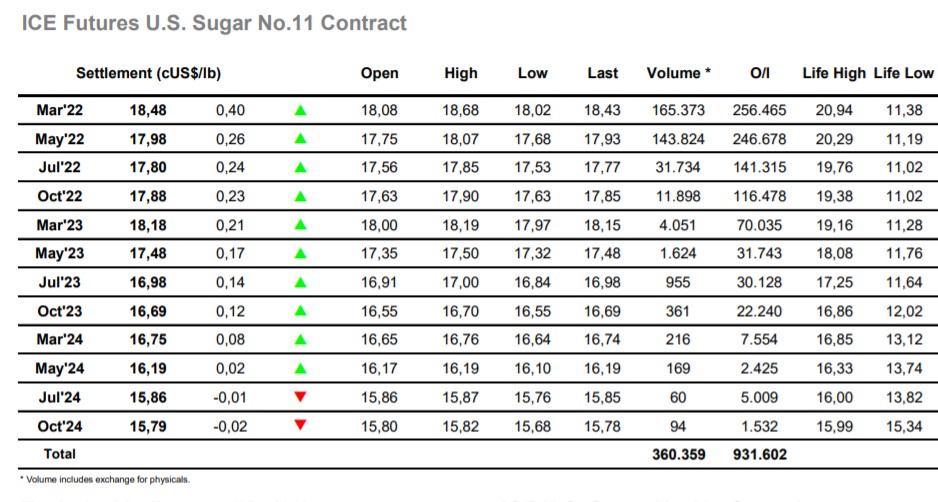

Sugar #11 Mar’22

A steady start saw the usual array of hedge lifting take March’22 upwards however as ever it was followed by a swift retreat into the red with March’22 testing in front of 18c for yet another time. In calm conditions the market then gathered itself to work back up towards the opening highs, and while activity was not overly significant for the outright prompts there was some reasonable morning volume changing hands for the March/May’22 spread. This provided the base for a late morning push up into the 18.30’s as March/May’22 buying gathered pace, the spread moving back up above 0.40 points as buyers chased despite the known presence of index selling this week. Progressing into the afternoon a calm interlude was broken by a very sharp push higher for the March’22 spreads, as the move up through the 0.40’s took prices on to new recent highs and led to a sharp increase in the pace of ascent. On incredibly high spread volumes the March/May22 differential reached a widest 0.61 points, hauling the outright March’22 position along for the ride to record its own high mark at 18.68. This placed values well beyond the former February high of 18.56 however the gains could not be fully maintained and as the index selling upped in volume during the final hour so March’22 slipped back into the range. Solid gains remained for the close though the price had fallen back beneath 18.50 with settlement at 18.48. The spread too was well shy of its highs and ended the session at 0.50 points on volume of more than 112,000 lots (before TAS considerations) to provide a total volume far in excess of 300,000 lots, the largest for well over a year.

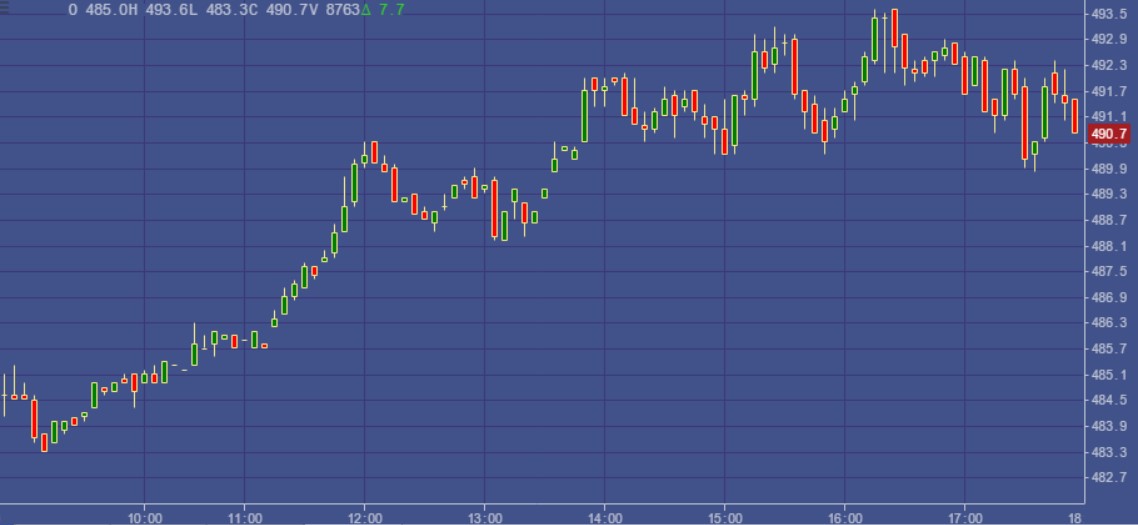

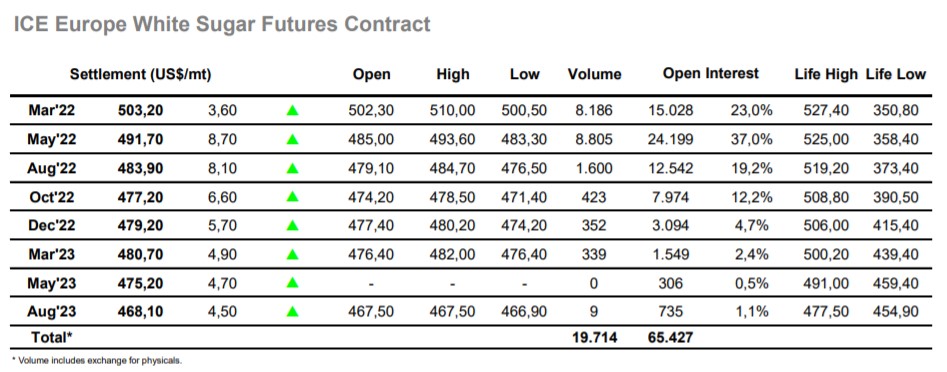

Sugar #5 Mar’22

Early trading saw the market follow a familiar pattern of higher initial trades followed by a retreat, however unlike recent sessions the slip was picked up in front of unchanged and the market soon worked back up by a couple of dollars. There was a continuation of the spread buying from yesterday keeping the March/May’22 firm, and this seemed to resonate some general strength down the board with all prompts showing gains for the day. The strength at the front of the board was also leading white premium values outward with March/March’22 working above $103 during the morning as the spread reached a widest mark at $18.20. A late morning push to the $490 area for May’22 provided a solid footing from which spec interest could filter back in, making further gains into the lower $490’s over the following hours. There was a sharp change in the direction of the spread however, no doubt influenced by the May’22 buying interest and over the afternoon the differential narrowed all the way back to $12.50. The May’22 meanwhile made great strides and held within a dollar or so of the highs through the afternoon, while its relative strength took the May/May’22 premium out beyond $95. There was a slight pullback ahead of the closing call on profit taking on which the March/May’22 narrowed back as far as $11.10; however the call saw prices remain solid and May’22 settlement was made at $491.70.