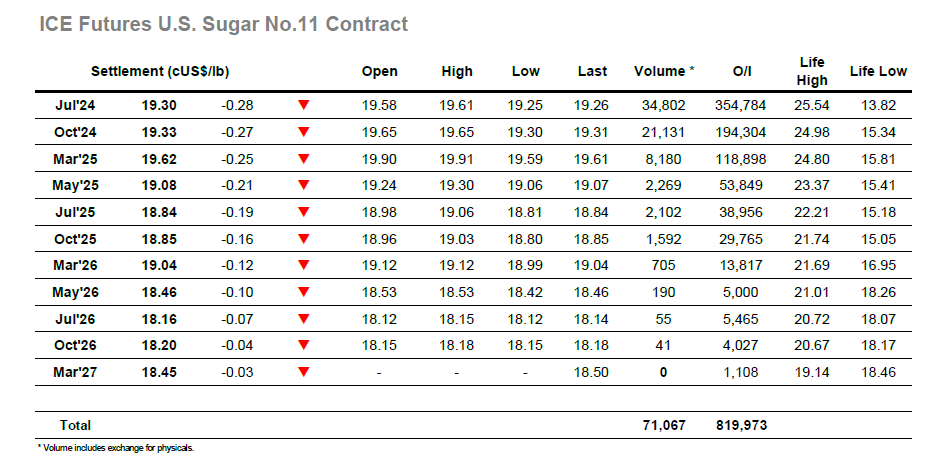

Opening at unchanged the market quickly settled into a tight trading band with very little sign of activity from either side. There was a small dip to 19.48 midway through the morning, but this simply widened the range to 0.13 points with the environment remaining featureless. It was only during the afternoon that Jul’24 broke new ground, with the movement still being generated by day traders/smaller specs. They pushed from the short side in keeping with current exposures and sent the price to 19.31 and the lowest levels since Monday. Nearby spreads were showing little change, and not a great deal of volume, and so as the market tracked along either side of 19.40 during the later afternoon most potential participants simply waited to the close to arrive. Jul’24 appeared set to end the week in the mid 19.30’s until some MOC selling emerged, establishing settlement at 19.30 and then recording session lows at 19.25 as the 19/20c band endures.

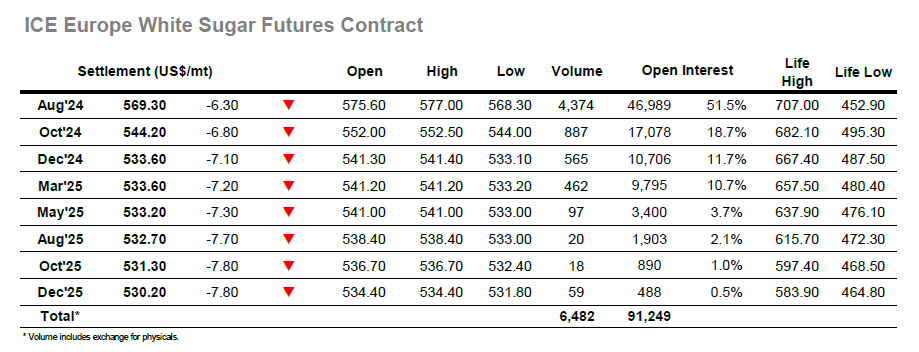

Another low volume start to a session saw Aug’24 slip from an early $577.00 high to $571.50, retracing the same ground seen over recent sessions. The market then embarked upon another extended period of sideways trading with activity taking place within the established range, with the only volume of any regard seen for Aug’24 where day traders met with some light hedging. For the rest of the board there was barely a whimper, and even spreads were only seeing odd lots change hands. Moving into the afternoon There was a little more selling emerging (long liquidation?) and so the range extended gradually downward, though the only moment of any excitement came with a small spike down to $568.30. The later stages played out at the lower end of the range as a lack of buying left values unable to recover, leaving a slow session to conclude at $569.30. White premiums showed little change with Aug/Jul’24 ending the week at $143.80 while the Aug/Oct’24 spread settled at $25.10.