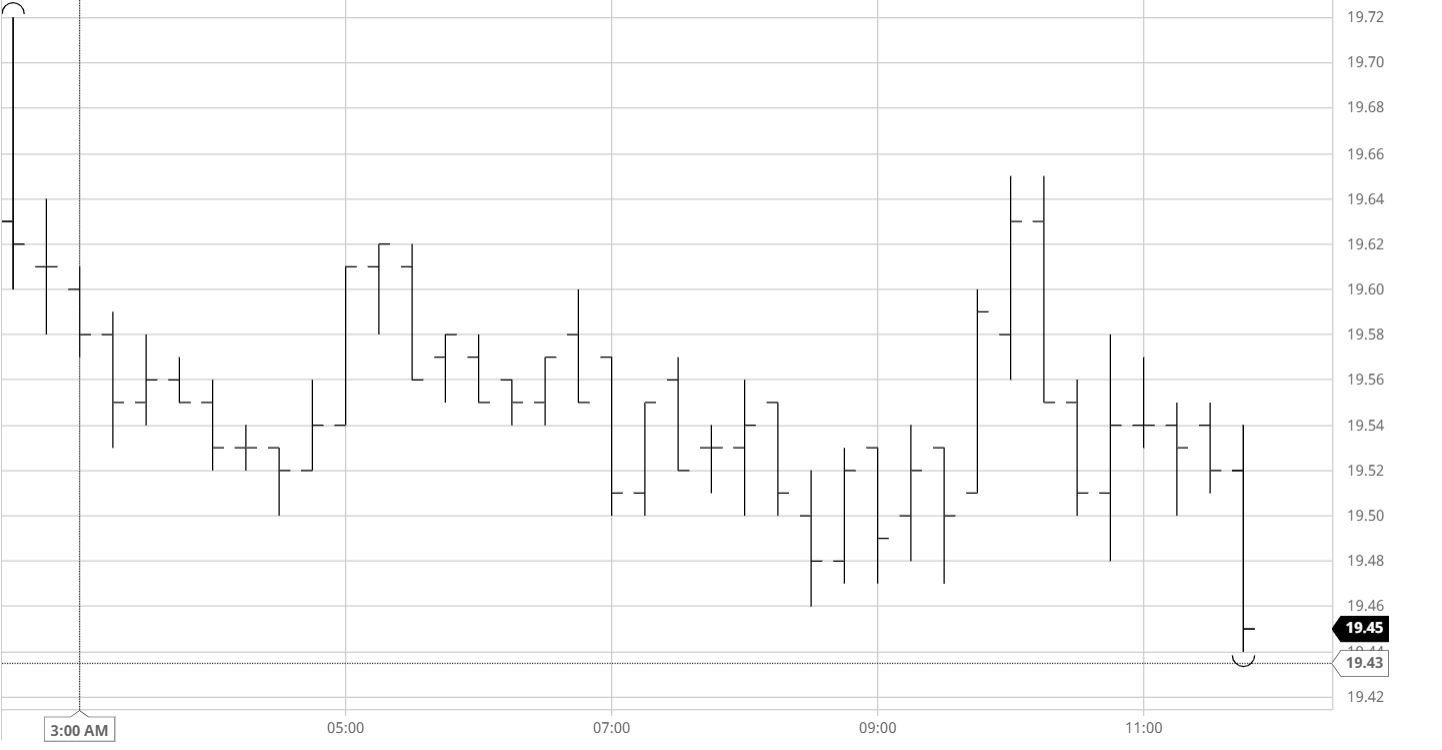

Sugar #11 Oct’21

Re-commencing following the extended holiday weekend, we saw a brief spike upward to 19.72 for Oct’21 before activity calmed with prices retreating to settle into a narrow band between Friday’s 19.62 settlement level and the low 19.50’s.

Much of the early volume was seen through the spreads, particularly the Oct’21/March’22, which was seeing the start of some more significant activity ahead of the index roll, which gets underway in full force tomorrow.

Ongoing spread activity led to higher volumes than may have been anticipated, with outright values firmly rooted within the same range as we moved into the early afternoon, with specs conspicuous in their absence and seemingly still content to sit upon their well established long which showed at a net 238,775 lots in the most recent COT report.

The remainder of the day saw Oct’21 nudge slightly to either side without gaining any particular momentum, while the Oct’21/March’22 clawed its way back from a morning low at -0.77 points to print as high as -0.65 points, despite the flat price malaise.

MOC selling emerged to send prices back to the bottom of the range and spilled over into the post close to extend the lower end to 19.44, though, overall, it was another day which did little to suggest we wont continue broadly sideways.

Sugar #5 Oct’21

Having held a broad sideways pattern within the $480s for several sessions now, the whites appear desperate for some news to break this pattern. However, there was none forthcoming this morning as Oct’21 calmed following some initial choppiness and soon found itself once more consolidating either side of $485.00. As the Oct’21 expiry moves ever closer, it’s the spread which continues to dominate volume. Again today, there were signs of specs rolling longs down the board as Oct/Dec’21 lost ground to reach a lowest -$22.30. The flat price, meanwhile, showed little interest in going anywhere with the only movements being some slight extension of the day’s range to new lows during the afternoon as the spread weakness took its toll. With no support to be found in a marginally weaker macro, prices continued at the bottom of the range heading towards the close and a final shakeout sent Oct’21 to $481.80 heading out, slightly negative on the surface but still firmly within the broad recent range.

Front month white premium values continue to toil, but 2022 positions are at least showing signs of maintaining away from the lows seen a few weeks since. Oct/Oct’21 ended the day valued at $53.10, March/March’22 at $69.70 and May/May’22 at $78.20.

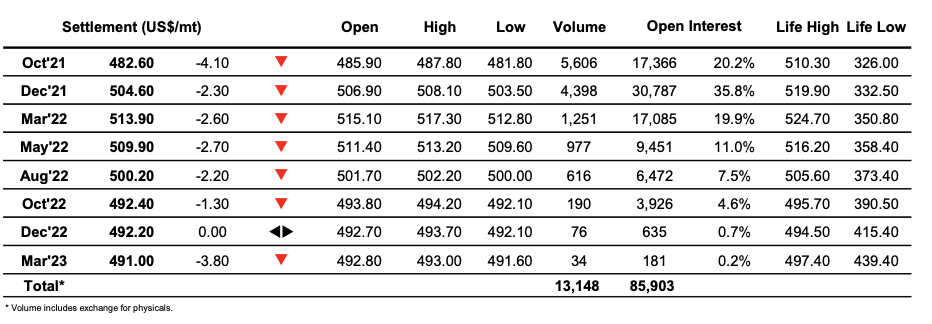

ICE Futures U.S. Sugar No.11 Contract

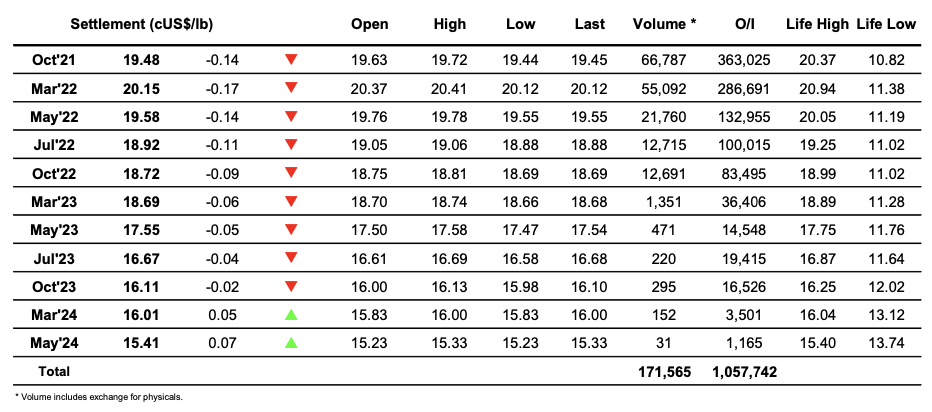

ICE Europe Whites Sugar Futures Contract