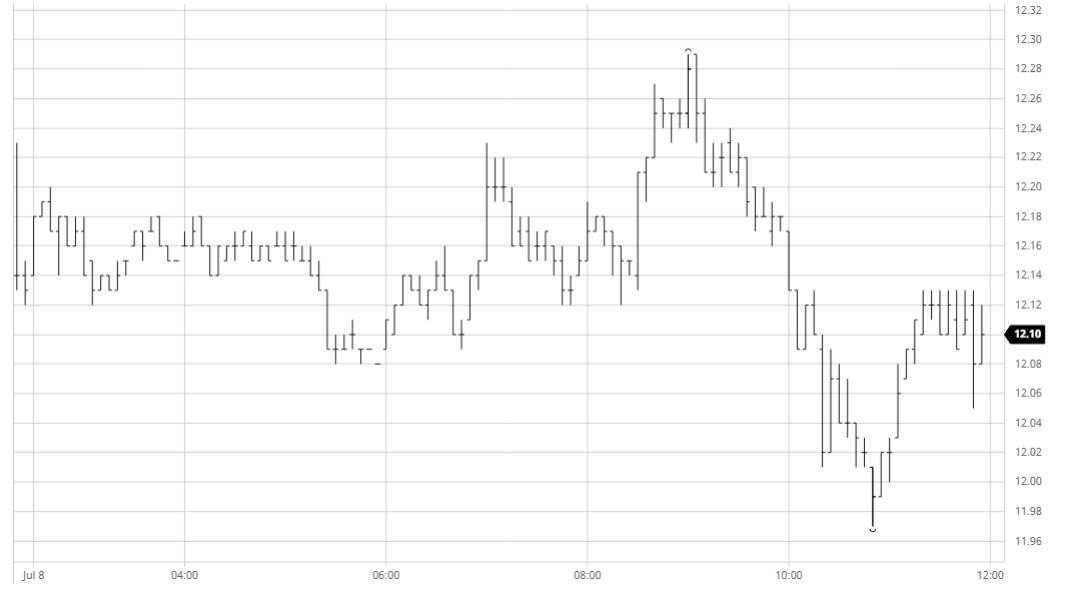

A very low volume morning even by recent standards saw values consolidating yesterday’s gains to remain well poised for another look upwards. Little happened until the early afternoon with us needing to wait for the arrival of US based specs to generate momentum in the absence of any fresh news, and they did not disappoint as Oct’20 pushed first to 12.23 and then onto 12.29 against two waves of buying. This move pushed in to the usual array of producer selling that continues to exist overhead, with the 12.29 high mark representing the twelfth time that Oct has seen a daily high of 12.25 or above since 10th June, yet is has only traded above 12.34 once during this period. Hopes that today could be the day to break this sequence were soon quashed by a round of long liquidation which sent prices back to briefly print below 12c before recovering to conclude the day mid-range. With the macro failing to provide the necessary impetus, USDBRL enjoying a more settled period in the 5.30’s and another failure to break higher added to the long list it seems the malaise may continue for a while longer.

SB Oct – Sugar No.11

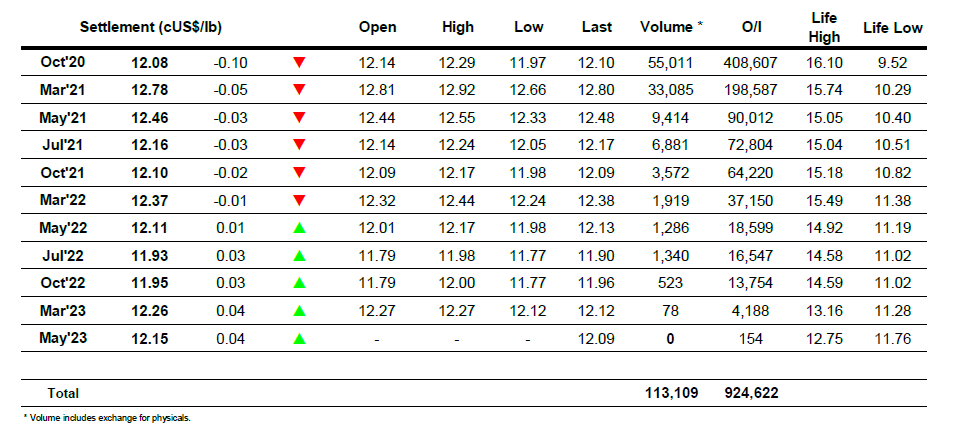

ICE Futures U.S. Sugar No.11 Contract

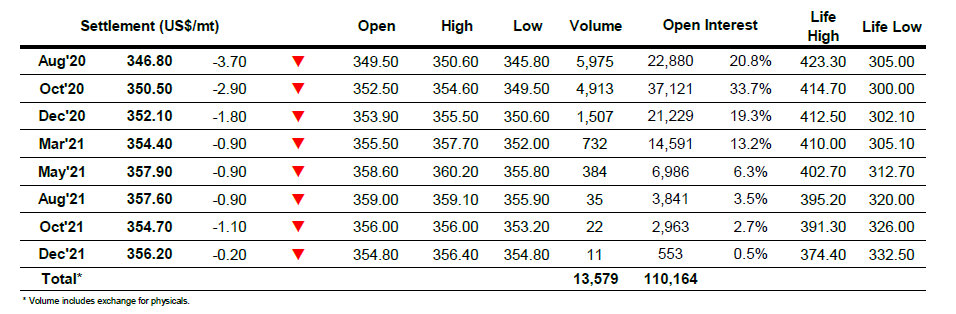

ICE Europe White Sugar Futures Contract