There was selling around as we resumed to send prices quickly downward, and despite the presence of assorted scale buying as the losses grew there was no sign of ant sizable buy orders to reverse the trend. By late morning, the March’25 contract was sitting within proximity of 21.00, and this presented the opportunity for specs / momentum traders to explore the recent lows once again in the hope of drawing some additional selling to the market. As the US morning got underway, they pushed the price down to 20.82 but as has been the case for many weeks this failed to attract much reaction and so the price rebounded a small way against some short covering. The losses placed sugar at the bottom of the commodity table for the day with the lack of spec interest explained by the movements its softs siblings Coffee and Cocoa which by contrast were sitting right at the top and further building on their huge recent gains. No.11 meanwhile simply chugged along either side of 21.00 through the afternoon as the failure to challenge the recent 20.70 low caused some traders to cover positions and withdraw while others flitted about with some small and meaningless involvement. The later afternoon continued to play out in the same way, holding above 21.00 through the final hour to limit the damage but not fully disguising a poor performance as March’25 settled at 21.04.

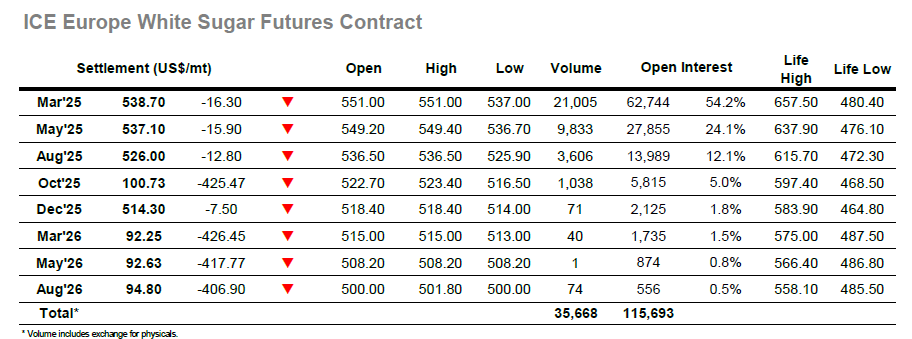

There was an opening drop through $550.00 as the market maintains the recent pattern of lower highs and lows in the $540’s which has seen the previous broad range contract considerably. Suddenly we were searching out consumer support once again and this only started to be found as March’25 reached the mid $540’s and slowed the rate of decline for the rest of the morning, though there was no hint of any resurgence. This had brought the recent $540.60 low mark back into view and the opportunity to test it was not being passed up by the smaller specs as they pushed the market down again during the early afternoon. Their efforts saw the former low surpassed with the price dropping to $537.00 despite not seeing any sell stops, with another period of sideways consolidation following as the sellers eased off the gas. This weakness was having a noticeable impact upon spreads and arbs, neither of which was showing as much resilience as usual as March/May’25 dropped to a small discount while the March/March’25 made new recent lows at $76.50. A short covering push brought the flat price briefly back to $542.70, however the value then slipped back to languish just above the lows with buyers showing no sign of paying up despite efforts by the No.11 to hold. This created additional weakness for the white premium which lost more ground and touched at $74.00 late in the day, and while the flat price held above the mid-session lows its settlement value at $538.70 looks poor on the chart and may well lead to additional downside testing.