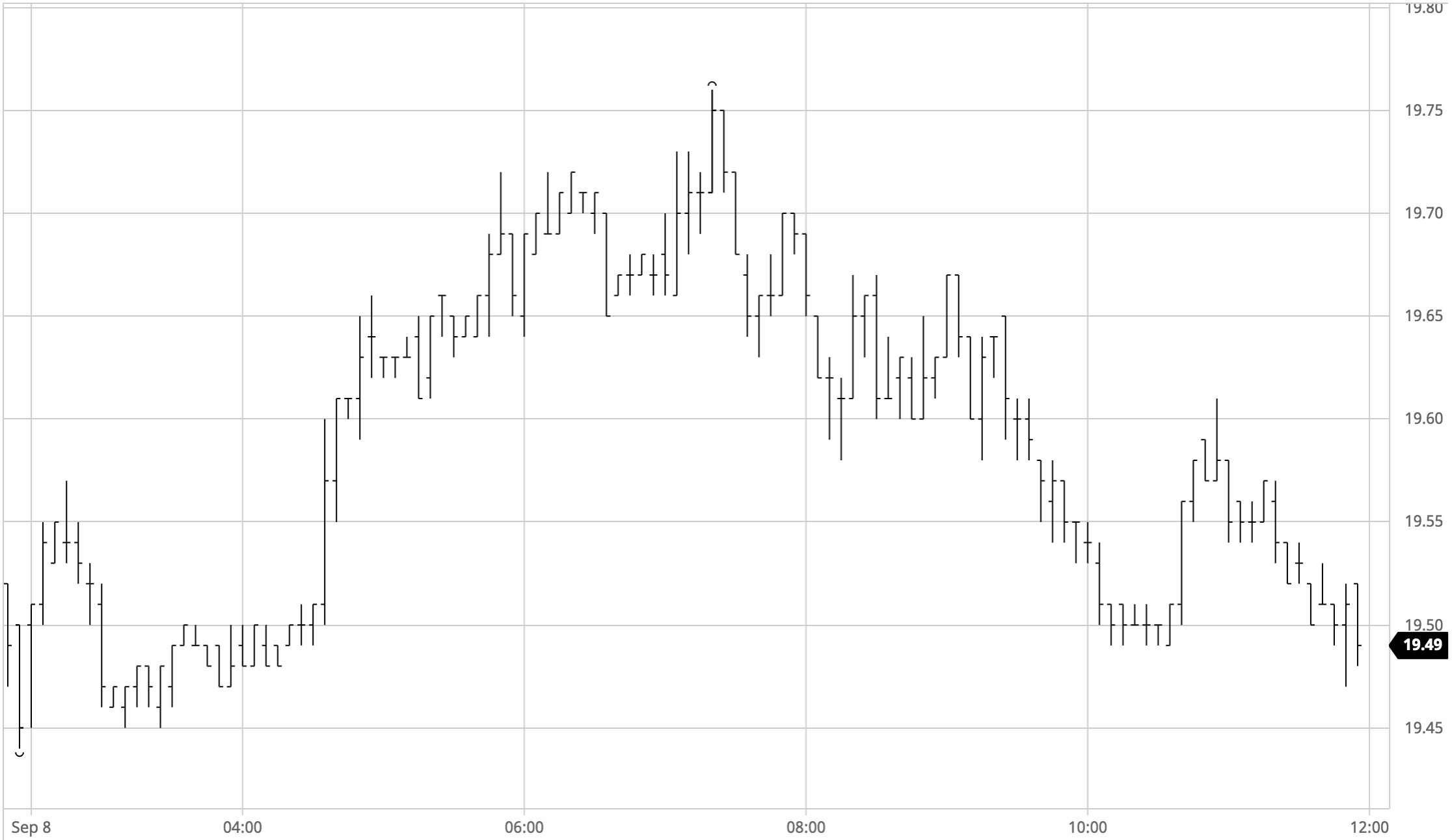

Sugar #11 Oct’21

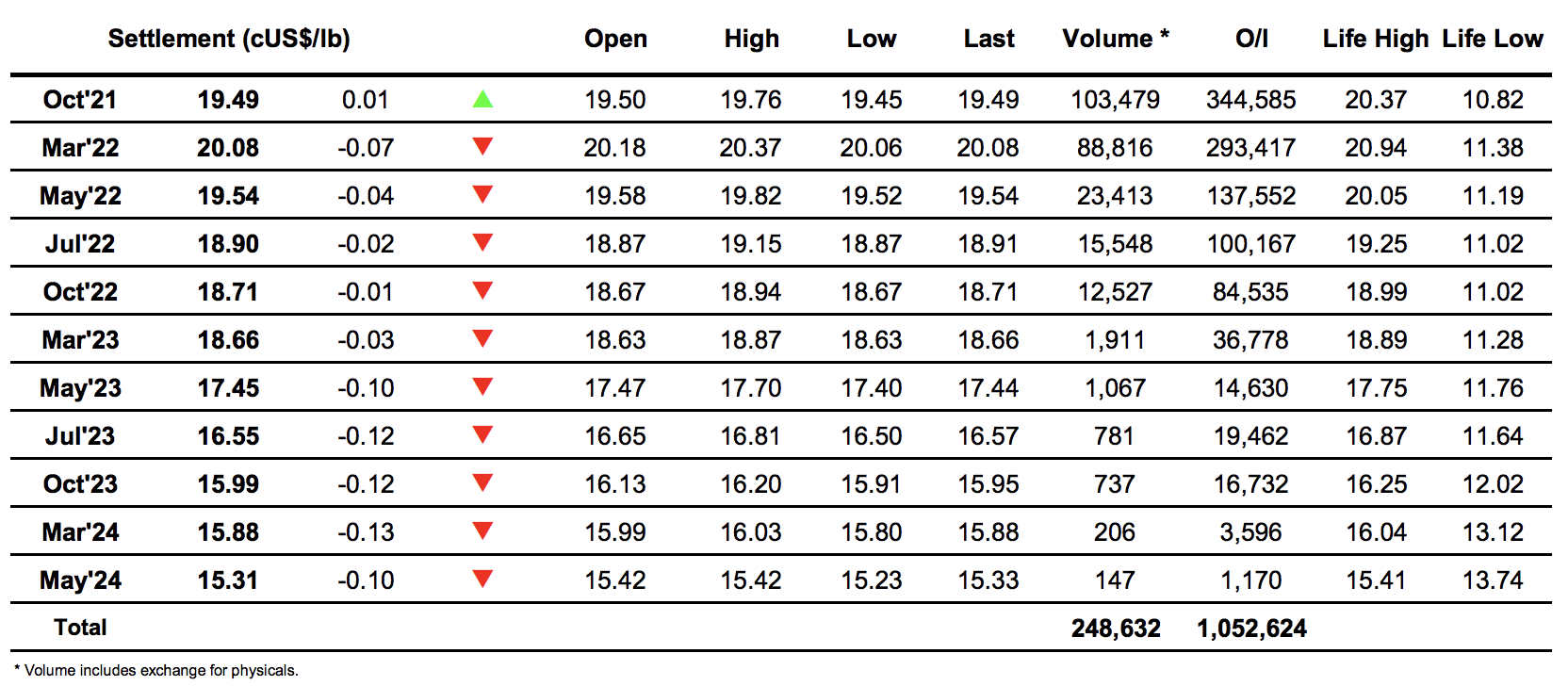

Having slipped to 2 week lows on last nights close the market was showing a small hint of vulnerability which could potentially draw it out of the current broad 19.50 / 20.25 band, however despite trading down to 19.45 during the first hour there was little desire to force lower and sufficient buying in place that we stabilised. A sharp burst of buying midway through the morning followed and put things back into a more positive focus however in keeping with recent sessions there was little on show to suggest that we would do anything other than bob around sideways once again. The same could not be said for the Oct’21/March’22 spread which was marking the first day of the main index roll period with some decent trade buying bringing the differential up towards -0.60 points over the course of the morning, no doubt to the delight of the spec longs needing to sell into it. The spread remained positive as we moved into the afternoon and despite stronger selling emerging it traded up further to a daily high at 0.58 points, in contrast to the flat price which from a high of 19.76 lost is lustre and headed back down through the range towards 19.50. The feeling remained that if you were not involved in the roll then there was little point in getting too involved, an apathy which is playing a large part in the current range bound pattern despite the Oct’21 expiry now being on just over three weeks away. The latter part of the session played out at the lower end of the range to leave Oct’21 little changed at 19.49 while the spread touched to -0.57 points before a glut of index pricing on the close left it settling at -0.59 points.

Sugar #5 Oct’21

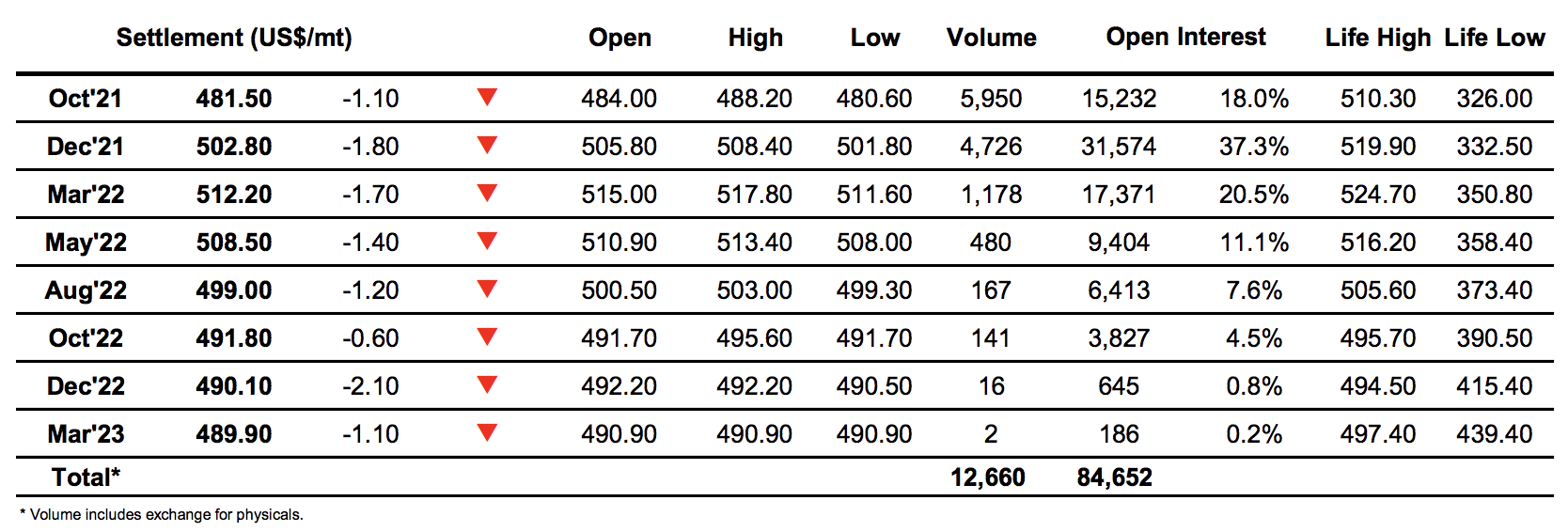

A quiet first couple of hours provided the basis from which Oct’21 could climb back up into the mid $480’s, maintaining the recent sideways pattern on low-ish volumes while losing a little ground relative to the No.11 and so seeing white premium values narrow back in. Still the climb continued into the early afternoon and we recorded a high at $488.20 before topping out with the start of the US morning still failing to garner any significant spec interest which we require currently if we are to head upward once more. Instead the market turned on its heels and over a couple of hours embarked upon a steady retracement of the morning gains which left prices back at unchanged levels with a couple of hours to go and those on the side line feeling thankful that they do not need to be involved. Volume was again only decent for the Oct/Dec’21 spread as those remaining in the front moth continue to shift their hedges down the board, but here too it was calm with most trading taking place either side of -$21. The final couple of hours saw the slide continue to new session lows though we bounced slightly and ended the day only moderately lower at $481.50.

As mentioned there were losses for the front month white premium today though we recovered some ground late on, ending for Oct/Oct’21 at $51.80, March/March’22 at $69.50 and May/May’22 at $77.70.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract