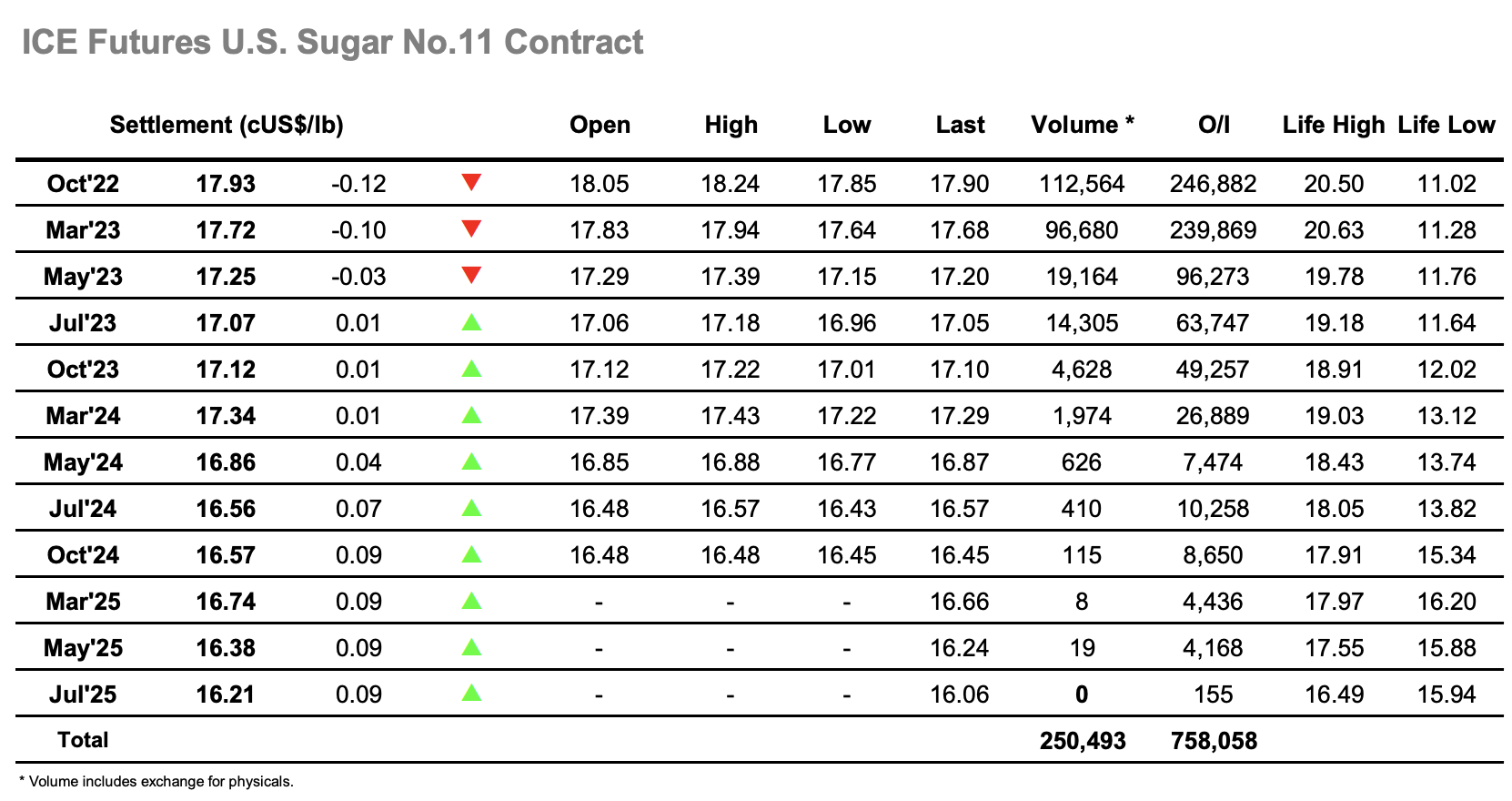

Opening highs at 18.19 were short-lived and on low volume the market soon settled into a narrow range near to overnight levels. With the front spread again providing a large percentage of the traded volume the market continued near to 18c throughout the morning before encountering some light spec buying early in the afternoon. This moved Oct’22 up to a daily high 18.24, though the move was assisted by Oct’22/March’23 spread buying (trade?) which extended the price to 0.32 points and match yesterdays widest point. This provided a great opportunity for the index sellers to move forward more aggressively with their own roll and through the remainder of the afternoon it was very much a case of yesterday repeating as the differential moved back down to the low 0.20’s while the flat price returned to its happy place in the vicinity of 18.00. The final part of the day played out quietly as late spread rolling which took the Oct’22/March’23 volume beyond 70,000 lots brought no fresh movement, leading to another settlement to the centre of the band with Oct’22 at 17.93.

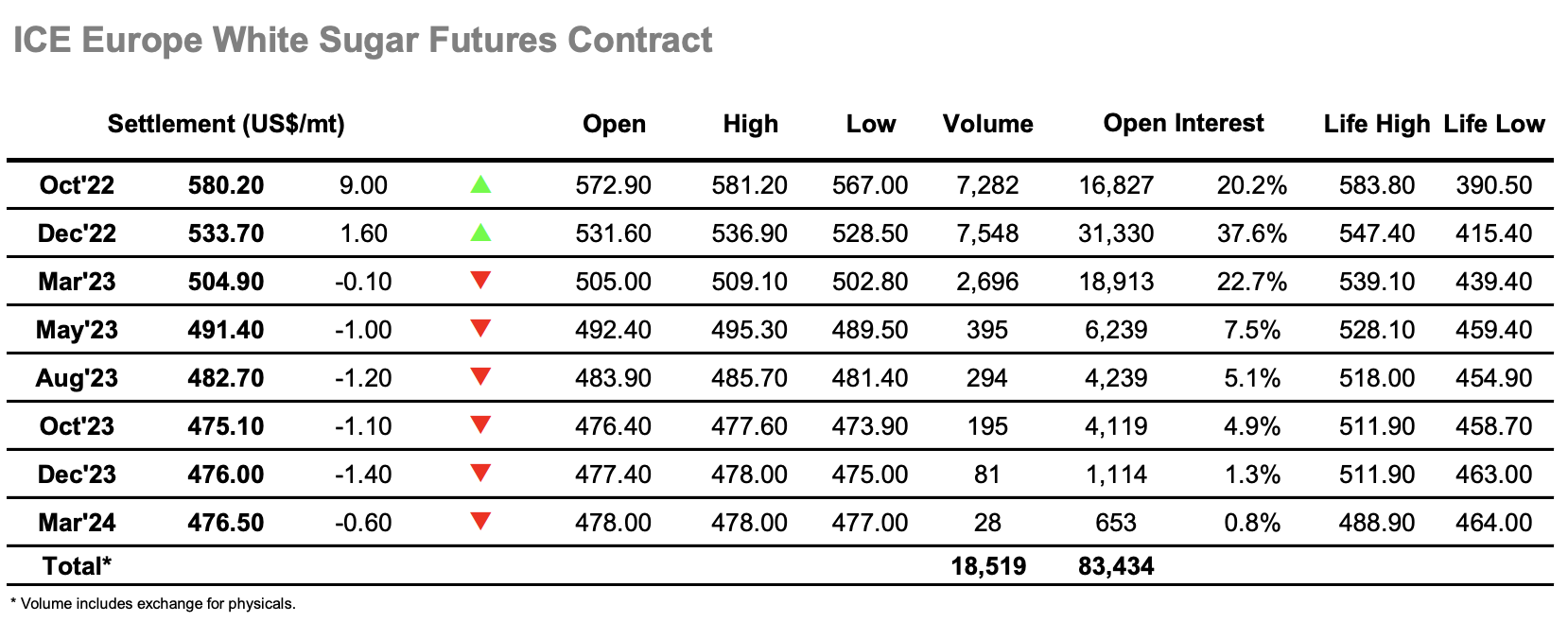

With very little outright volume changing hands we saw nearby values drift a few dollars lower initially before looking to clamber back upwards ahead of the Americas day getting underway. Volume notably picked up as we moved into the afternoon, both for Dec’22 which gained some traction and moved ahead to $536.90, and also for the soon to expire Oct/Dec’22 spread which pushed on ahead into the mid $40’s. Spread activity made up more than 70% of the volume across the front two positions with positions continuing to move forward, and this ensured that the Oct’22 contract at least was buoyant with a surge back up to $581.00 during the afternoon. This action kept nearby premium values solid with Oct/Oct22 reaching to $185.00 and March/March’23 nudging towards $115.00. By late afternoon it was only the Oct’22 maintaining strong gains as the spread ended at $46.50 while Dec’22 settling at $533.70 provided the only other net gains as all 2023/2024 positions settled lower.