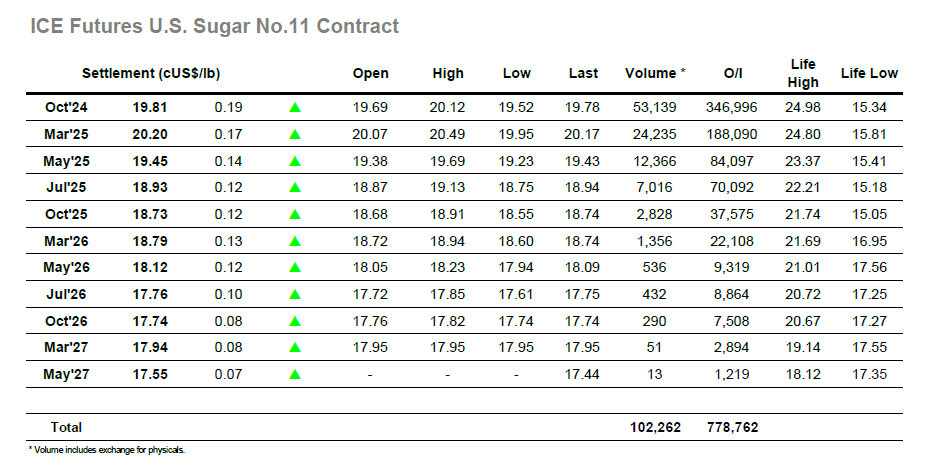

It was a calmer start to trading today with Oct’24 ranging between 19.69/19.52 during the early stages, though as the morning moved along the upper end of the range extended slightly to 19.77. This was in keeping with a market which appears to have ‘found its level’ for the near term, and the low volume reflected the lack of participation away from the specs / smaller traders. The calm scenario maintained into the early afternoon, broken only when the specs decided to test back higher and went in search of 20.00. Their efforts yielded some small success with highs at 20.02 achieved at a reasonable pace, though from here it became tricker as their own buying reduced while consumers/end users showed no interest in following and remained content to sit with downside scales. Specs proved more persistent than may have been expected through the afternoon in taking Oct’24 to a session high of 20.12, however their efforts came at a cost when the final hour saw an increasing pace of liquidation. The price plunged back into the 19.70’s during the final 10 minutes, and while settlement at 19.81 represents a daily gain the upshot is that we continue back within a range.

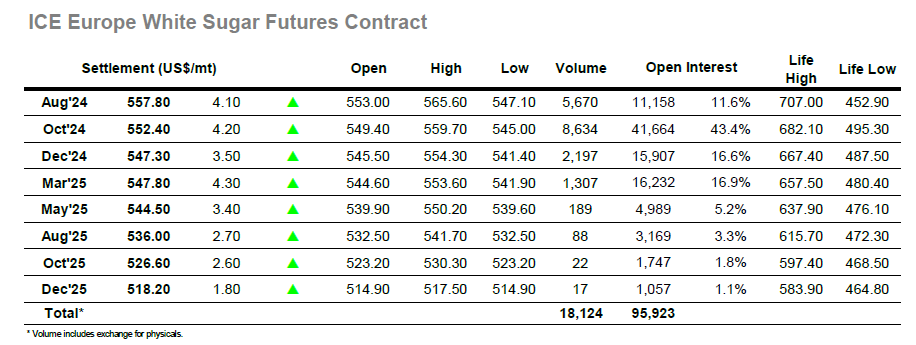

After a series of poor performances, the whites have been looking decidedly vulnerable, and this prompted some early selling which pushed Oct’24 down to $545.00. The market did look to dig in around this area and the rest of the morning was spent tracking along the mid/upper $540’s, nothing spectacular but a start to the market halting the decline. All remained calm through early afternoon but aided by the more supportive No.11 and some bargain hunting for nearby premiums the market did then begin to turn upward, initially slowly through the lower $550’s and then at a greater pace to reach $558.30. For the premium this served to bring Oct/Oct’24 back above $116.00, a limited recover but one which may start to restore some confidence. The Oct’24 continued to push the upper end for the rest of the session and achieved a high of $559.70 with the arb pushing through $118.00, though these levels were no held to the close as end of day position squaring arrived. Oct’24 settled at $552.40 while at the top of the board Aug’24 had a calmer day with Aug/Oct’24 spread ending little changed at $5.40.