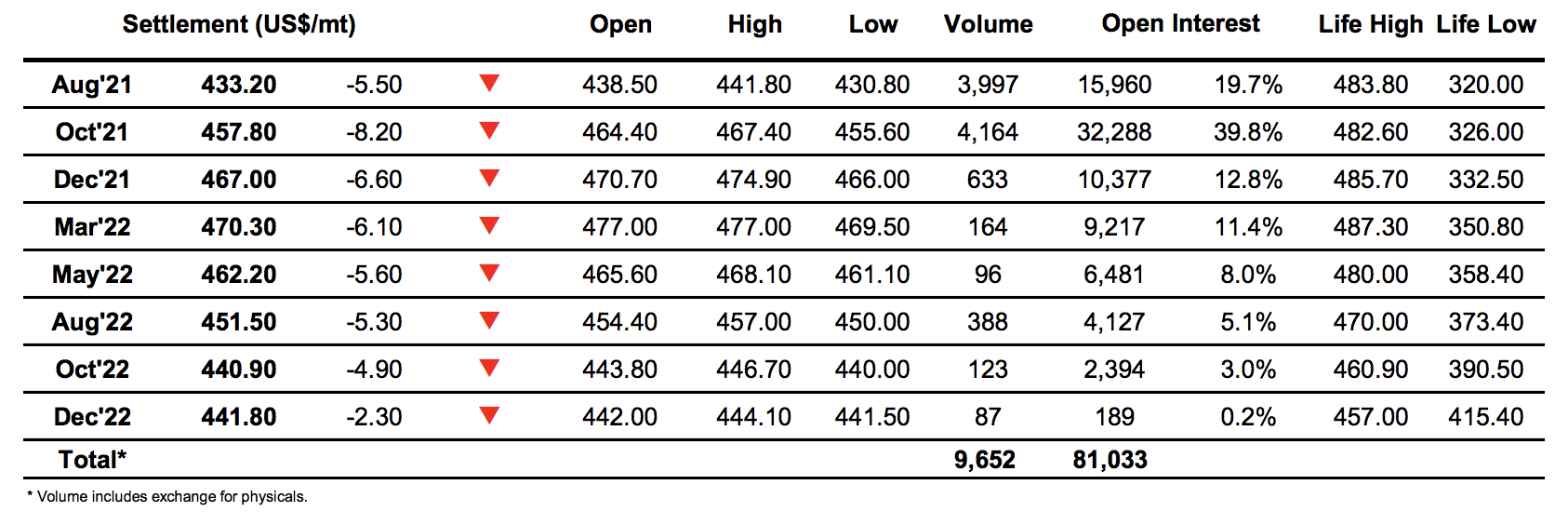

Sugar #11 Oct’21

There was some early pressure upon the market this morning however despite recent poor performances we saw it dig in with some moderate buying pulling Pct’21 into positive ground at 17.81 by mid-morning. The problem at present however is that with the macro struggling (Opec+ damaging the crude price) and our own technicals looking poor there is simply not the level of spec interest required to sustain the higher levels and so instead we began to slide once more and saw a sharp dip downward to challenge yesterday’s 17.45 low mark. This level is very marginally below the 50% retracement mark of 17.465 for the recent 16.44 / 18.49 move and we dug in to hold a daily low at 17.46 with support clearly prevalent in this area. Moving through the afternoon we settled into a band at the lower end of the day’s range and though subsequent moves led us back to the 17.46 mark the lows held firm against the relatively limited volumes on show. We eased calmly towards the close however when larger interest re-emerged during the final 10 minutes the market came under renewed pressure and the technical support broke to trigger some fresh long liquidation from funds causing a spike down to 17.32. Settlement was established well away from these lows at 17.45 however with market factors remaining negative including the recent move back towards 5.30 for the USDBRL which will aid returns to producers it is difficult to imagine a resurgence for the near term at least.

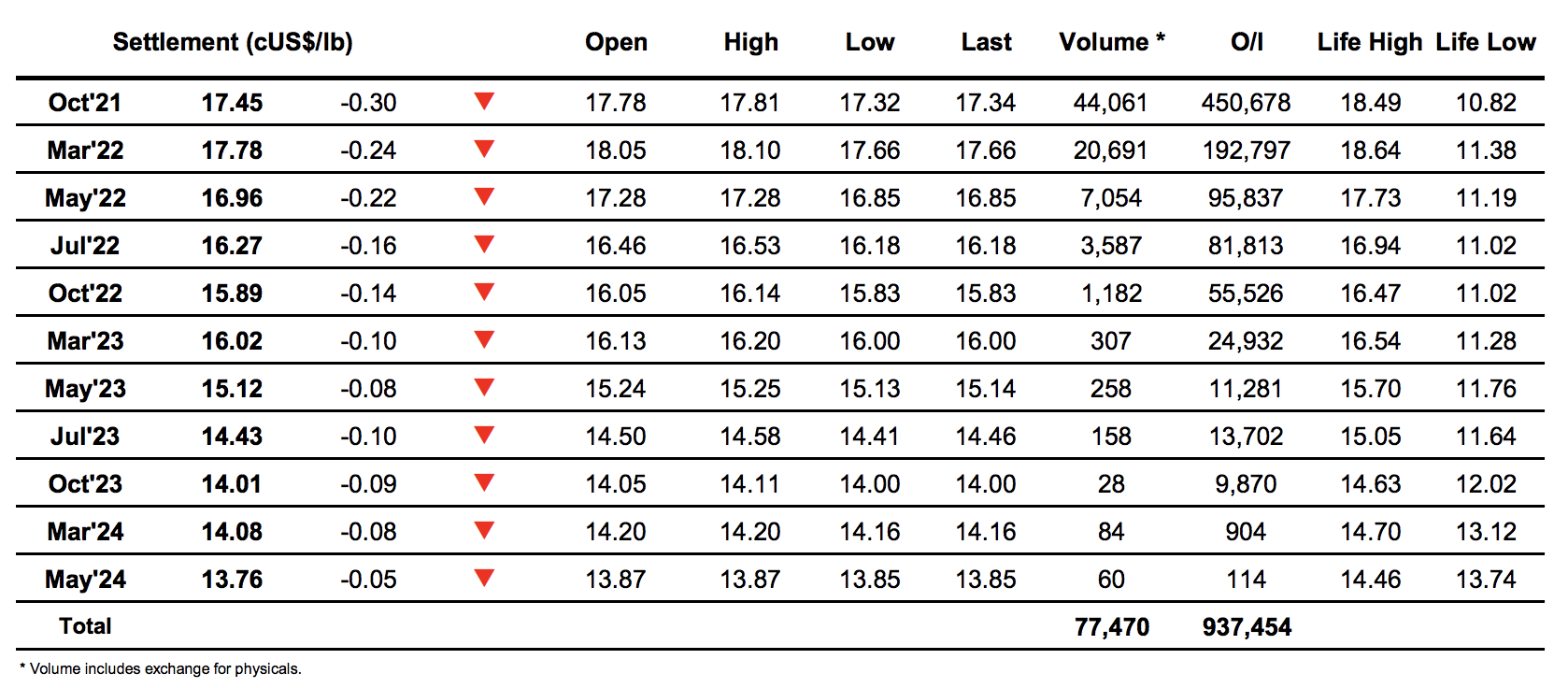

Sugar #5 Oct’21

The whites continue to chop around with current light market depth contributing to the intra-day volatility, with early trading seeing Oct’21 flit either side of overnight value before topping out at $467.40 as the buying dried up. This set things back on a downward path and with very little buying in place at yesterday’s low mark of $460.00 we extended the recent fall a touch further to $459.10 despite only odd lots changing hands. There was however slightly more positive movement for the Aug/Oct’21 spread which though still at a huge discount did claw its was back up to the -$24 area as we moved through the early afternoon. The flat price continued to flit around at the lower end of the daily range but with little volume being seen outside of the front spread and sentiment turning away due to recent macro weakness there was no hint of regaining any real traction and by the time we reached the final 30 minutes prices were once again within touching distance of session lows. Heavier selling as we headed into the close saw prices burst lower to reach $455.60, setting a couple of dollars above at $457.80 but adding further fuel to the current negative short term outlook.

· White premiums continue to flit within the recent range, closing at the lower end with Oct/Oct’21 settling at $73.10, March/March’22 at $78.30 and May/May’22 at $88.30.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract