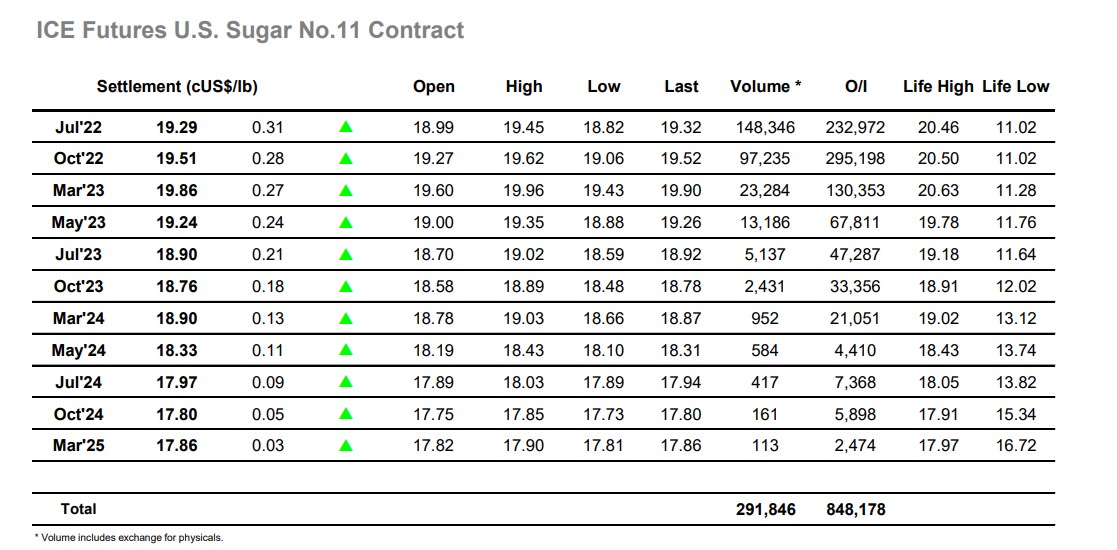

Having consolidated the 19c area yesterday the market started very much in the same vein with morning trading confined to an 18.93/19.07 range which had been established over the first 10 minutes. The market was feeling rather lethargic and a nudge lower to 18.82 as the US-day got underway suggested that we would see further testing of the underlying consumer support, though just when nobody was expecting it things turned in spectacular style. Buying from trade and spec sources sent prices accelerating upward, picking the usual array of algo interest up long the way as Jul’22 reached 19.45, the momentum also bringing the Jul/Oct’22 back up to -0.17 points despite the continuing presence of significant index selling with the roll into its third day. The rally was also helped by a lack of interest from producers with the Brazilian mills still quiet with the USDBRL maintaining comfortably below 5.00. Long liquidation/profit taking meant that the highs were not maintained for long, though longs will have been pleased that prices levelled out in the 19.20’s to hold some gains in line with the moderately higher commodity basket. Fundamentals continue to show a strong tail to the Indian crop and decent progress in Brazil, and so while the market seems to be finding a base it is difficult to find a reason for a significant rally at present, suggesting todays action may be repeated and play continue within the broad 18.50/20c range moving forward until some more substantial influence is found. MOC buying ensured a solid close at 19.29 for Jul’22 with Jul/Oct’22 settling at -0.22 following some late index/spec rolling.