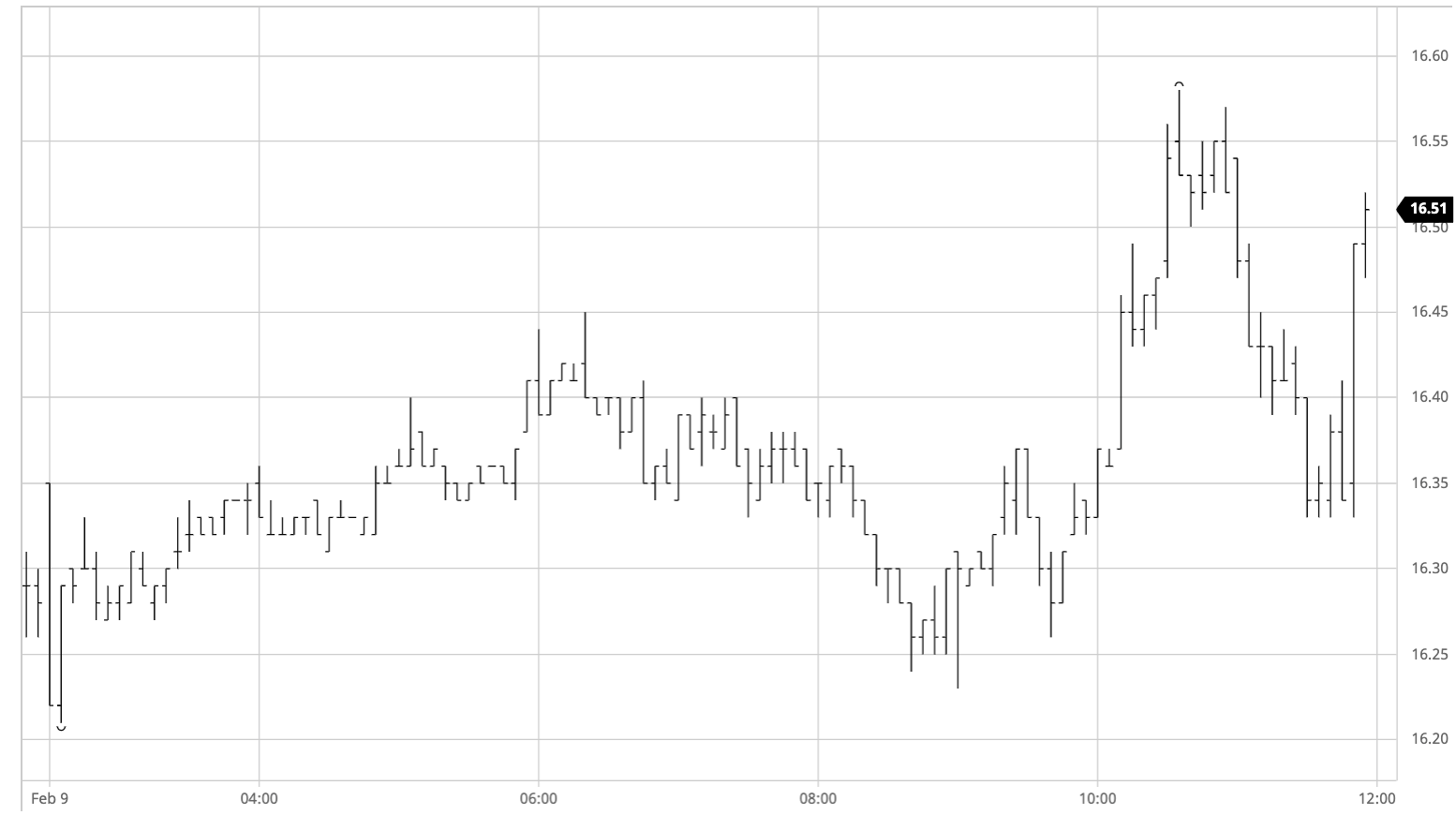

Sugar #11 Mar ’21

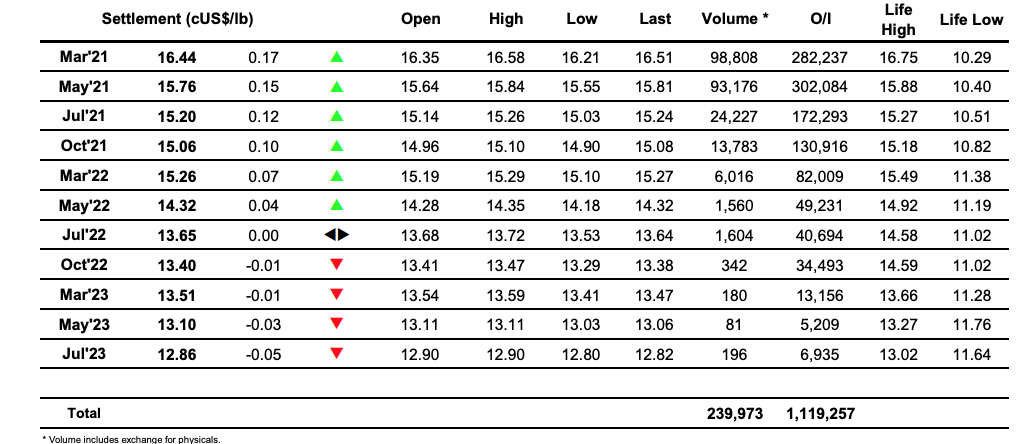

The decline seen in nearby values yesterday afternoon seemed to have knocked some of the spec momentum this morning as the market edged quietly upward on low volume but lacked the spark which has enlivened things in recent times. By early afternoon the steady progress had taken March’21 as far as 16.45 but lacking the concerted buying to continue higher we then began to drift once more and by mid afternoon were back within touching distance of the opening lows. This decline may in part have been down to the pick up in fund rolling that the US morning brought with stronger selling of the March/May’21 spread seen today than on the previous two days of the rolling period so far, however it also seemed to be the trigger for the specs to return to the market and push upward once again. A mid afternoon rally resulted in a sharp push up to 16.58 for March’21 and a significantly wider spread value of 0.75 points but as so often has been the case we were once more unable to sustain the move and as we worked into the final hour values had retreated back to the middle of the range. It seemed that we would end quietly however the longs had other ideas and a sharp burst of MOC buying sent March’21 back up towards 16.50. Alongside this rally a final burst of March/May’21 volume took todays total to almost 80,000 lots including the TAS volume, a huge proportion of an otherwise disappointing volume. March’21 settlement was beneath the closing highs at 16.44 and whether this can be a platform from which to finally try and break out of this range in which we find ourselves remains questionable

Sugar #5 May ’21

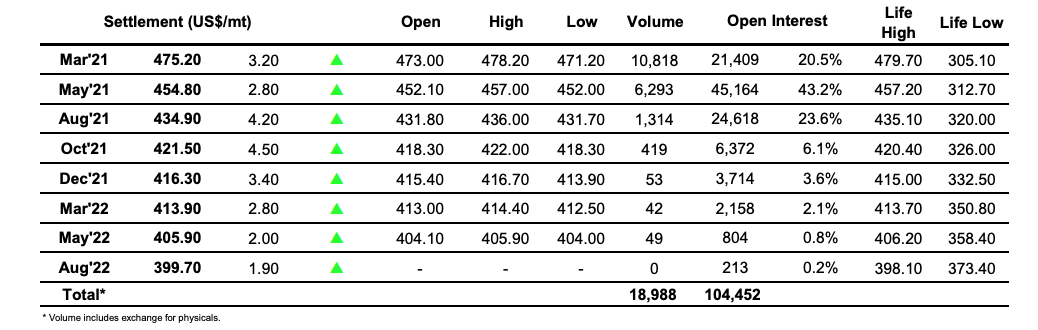

The day began positively with light buying pulling the nearby prompts upward in an effort to put yesterday afternoons struggles quickly behind us. This initial stability had the desired effect and soon we started to make additional gains with the thin environment finding little resistance on route to a morning high mark of $456.50 for May’21. March’21 was also coming along for the ride as we approach the expiry, where with 4 days to go we find an open interest figure of 21,409 lots showing us that the funds are now moving positions forward with more haste though it has had little impact on the March/May’21 spread value which continues to trade a range either side of $20. A decline back towards unchanged levels midway through the afternoon seemed to signal that we would endure a featureless day however one can never rule out the persistence of the specs and algos who duly obliged to enliven proceedings with a sharp push to be trading at new session highs with just an hour remaining. Rather than sustain the move the final hour then saw an even quicker decline which set us back towards the lower end of the range once more, and it seemed the only achievement of the afternoons movement had been to swing the May/May’21 white premium around between $109 and $107. There was a final twist as MOC buying shot values back away from the lows in the final minutes, leaving May’21 to settle positively at $454.80.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract