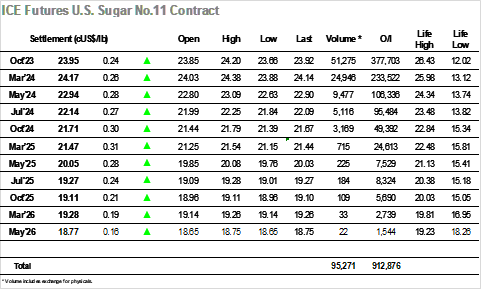

Opening buying printed Oct’23 up to 23.90 though the spike I value proved to be brief with the market soon calming to sit back into the 23.70’s. With so little activity taking place there was a further slide back to 23.66 before buying returned and took Oct’23 up to new daily highs as we reached noon. These firmer levels were maintained through the early afternoon with spec buyers ensuring comfortable consolidation, and though there was some heavier selling in place from producers down the board as Oct’23 approached 24c the buyers remained undeterred. Mid-afternoon saw the publication of the latest Unica numbers showing that the 2hd half July producing 52.962mmt cane / 3.681mmt sugar / 50.65% mix / 144.02 kg/t ATR, in line with expectation for an improved tear on year showing and sparking a quick correction back to 23.82. The only disappointing figure in these numbers was the ATR, and whether it was this or the newswires becoming excited about the high probability of a strong El Nino the market quickly regathered to surge through 24c and on to a high at 24.20. This impressive showing was purely spec driven however and with no follow-on interest to continue their efforts there was a retreat to the 23.90’s during the final hour against long liquidation. The market remained here through the closing stages to record a mid-range settlement of 23.95 for Oct’23, positive but still with no sign that the move possesses the momentum required to challenge significantly higher.

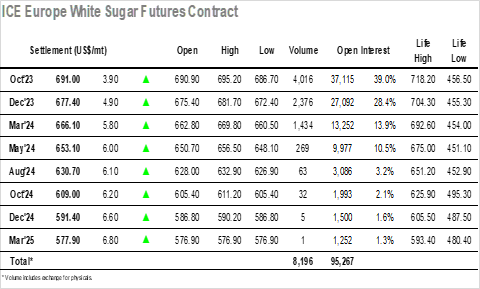

Opening buying saw Oct’23 spike to $693.70 and continue where last night’s strong close left off, briefly valuing the Oct/Oct’23 white premium above $168.00 in the process. The situation then calmed with a morning of quiet consolidation taking place either side of $690, the market maintaining mildly firmer values as day traders look to try and build the positive bias. This pattern maintained through into the early afternoon albeit with some additional choppiness, and it was only the arrival of spec/fund buying for No.11 that invoked some associated buying to our market to raise Oct’23 to $695.20 midway through the afternoon. Despite the rising flat price, the market felt weary with both spread and white premium values struggling to maintain recent gains, always worrying for the bulls with Oct/Oct’23 back to $161.00 and Oct/’23/March’24 recording a low at $12.10. The final part of the session saw the price action continue in the lower $690’s, and while this was a solid enough showing with settlement made at $691.00, the spread and premium suggest there is much work to be done if we are move back above $700 and challenge last week’s highs in the coming days.