A calm opening provided the base from which Jul’24 started to track higher again, steadily progressing to end the morning in the upper teens. There remain a significant number of speculative shorts in the market with Friday’s COT report showing very little change for the reporting period, leaving the net position standing at -81,725 lots, and though a little of this may have been covered since Wednesday the majority will remain as was. There was no change to the pattern moving into the afternoon as the slow climb extended to 19.30, however the picture was to then change as the buying eased and long liquidation took over. The days efforts were erased in less than an hour as the selling met with only thin buying and sent the price back to 18.83, and suddenly there was a whole new perspective in play. Some light buying did reappear to test the 19c pivot again, but having failed to push back through the market showed more vulnerability with a slide to new lows as the final hour arrived, and with the market now firmly back within the past months range the slide continued into the 18.60’s. Spreads also weakened with recent gains erased for Jul/Oct’24 as index rolling combined with outright selling to send the value back down to 0.04 points before Jul’24 made settlement just 3-points above the low at 18.60. With support not found until the 18c area this leaves the market in the centre of a now wider range as we move forward.

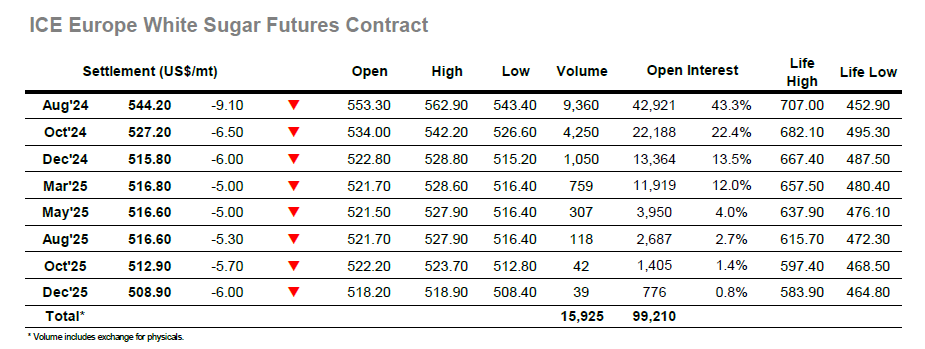

Having taken a back seat to the No.11 market over recent days the whites were attempting to get back on the front foot with an initial push up to $557.50, though volumes were still lower than ideal for a concerted move higher. The upside was then given fresh momentum as a late morning spike on 1,400 lots saw Aug’24 spike to $562.90, though the remained shy of last weeks highs and some profit taking followed. Still the market remained a positive air and through into the afternoon tracked along at the upper end of the range before pulling back as the buying eased. The slide had an impact upon the white premium with Aug/Jul’24 giving back the morning gains which had seen it valued above $139.00, now finding itself back in the mid $130’s instead. Additional pressure was applied through the final two hours as the market unsuccessfully attempted to hold at $550.00 before breaking down and slipping to lows at $543.20. Aug/Jul’24 slipped towards $133.00 on this weakness while Aug/Oct’24 also cracked to end the day at $17.00, movement which suggests the upside movement has ended for the time being. Aug’24 settled at $544.20, leaving room to both sides to resume the rangebound pattern of recent weeks.