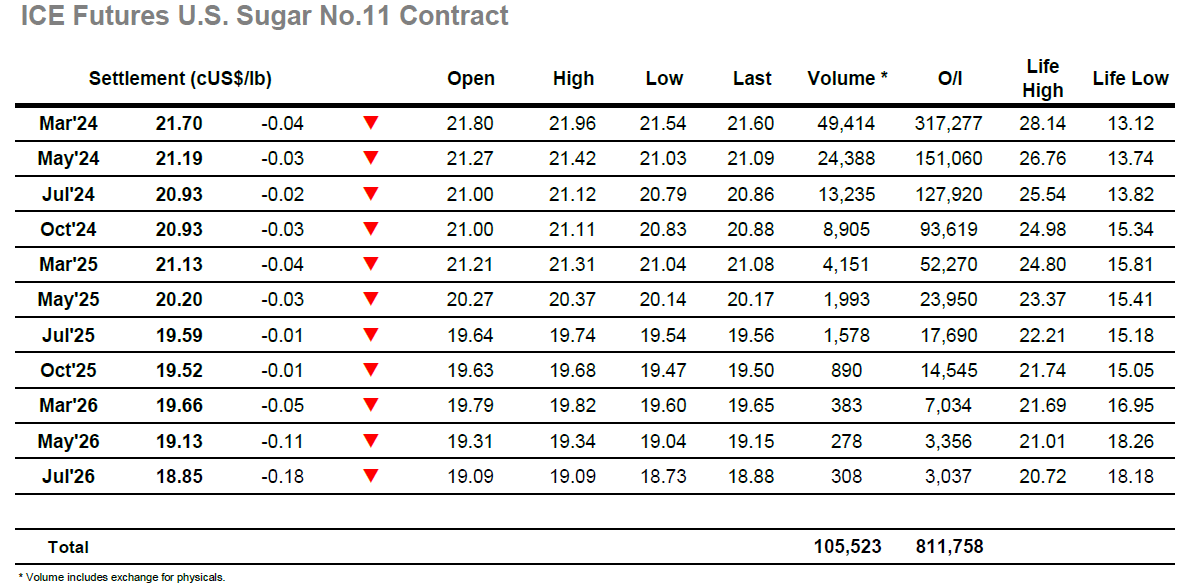

There was a continuation of yesterday’s positive movement as we got underway this morning with March’24 nudging to a new high for the year to 21.96 before looking to consolidate the move. It managed to do this quite comfortably initially however by late morning some long liquidation sparked a reaction to send the price back to 21.63. With volumes still painfully light the market continued within the range into the early afternoon, a malaise broken only when another round of small spec selling sent the price tumbling to a new low 21.55. This move proved to be brief as buybacks soon followed to send the price back up into the range, generating some fresh enthusiasm which enabled the market to climb back towards the morning highs. The upward move was aided by March’24 spread buying which saw March/May’24 trading out to 0.56 points, however with only the small specs/day traders showing in any prominence the market stalled again to consolidate the 21.80 area through until the closing stages. All remained quiet until call when long liquidation once more created movement, leading to a settlement value at 21.70 before incredibly making a session low at 21.54 on the post close.

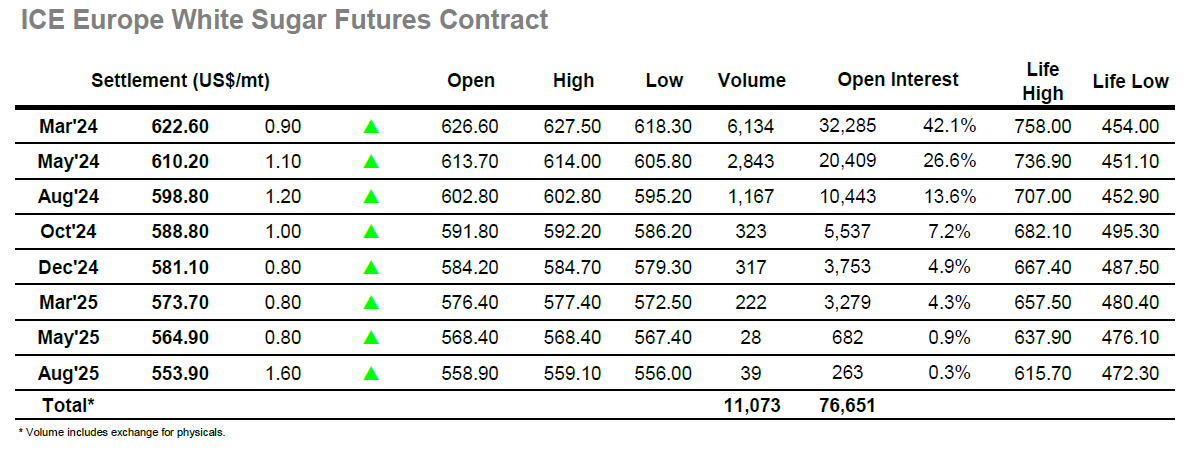

The current resurgence continued with a jump to $627.50 for March’24 on the opening and though the gains then reduced the market remained comfortably positive for the first couple of hours. A pullback against day trader liquidation later in the morning was picked back up, however with small traders/specs dominating the low volume environment the market retained some vulnerability and following a sustained period of consolidation there was another washout of longs to a $618.30 low. Volume was being boosted to moderate levels through some steady March/May’24 spread activity, however for the flat price it remained a choppy picture with a rally from the lows culminating in another look at $627.50 and an intra-day double top. Still, this will have pleased the bulls and buying continued in sufficient quantity to support the market heading towards the closing call. There was to be one final twist as the final stages saw long liquidation and plunge back down through the range, and while settlement at $622.60 changes little the evidence of todays activities still seems to point toward broadly sideways trading with the volume/interest needed to make more sustained moves still lacking.