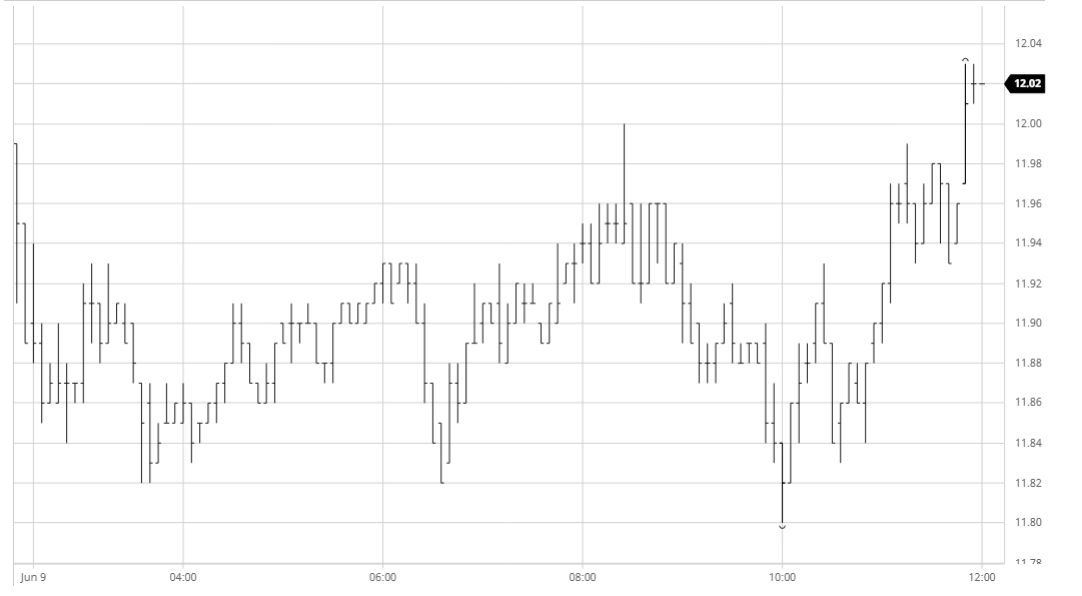

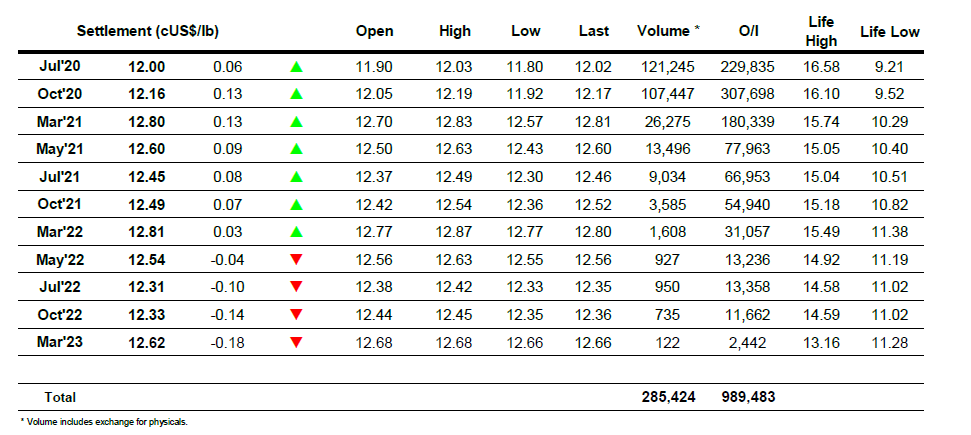

Early trading saw nearby values between unchanged and a few points lower on rather subdued activity. With the macro quietly lower, led by some early crude weakness the recent spec buyers were proving to be remarkably quiet, and it was spreads that provided the bulk of the morning volume with the ongoing index roll placing the Jul/Oct’20 under pressure with the discount widening into the teens. This seemed to set the pattern for the day, and though a marginal macro recovery encouraged some light spec interest which took Jul’20 back to 12c the move lacked substance and we quickly returned to the range and light outright activity. The Jul/Oct’20 spread meanwhile was seeing a massive volume which ultimately totalled around 90,000 lots, making up a huge proportion of the market total for the day as index traders sold it out to -0.18 points though it ended the day at -0.16. Specs did look to protect their recent longs with some buying during the final hour which sent Jul’20 back above 12c in the final 10 minutes and this ensured a positive settlement, however it feels as though we remain reliant upon the macro to determine which way from 12c we now move.

Futures no.11

Futures no.11

ICE Futures U.S. Sugar No.11 Contract

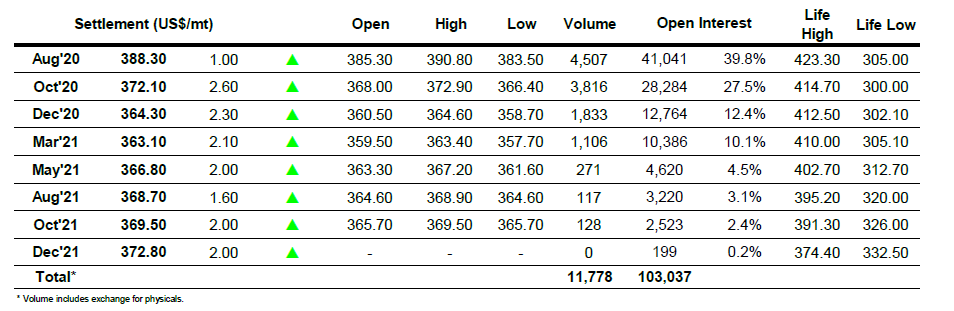

ICE Europe White Sugar Futures Contract