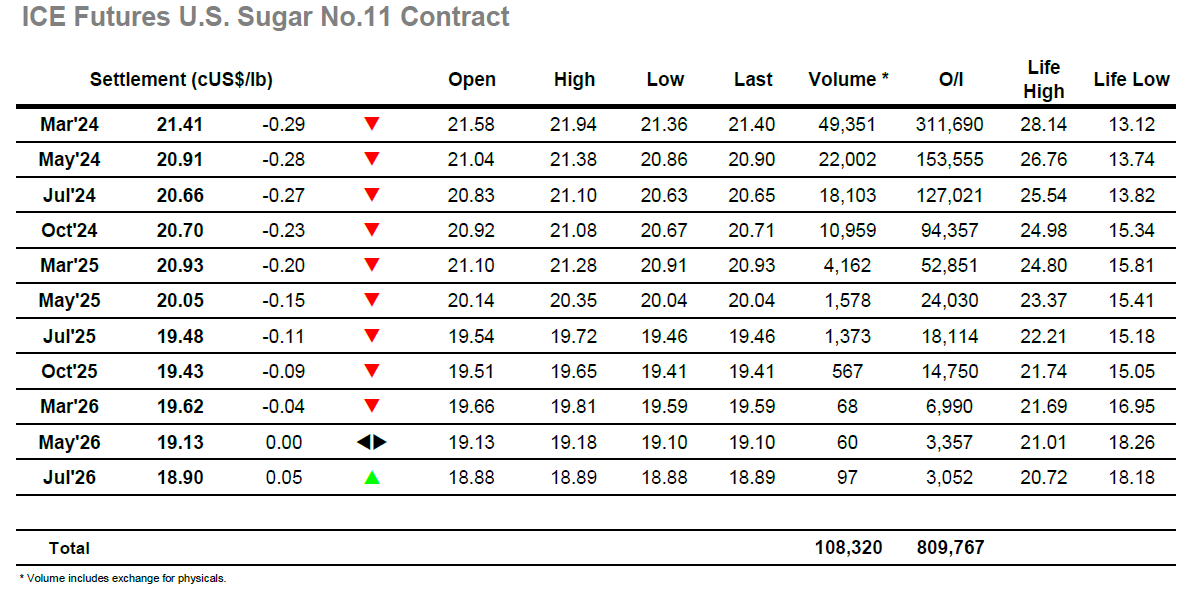

The day began with a dip to 21.54, reflecting the activity of last night’s post-close, however this was soon gathered up and the market returned to hold around overnight levels. Following a pause, the market picked up to move within a few points of yesterdays highs however with only light day trader buying driving things once again there was no effort to break 21.96 allowing for another period of slow consolidation to develop. In keeping with the year so far, the market remained quiet, and aside from a brief dip as the US morning began there was very little change to the market dynamic over the next few hours with a marginal new high at 21.94 still just shy of yesterdays mark. With the market not moving higher there was a retreat based upon long liquidation midway through the afternoon, though even this proved to be a slow placed affair as March’24 retreated to 21.56 over the next two hours. Though spreads were also seeing only low volume the decline did not impact the gains already registered with March/May’24 holding at 0.56 as the lows were reached. That was not to be the end of the flat price wobble with the final hour seeing the losses extend to 21.36, this time the pressure rippling into the spread which gave back its gains to sit around 0.50 points again. The close was calm to leave March’24 at 21.41 going out to conclude a day which leaves us still entrenched within the recent range.

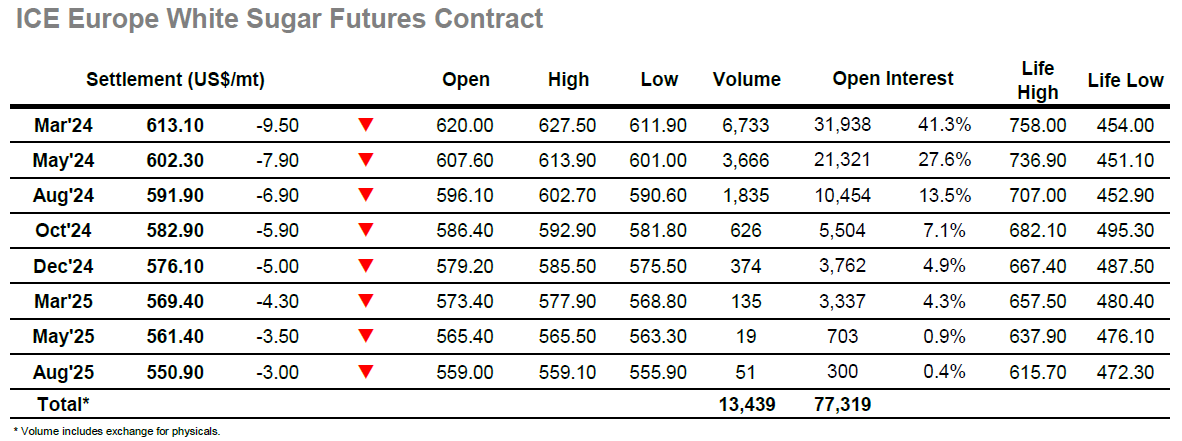

Lower opening prints were short-lived as March’24 levelled out near to overnight value, and while things were slow for the initial period the market was able to establish a level from which to push higher again. During the later morning March’24 was able to find the support to move up and match yesterdays $627.50 high mark however the volume was lacking to push any further and so there was an inevitability about the long liquidation which followed to send values back to the lower $620’s. With the flat price stalling there was a ripple effect into the spreads and premiums where March/May’24 was trading down to $10.60 while the March/March’24 WP was off from its morning highs and trading around $141.00. The lack of momentum encouraged specs to look lower instead, and the rest of the session became one of struggle as March’24 failed to hold the upper teens and then retreated to $612.00 ahead of the close. There was to be no turnaround on the call with March’24 settling at $613.10, cementing the market back towards the centre of the last two-week range.