Sugar #11 Mar ’21

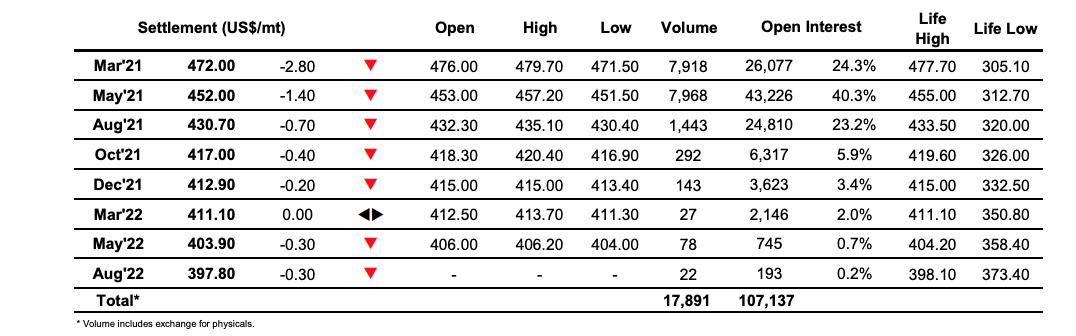

The strong finish to last week combined with news that the funds had reduced their long holding a little further to 216,277 lots by encouraging some early support with the potential for buying to come in and challenge the 16.75 contract high mark. The moderate early gains soon tempted some light but aggressive buying into the market and sent March’21 to a high of 16.61 though the move merely proved to be a small spike and values soon eased back into the range where a sideways path was established. This pattern endured for several hours and moving through the early afternoon there would have been very little trading were it not for the ongoing index fund roll which had accounted for around 70% of the volume in the nearby prompts. A mid-afternoon push back upward by the specs found continuing resistance in the 16.60 area despite a firmer USDBRL value of 5.32, and having created an intra-day double top the market suffered a sharp decline to new session lows as many of the day traders headed for the exit door and blew their longs back out. There was an effort to try and pull values back towards unchanged levels but unlike last week we were lacking that extra momentum required, possibly due to the weight of ongoing March/May’21 selling from the index roll that has the spread trading beneath 0.70 points. The differential further weakened to 0.66point by the close as the selling ramped up, with the flat price also making new lows at 16.26 and suggesting that we may see the range continue for the time being.

Sugar #5 May ’21

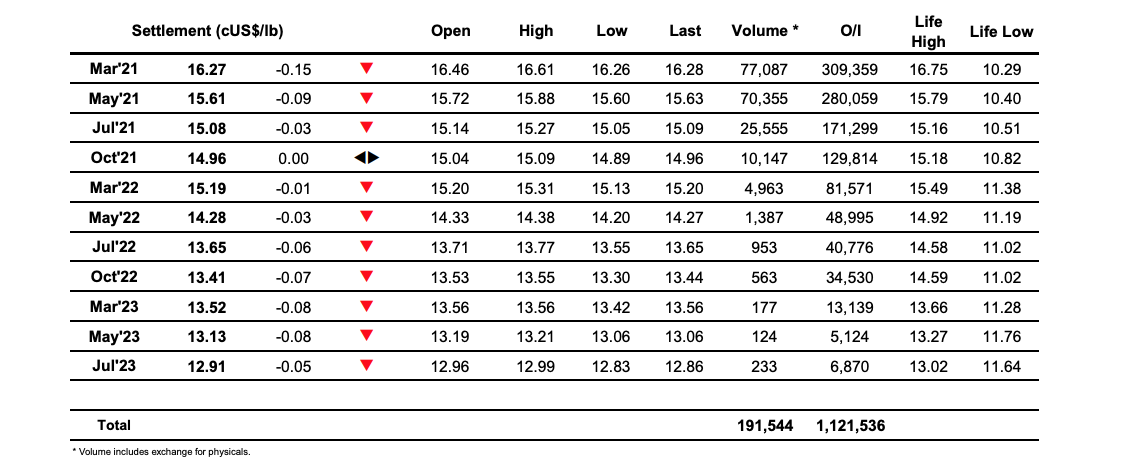

The final week of trading for the March’21 contract began with higher values, continuing the upward momentum of late last week. The early move took May’21 up to $457.20 while the March’21 reached a mighty $479.70 with the March/May’21 spread recording a widest trade at $23.70 in amongst the early choppiness. Slipping back from the highs the market continued to garner underlying support near to unchanged levels and this provided the basis for a prolonged period of consolidation during which time volumes proved minimal. The monotony looked likely to be broken midway through the afternoon as a fresh push upwards occurred however this simply served to create an intra-day double top that ended with a sharp washout from day traders that sent us back to the lower end of the range once more. By now the nearby spreads were beginning to struggle a little and March/May’21 came back beneath $20, while the March/March’21 white premium also retreated form its highs to be trading around $112. We seemed likely to end quietly within the range until the final hour when some further long liquidation sent prices down to new session lows, and while this may be merely corrective action following the push to contract highs it will certainly assist the near term technical which have been showing signs of being overbought.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract