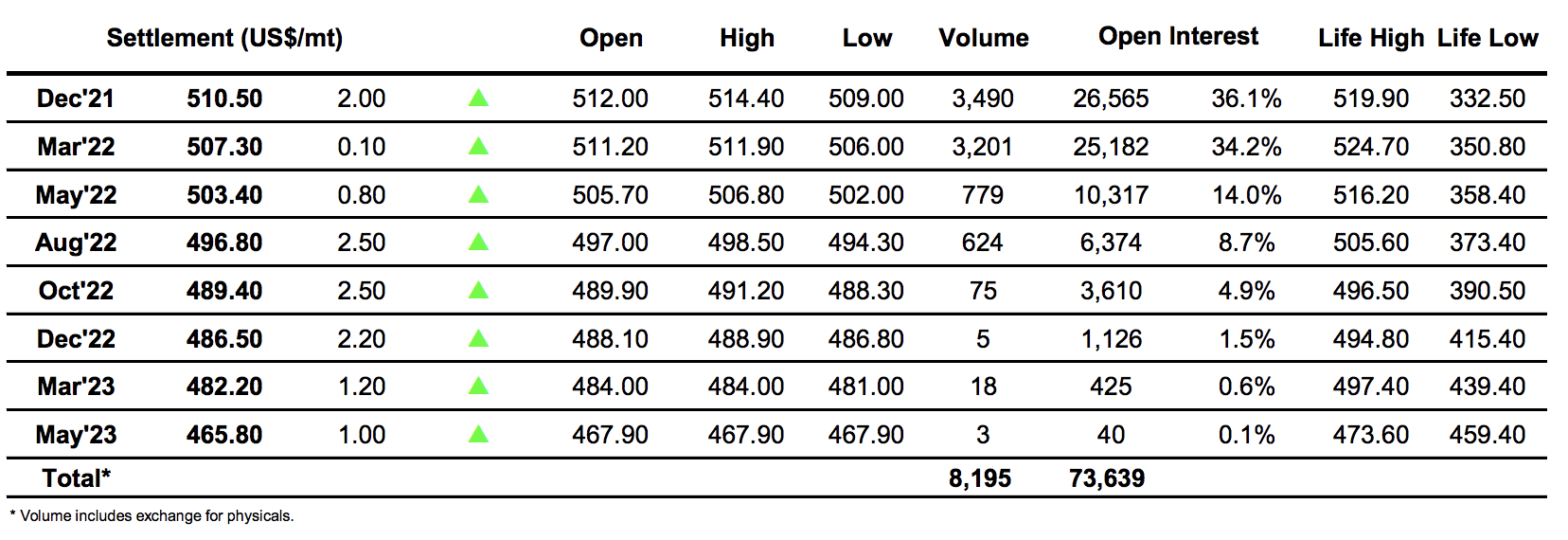

Sugar #11 Mar’22

The day commenced with March’22 on the front foot with an instant punch back up to 19.97 before buying cooled to allow for consolidation within the confines of the wise 20 point opening range. By late morning the market had gathered itself to make another push higher but though this led the price through 20c there was no great progress with a prolonged period seeing us trade no higher than 20.02. With spreads holding fairly flat and seeing very low volumes there was again little impetus being generated to spark some kind of break from the range, and though we eased back over the afternoon to record a new session low it was merely a single tick beneath this morning’s opening print and we soon bounced back up into the range. The final 90 minutes saw March’22 confined exclusively to the 19.80’s, ending another very slow day with settlement at 19.84.

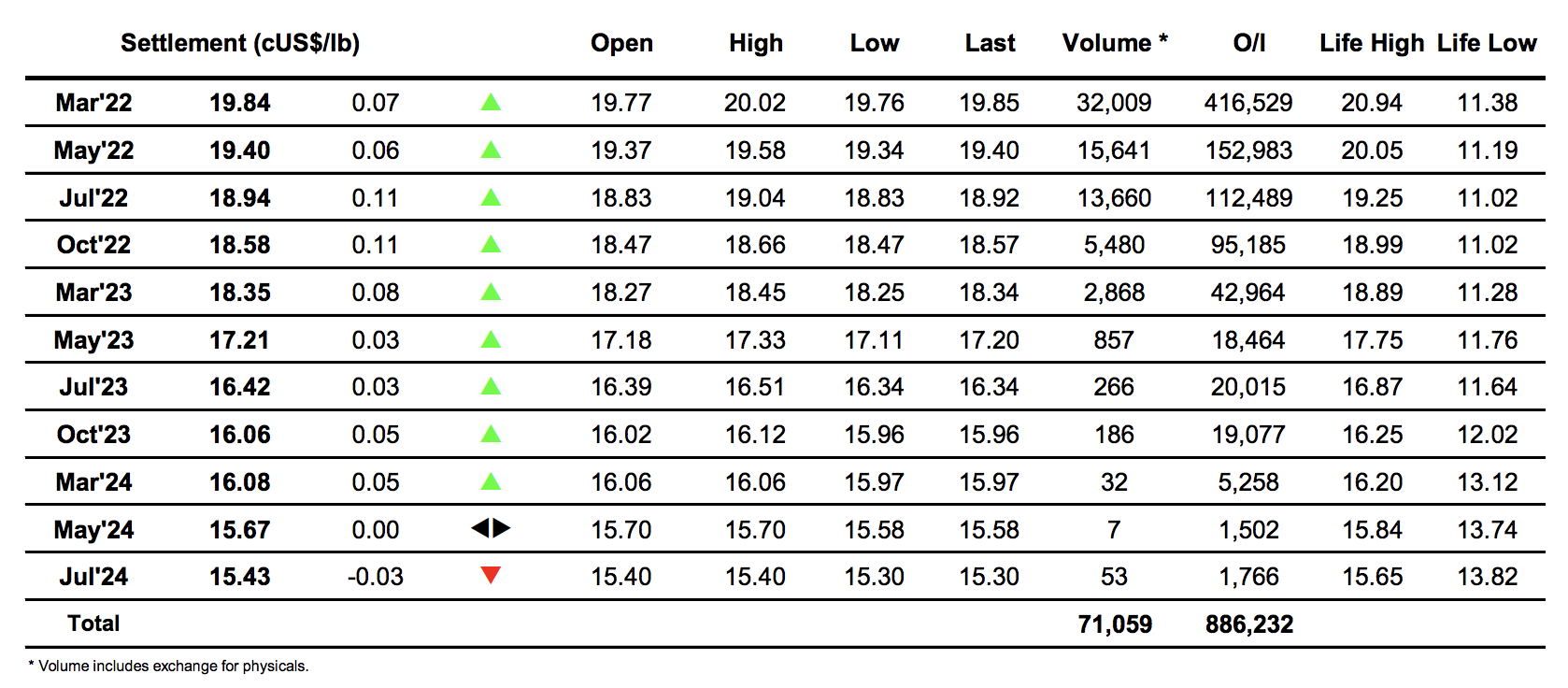

Sugar #5 Dec21

Opening buying left a gap on the intra-day chart as Dec’21 moved above $513 and with the bulk of these gains maintained we had a platform to make a further push north as the morning progressed. High’s were recorded at $514.40 though buying was light, and though consolidation followed ahead of the US based traders coming online it was their arrival which prompted some liquidation which sent us back towards the morning lows. This proved sufficient to kill off any upward potential with the afternoon seeing another tedious period through which the market edged steadily lower to fill in the earlier mentioned chart gap. Despite this crawl back down in the flat price there was a continuation of the recent Dec’21/March’22 strength with todays efforts taking the differential to $3.90 on volume which made up well over half of that seen for the front two prompts. A mixed close saw Dec’21 settle to conclude yet another range bound session.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract