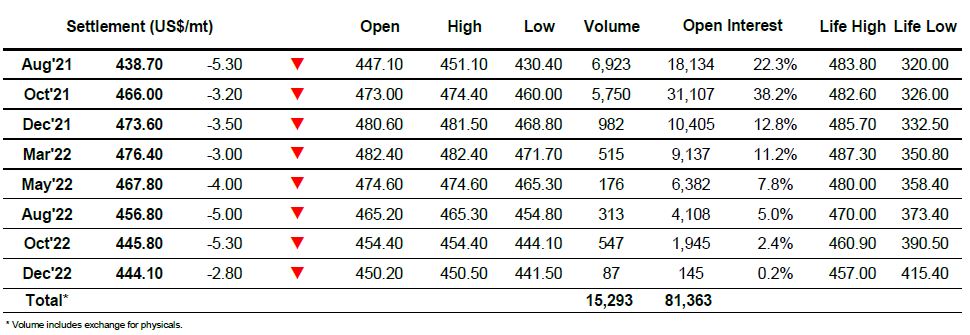

Sugar #11 Oct’21

Strong early buying from trade/consumers had Oct’21 trading up as far as 18.11 during the first hour and for a while it looked as though the market may put the technical negativity of yesterday behind it and bounce back. The rally could not be sustained however an as the buying eased up we saw prices fall back into the 17.90’s which while still higher on the day started to take the shine off of the initial push. We continued in this area through until noon however at this stage the cracks began to open up once more and ahead of the US morning prices slipped down into negative ground. With falling outright values so the nearby spreads also began to come under renewed pressure and in tandem we saw both head south that by mid-afternoon we had the Oct’21 down at 17.45 with the Oct’21/March’22 extending to -0.37 points. The outright being almost 100 points lower than yesterday’s high encouraged some supportive buying / bargain hunting into the market and for the final couple of hours it enabled prices to consolidate in the 17.60’s though the bigger recover came for the spread which accelerated back up to -0.28 points. More buying for the close whether protective or short covering took the price up a touch further to settle at 17.75, minimising the net loss for the day though still appearing vulnerable technically.

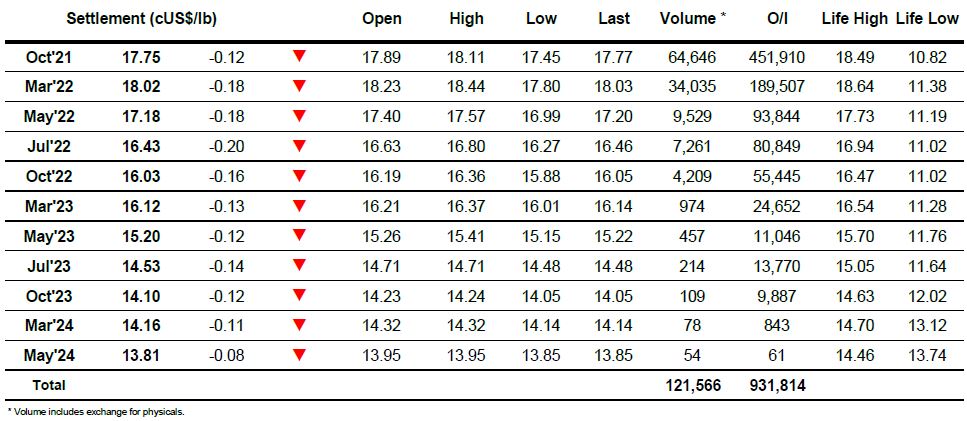

Sugar #5 Oct’21

The market initially shrugged off yesterday’s late collapse with some steady buying during the early part of the day pulling prices back upwards to $474.40, however one the initial hedge lifting had been concluded we then edged back off toward overnight levels and in so doing filled the overnight gap. Last nights close had undone all the good recent technical work and the resulting concerns became apparent through the later part of the morning as Oct’21 broke beneath yesterday’s low and headed down to the $465.00 area. With most specs continuing to be positioned from the long side there was naturally some defensive action along the way however any recovery was short-lived and by mid afternoon the price had plunged further to a low of $460.00. Aug’21 spreads too were pressured during this period and we saw Aug/Oct’21 to a new low mark of -$29.70 before picking up by a couple of dollars late in the session. The flat price held in the lower to mid-$460’s as we moved towards the close with late buying ensuring a settlement at $466.00, away from the lows but maintaining a negative bias.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract