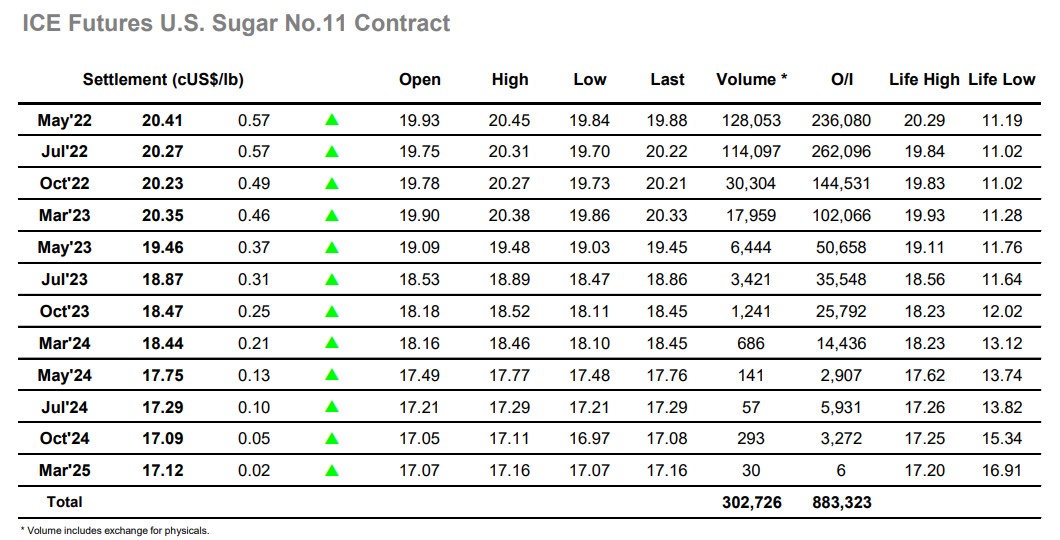

Yesterday saw May’22 trading up through 20c for the first time since November, and the specs were encouraged by the recent strength to hold the market steadily again following today’s opening. It took a while to build any momentum though slowly but surely the gains arrived with the spot month trading to 20.10 before the morning was through. Any serious progress was always going to be reliant upon the US specs and their greater volumes, and they did not take long to accelerate the gains with an early afternoon push toward the 20.29 contract high mark. With producer scale selling remaining moderate there was limited resistance and in quick time the price reached to 20.32, though this was followed by some light profit taking having failed to uncover any buy stops or additional momentum. Despite the wider macro failing to find the same levels of buying, sugar was determined to push ahead with the rest of the afternoon seeing the gains extended over a couple of waves to a new contract high at 20.45. Still, most of the volume came from the spread where the ongoing index roll generated another large March/May’22 volume of 81,000 lots, though there was little movement in the price which ended the day at 0.14 points. Longs were determined to maintain the gains into the weekend, and May’22 ended with a strong settlement level at 20.41, the onus now firmly on the specs to continue higher with consumer interest non-existent at the higher levels.