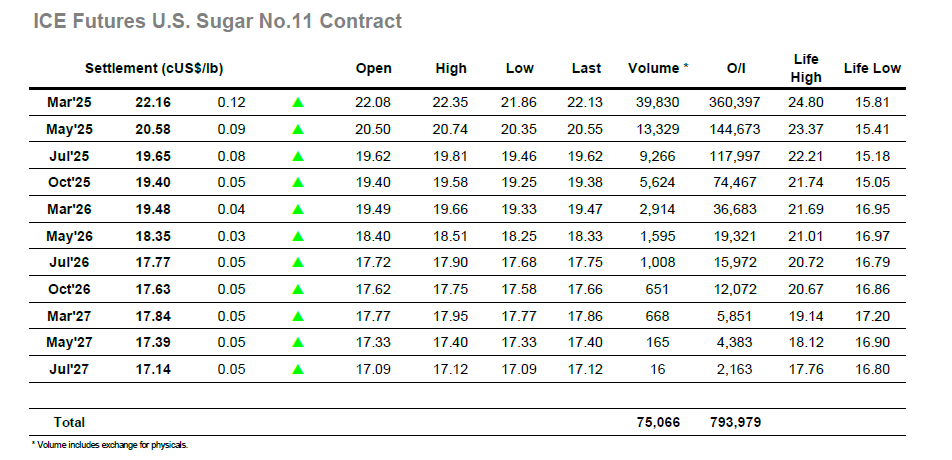

The market saw some opening gains as the lowest levels in a couple of weeks drew in a small amount of physical pricing, however this was completed in moments and soon the market slipped beneath 22c with morning activity settling into a narrow band centred around the 21.90’s. The price received a lift later in the morning as a short wave of buying proved sufficient to haul March’25 back up to 22.17, though congestion in the vicinity of the late September low then hindered any further progress and a new round of sideways trading developed. Volumes were light as the market stagnated for another three hours, but just as it appeared that would be the story of the day so another short but sharp burst of buying emerged to break the malaise and send the price through to 22.35. This move ended abruptly however over the next two hours the market dug in to hold in front of the earlier highs as longs looked to cement a move back above 22.14 to remove any negative technical connotations. The price flitted either side of this mark through the final hour before settling just above at 22.16, while March/May’25 closed the day marginally up at 1.58 points, leaving the market still appearing confined to a range having arrested yesterday’s fall.

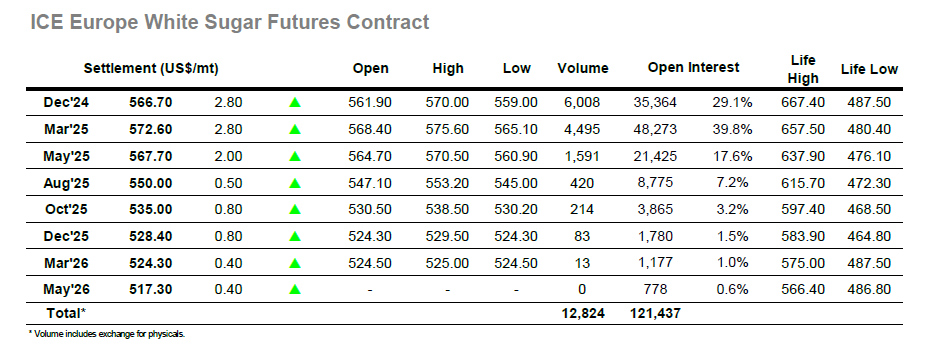

Following the bluster of yesterday’s session, it proved to be a calm and controlled start from Dec’24 with activities confined to a narrow band. A brief effort to move into credit stalled at $564.50 with buyers reluctant to push beyond the former low / previous support, and so the drift began with the front month finding some support around the $559 mark. Late morning saw the price rally to new session highs on barely 150 lots and wipe out the deficit, but rather than act as a precursor to a continuing rally this simply market a changing of consolidation area with prices now settling down to hold tediously in the $565 area. Fresh news was non-existent and so the market was showing no sign that it may find a way of generating more interesting movements until a No.11 inspired push saw us following upward to $570.00. The movement looked to be macro related with most commodities showing positively, and while it pulled prices to a healthy-looking credit the reality was that we were facing an inside day on the chart. The price dropped back from the highs during the final hour though remained in credit with Dec’24 concluding a slow session at $566.70 to leave the outlook unchanged for another day.