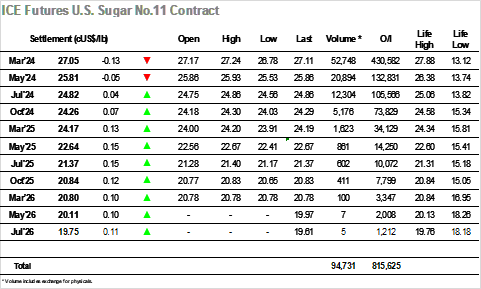

These has been a sharp turnaround in fortunes since last Wednesday with the 4-sesssion seeing March’24 move through a 200-point band from 25.28 to 27.28, and while the movement has created a strong technical picture there was no immediate continuation this morning. Instead, the March’24 contract simply bobbled along either side of unchanged through the early morning, and when some more dynamic activity arrived it was the downside which became active with some long liquidation dropping the price beneath 27c. On low volumes the price action then centred around the 26.90’s for a period, and though a recovery followed it was limited by apprehension from smaller traders ahead of the UNICA release covering the second half of September. This data came in a little better than anticipated, showing production for the period at 44.777mmt cane / 3.364mmt sugar / 51.12% mix / 154.25 kg/t ATR and led the market down to a new low at 26.78 soon afterwards, though the fall was brief with defensive buying coming back to prominence. The rally topped out again above 27c and the remainder of the session was spent flipping either side of 27c on inconsequential activity, beforeeventually concluding and inside chat day at 27.05

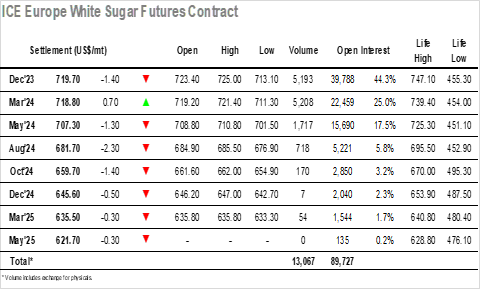

Opening buying too Dec’23 up to $725.00, breaking above yesterday’s highs and ensuring a steady start for the March/March’24 white premium above $120.00, however by late morning the lack of continuation buying left the market slipping back to be sitting in the upper teens. With outright volume proving light we continued in this area for a couple of hours, finding most directional movement generated by the No.11 market and tracking against that. There was however some solid volume changing hands for the Dec’23/March’24, more than 50% of the total for each prompt coming from that source alone as solid selling knocked the value back from and early $4.00 high to be at only a small $0.50 premium. New session lows were seen midway through the afternoon against No.11’s reaction to Unica, but these proved to be short lived and in a quiet environment the rest of the day played out within the range. March/March’24 was again attracting some buying interest which continued its recent recovery to $122.50, while for the flat price some late buying took Dec;23 back to the low $720’s, though settlement was recorded at $719.70.