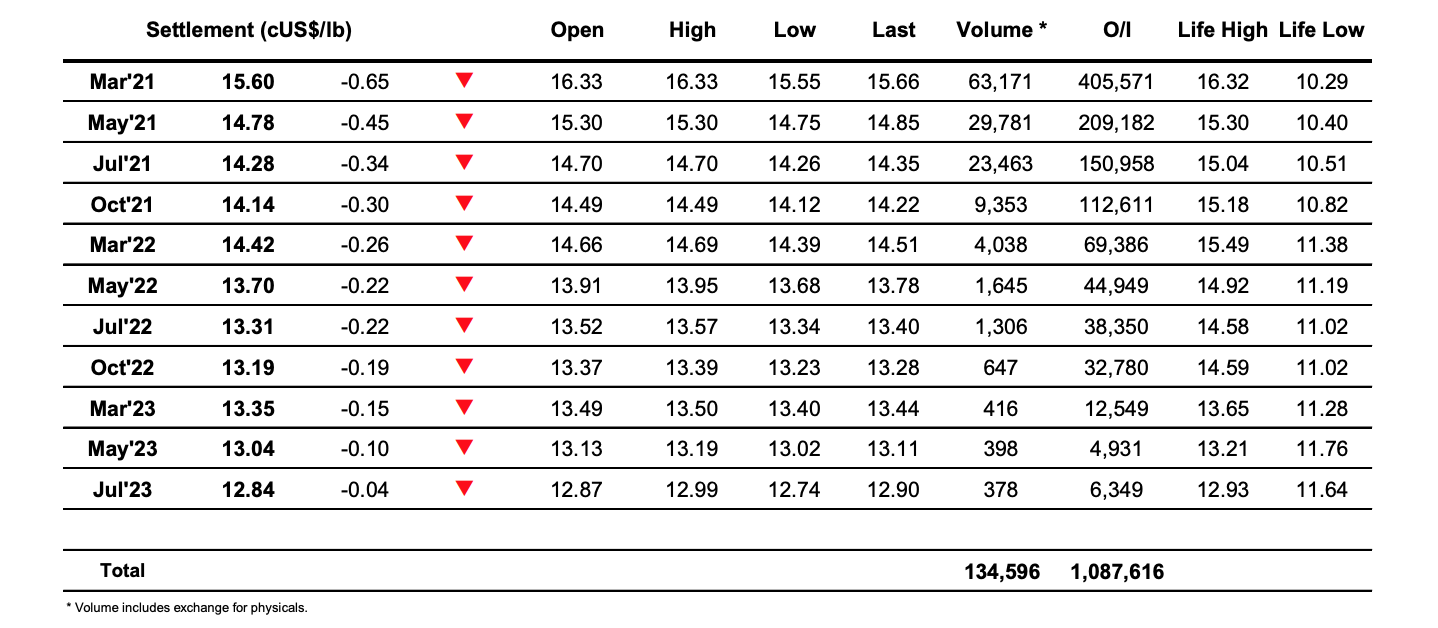

ICE Europe White Sugar Futures Contract