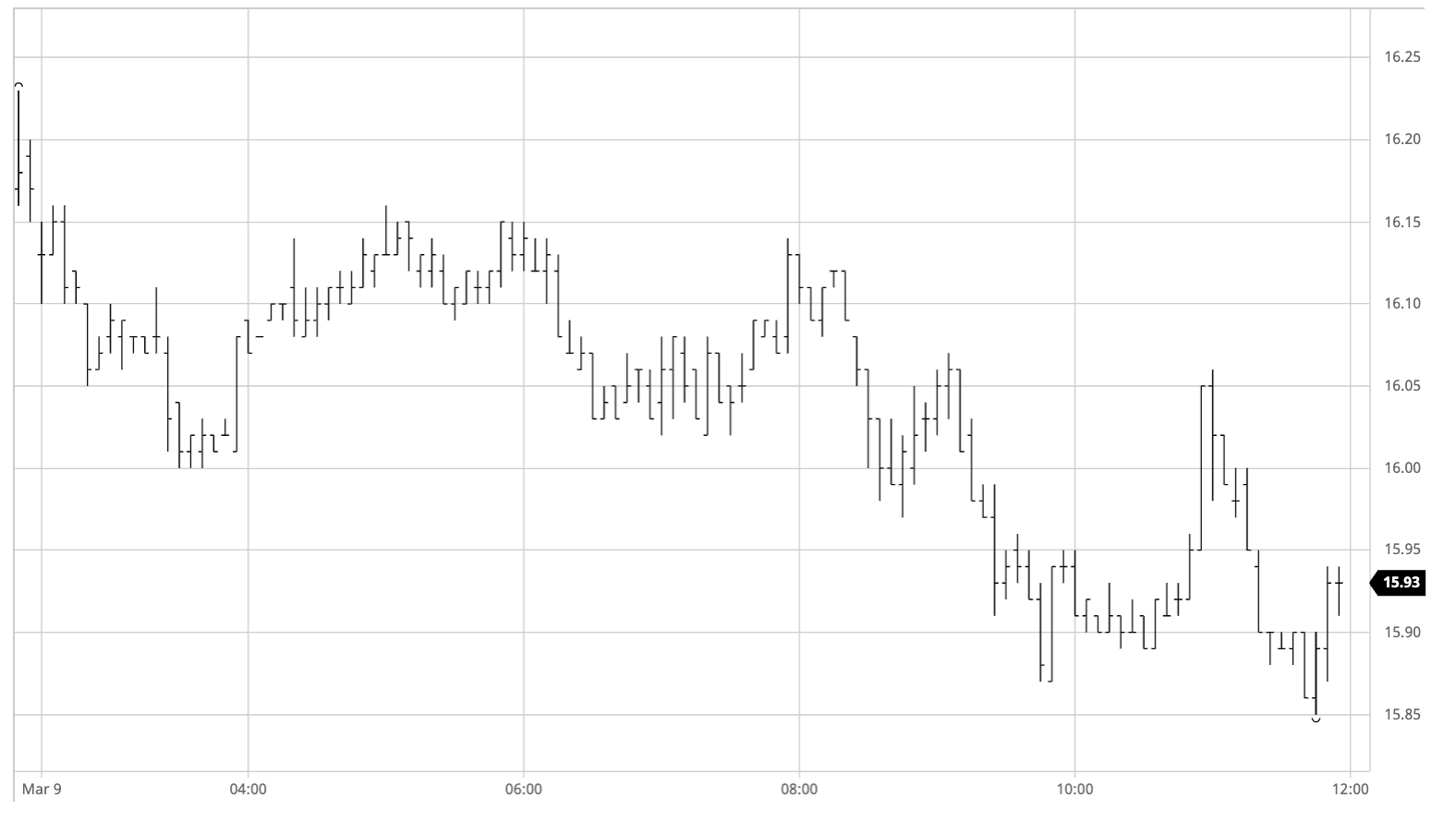

Sugar #11 May’21

The disappointing performance yesterday set the tone for early weakness and light selling took May’21 down to 16c during the early stages where it found some psychological support. This support enabled values to make a small recovery but in continuing thin conditions its limited volume only pulled the price back into the lower teens before we topped out and entered the latest in a tedious set of sideways trading patterns, holding between 16.02 and 16.16 for more than four hours. When the range was finally broken it was the lower end that was tested as we extended the recent band downward by trading beneath 15.96 and extending into the 15.80’s. While scale buying was in place to ensure that prices did not fall away quickly its nature meant that there was little desire to push back upwards in a significant way and so it was only a brief and unsustained short covering rally the saw prices back above 16c before we returned to the lower end of the range once more. Spreads were also under fresh pressure with May/Jul’21 trading into 0.45points and this also hindered any chance of recovery and led to a session low being recorded at 15.85 as we approached the closing call. The call itself was mixed and led to a settlement level of 15.90, just 5 points above the low and technically weak with the market looking a little fatigued whenever the macro impetus wanes.

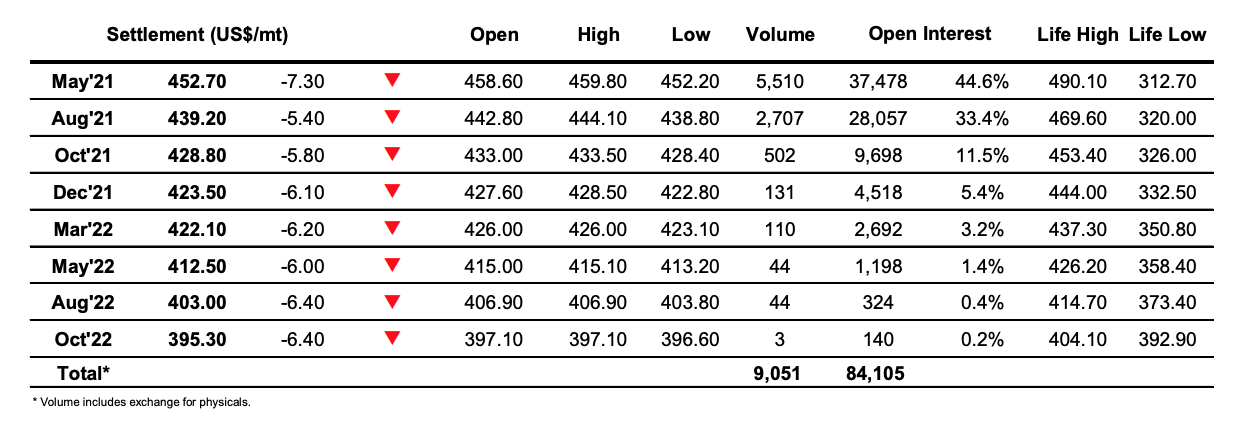

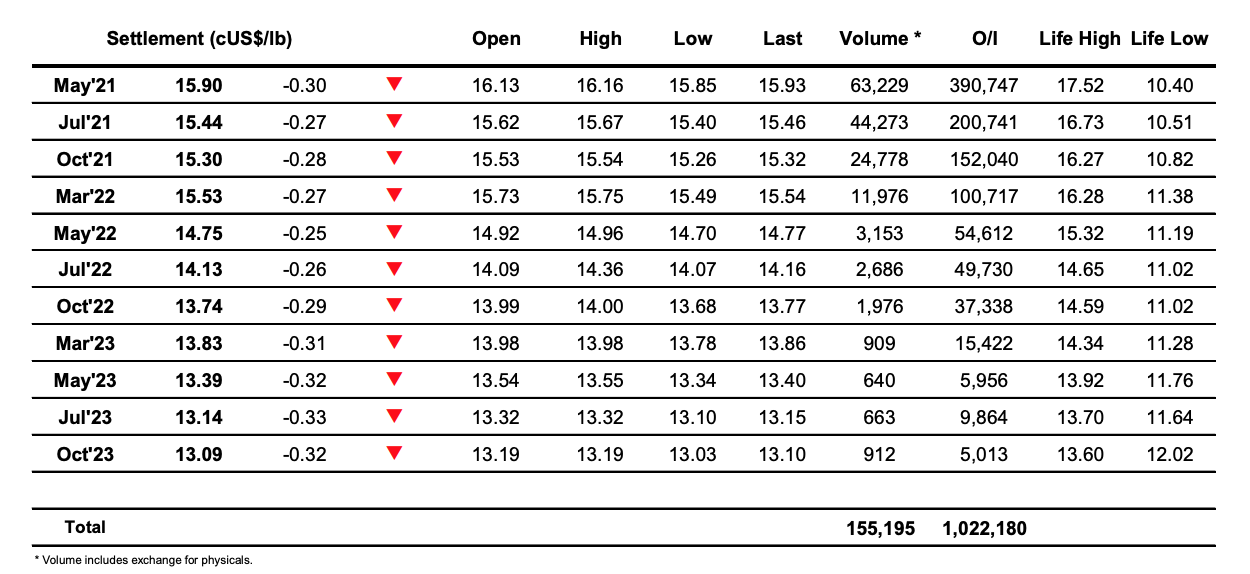

Sugar #5 May’21

Early weakness saw May’21 quickly drop down towards $457 and then continue to a morning low of $455.80 soon afterwards as traders looked to challenge the recent $454.50 low mark in an effort to escape the confines of the range which has held for the last week or so. Defensive buying then emerged to quietly edge prices back up towards unchanged levels and fill the overnight gap on the intra-day charts but with that done the momentum soon ended and we entered a slow sideways pattern that has become synonymous with recent days. The situation only began to change once we were well into the afternoon with another burst of selling which this time took us down to the lowest levels seen since mid-February as May’21 traded beneath $454, and while the dip was again picked up by short covering the rally was brief with another new session low set at $452.20 during the final hour. A technically weak close saw May’21 settle only just above the lows at $452.70, suggesting there may be further struggle in the short term.

Whites premiums had another narrow range today as the movements tracked alongside No.11 reasonably constantly, ending the day values at $102 for May/May’21, $98.75 for Aug/Ju’21 and $91.50 for Oct/Oct’21.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract