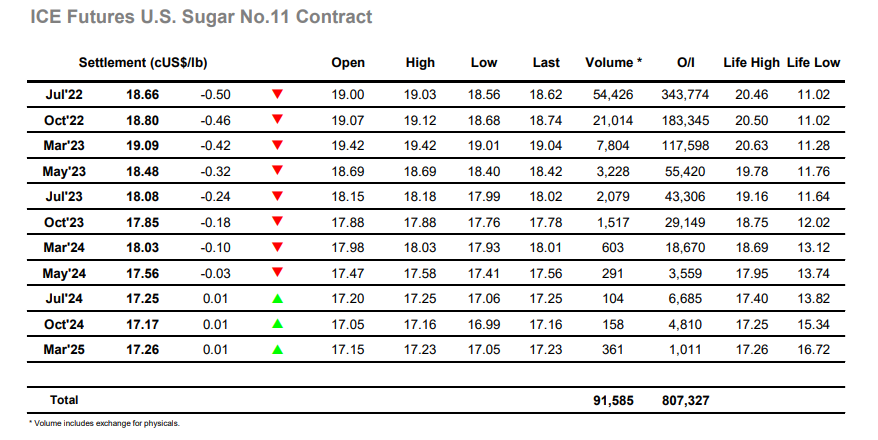

Fridays performance had given fresh hope to the specs that some further recovery was possible against macro/technical factors, however that seemed a distant memory as early trading saw Jul’22 sold down to 18.88 before attempting to consolidate the 18.90’s. Most commodities were trading downward, possibly because of Putin’s Victory Day address being less aggressive than some had anticipated, and without the wider macro support there was little to keep the market up. By late morning we were seeing the prices start to ease further with a steady decline following through much of the afternoon that returned prices to last weeks support area in the 18.50’s. The recent 18.54 low held firm as scale buying continues to provide a base, but though some short covering followed it had only a limited impact upon the front month with no reason for buyers to step in with any aggression. A slow final hour saw process continue away from the lows as Jul’22 settled at 18.66. Today’s poor showing serves only to illustrate that against the current fundamental picture it will take a significant macro move to bring the level of spec buying required to mark a sustained move back higher. In the meantime, we anticipate more of the same “rangebound” trading for the coming days pending any fresh news.