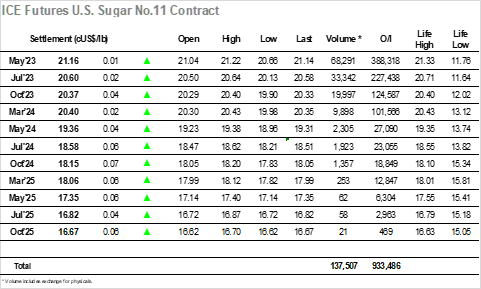

Early trading saw May’23 gap lower on the intra-day charts, slipping beneath 21.00 as the previously mentioned pattern of consolidation following new highs plays out again. For most of the morning things were quiet, low volume changing hands only as the price set near to 20.90 with participants waiting to see if the US day drew any fresh movements/activity. As it happened there was initially some selling that extended the range down to 20.66 in quick time, before defensive buying kicked in to pull the price back upward, keen to ensure that the structure remains intact for the end of the week. Further pushes followed through the rest of the afternoon to erase the losses and put the market back into small credit, putting the market in a situation to potentially end the week near to the contract highs. Session highs were made at 21.22 ahead of the close, with settlement made at 21.16 to provide a strong ending to the week. Tonight should see another COT report released as we continue to catch up on the backlog, though with the next set of data only covering the period to 21st February it is unlikely to show significant change to the position with the move higher commencing since that date.

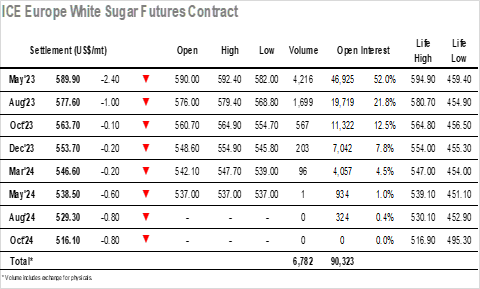

There was no continuation of yesterday’s buying and so the market once more went into consolidation mode, dropping back down through the $580’s to sit in the $584.00 area for much of the morning. There was no fresh news however that has not deterred the buyers in recent times, and while the market was enjoying a calmer session the general supportive nature the was now underlying the market keeps the technical picture looking firm. The early afternoon saw a small push down to a session low $582.00 though the recovery was even quicker as buyers stepping in top hold the market above yesterdays lows. With most of the activity being driven by specs this recovery from $582.00 provided the encouragement to push back up once more, targeting the gap to $591.10 that had been left on the intra-day chart. It took a while, but this was achieved later in the afternoon with the market reaching $592.40 before topping out against long liquidation. Again, the spreads were failing to match the flat price movements with May/Aug’23 dropping back beneath $12.50, though the market seems unconcerned by this so far. The highs went unchallenged through the later part of the day, although the market remained stable, settling at $589.90 as we head into the weekend with the positive picture still firmly in place.