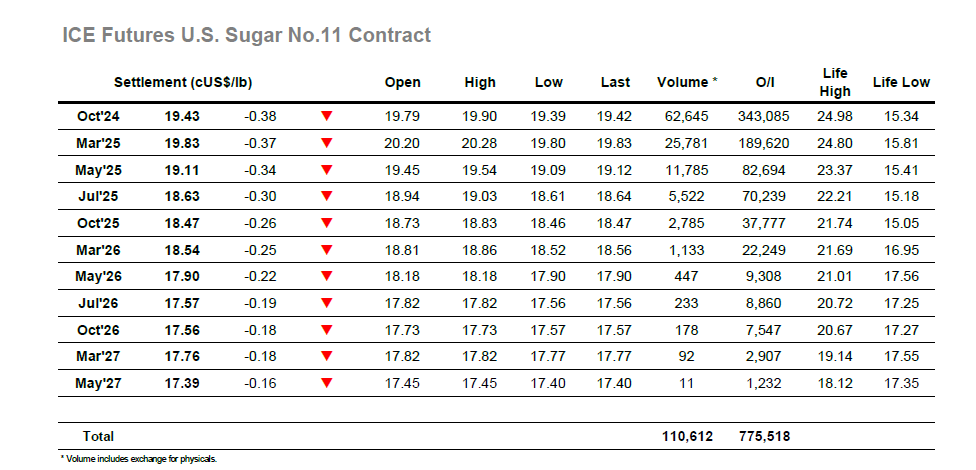

The market was quietly steady during the first 30 minutes as Oct’24 printed upward to 19.90, however once the initial hedge lifting for overnight business had concluded the picture started to change. There was no significant fall, but having moved to new session lows the price continued to edge downward into the consumer pricing and to leave Oct’24 in the upper 19.50’s by the end of the morning. A test of yesterdays 19.52 low followed with a short burst of selling sending the price to 19.40, however there was an abrupt about turn back into the range and the price was sitting back in the 19.60’s ahead of the publication of UNICA data for the second half of June. This showed Cane at 48.806 mmt / Sugar 3.247 mmt / Mix 49.89% / ATR 139.96 kg/t / Ethanol 2.307 mlt, placing them above the same period for 20023 and largely in line with expectations. The market reacted with a brief spike to match the earlier 19.90 high, but given these figures were not bullish the price quickly tumbled back to sit in the lower 19.60’s once again. Further price erosion followed and by the time we reached the close Oct’24 was matching session lows to leave the chart picture looking weak. Settlement was recorded at 19.43 for Oct’24 with the Oct’24/March’25 spread at -0.40 points heading into Friday.

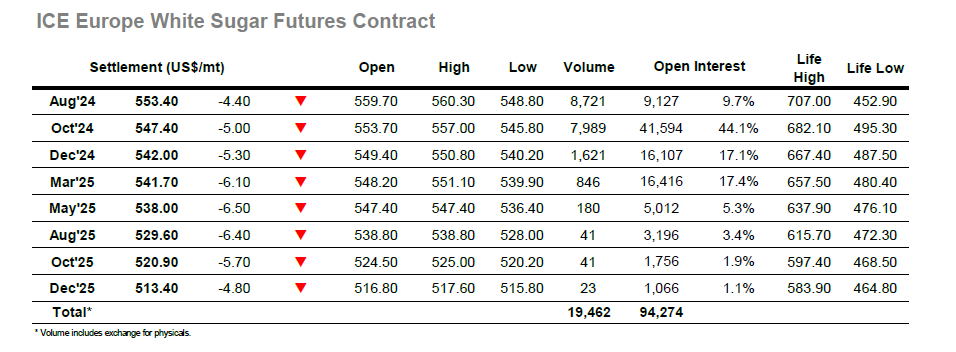

Mild opening gains could not be sustained, and the market proceeded to give back some of yesterdays recovered ground, falling to the $548.00 area before attempting to hold. This led to a somewhat featureless morning on low volumes, with the rolling interest now reducing as Aug’24 moves nearer to expiry and so leaving mostly the day-to day activities taking place. What interest there was for the spread was taking place a little lower with Aug/Oct’24 dropping back to $2.50, though with open interest now standing at just 9,127 lots it is likely to remain this way as part of an orderly expiry. Early afternoon saw a brief drop to $545.80, however Oct’24 then saw buying arrive to recover to the range before bouncing up to a session high at $557.00 in conjunction with No.11 following the UNICA report publication. These highs could not be sustained and the sloppy nature of proceedings across the past week came back to the fore during the final part of the session. Prices slipped back to within a dollar of the lows on still limited confidence, however the performance was better than many recent efforts, represented by a firmer Oct/Oct’24 white premium which traded up to $119.50 late in the afternoon. Oct’24 settled at $547.40 with Aug/Oct’24 marginally wider at $6.00, and while it was a lower close it represented an inside chart day as the market attempts to dig in.