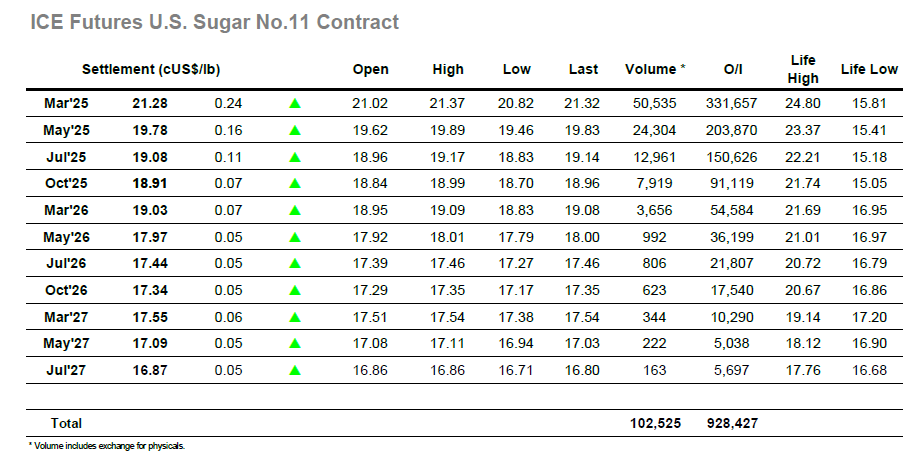

The day began with March’25 trading either side of unchanged, with the early part of the session then quietly steady as the price nudged up into the teens against hedge lifting and consumer pricing. By the middle of the morning the volume of buying was reducing and so the market began to slide back once more, initially holding near to 21.00 but then slipping back down into the 21.80’s to revisit yesterday’s lows as the Americas day was getting underway. These were matched with prints at 20.82 before the price rebounded against day trader short covering, with the movement showing unlikely pace due to a lack of resting sell orders and quickly matching the morning high. That was not the end of the movement as the small traders then attempted to drive the market up further, though as with their earlier efforts the lack of sizable volume soon led to the move stalling and yet more position covering. Such see saw movement continued through the afternoon as the price rebounded to a session high 21.37 though these highs were not maintained until the close, Still the market remained to the upper end of the range with March’25 achieving a settlement at 21.28, a more positive conclusion though still leaving the bottom of the current trading band within view.

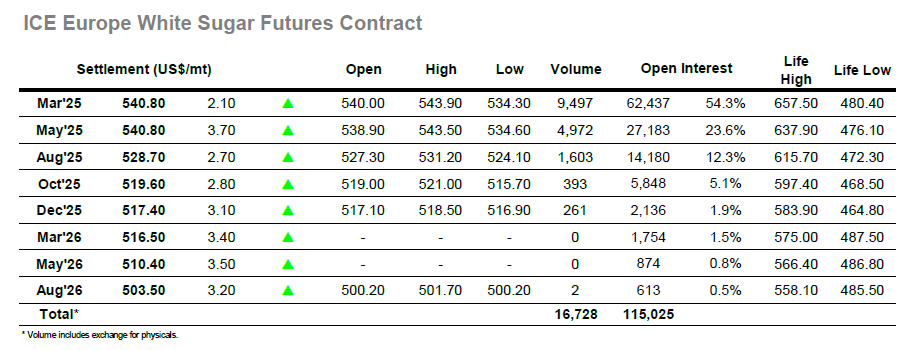

Opening gains did not sustain initially but the market was finding sufficient buying against physical activity to hold back in the $542.00 area. As this buying eased so too did the price with the initial drop back to overnight levels encouraging through fresh spec selling which had March’25 trading at another set of new recent lows by the end of the morning. The losses continued to $534.30 before short covering kicked in, and it had a spectacular impact as the price reversed in a straight line to $540.80. This may have placed the flat price value back into credit, but it was doing nothing for the spreads and arbs which were seeing a second consecutive day of struggle and losses. March/May’25 was trading at a low of -0.50c discount, while for March/March’25 the recovery failed to pull the value from its lows as it traded around $72.50. Through the afternoon the market swung in both directions without making much of an impact, though the upper end of the range did widen to $543.90 along the way. The close was somewhat mixed with many traders unsure of near-term direction for sugar given our ongoing technical vulnerability mixed with a more resilient No.11 picture, leaving March’25 to settle at $540.80 and March/March’25 still weakening at $71.70.