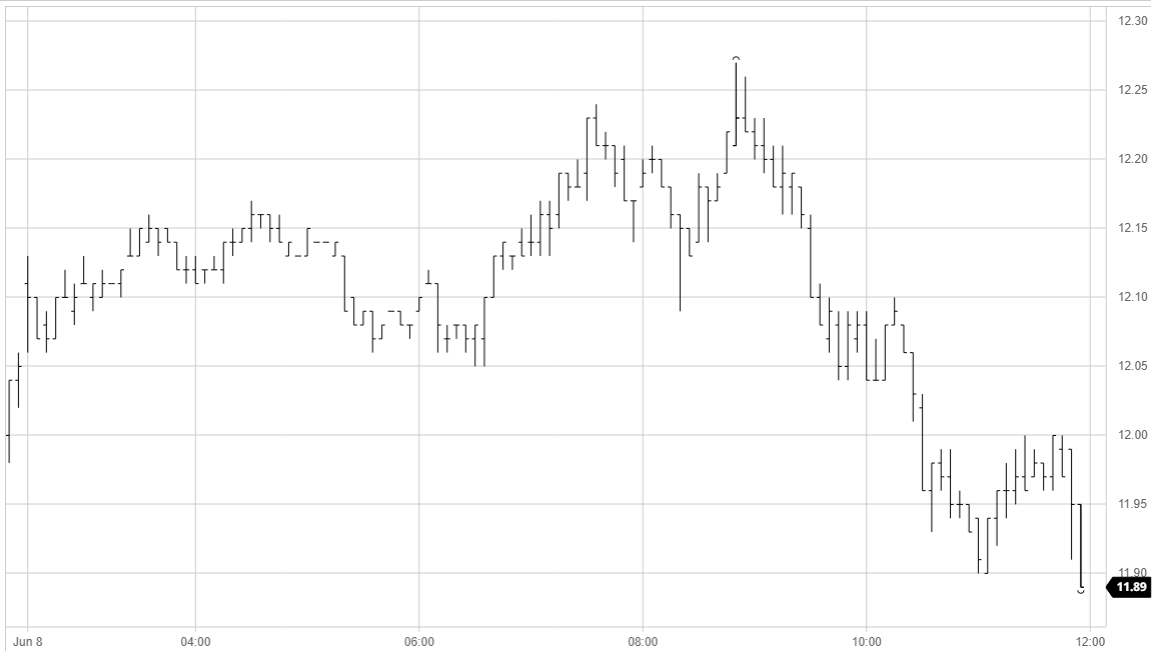

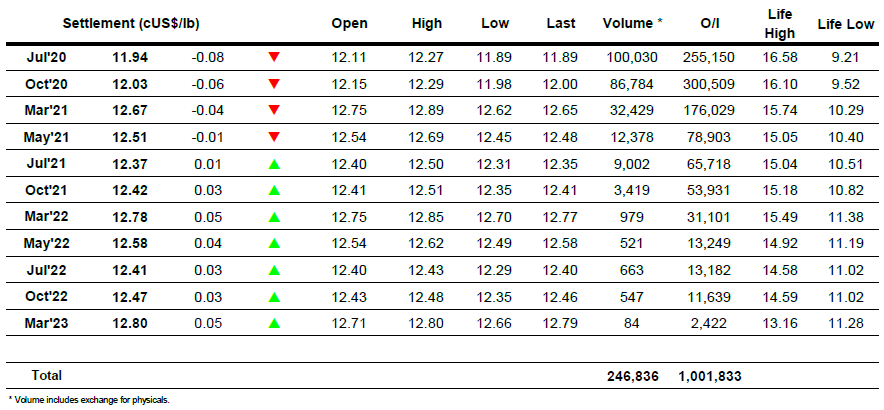

The news that Fridays COT report showed only our anticipated modest increase, placing the speculative community at 8,682 lots long, suggests that even with some heavier buying on the subsequent rally their current long holding remains relatively small and will be mostly in the hands of the smaller specs/non-reportables. With this in mind and the continuing technical strength it was not too surprising to see continuing buying on show which enabled the market to push higher still with initial gains forming the base to move onwards and fill the technical gap to 12.23 which dates back to March. A second wave of buying soon afterwards took Jul’20 to a new session high of 12.27 however with the market showing signs of being overbought a correction followed that sent prices back down to the morning lows. Spreads meanwhile continued to see a large proportion of the volume, particularly the Jul/Oct’20 which was by now weakening back off from a daily high of -0.02pts as the index roll continues to reach -0.10pts by late afternoon. A further wave of spec long liquidation took place as Jul20 moved down through 12c and this was a blow from which it could not recover, for today at least with late selling leading to a settlement price at 11.94. This represents the first lower close in a week and has occurred as the energy sector turns lower (crude down 3%) but in spite of continuing strength for USDBRL that has taken it to 4.87. In the face of an unchanged fundamental picture we may well be reliant upon the macro turning back upwards if this is not to prove to be short term topping action.

N.o 11 Futures

ICE Futures U.S. Sugar No.11 Contract

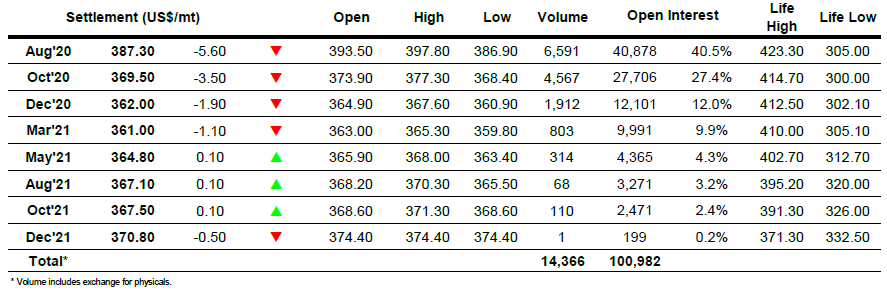

ICE Europe White Sugar Futures Contract