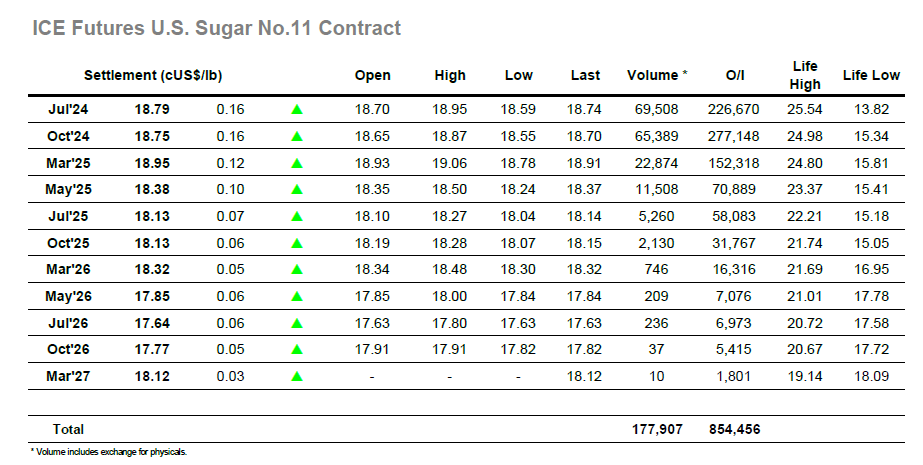

Having slipped back into the recent range we saw a market struggling to find its way forward, and the early part of today’s session saw reticence amongst traders with a nudge to the low 18.70’s which failed to yield any interest to either direction. Monotonous trading ahead of the US morning was then forgotten and on slow conditions the Jul’24 contract continued along established routes and slipped back to 18.64 before finding some buying that ignited the price higher to 18.86, at which point progress one more stalled. Thew afternoon drew a little more fun with a spike to 18.95, though generally the picture remained quite quiet, and the market found sufficient interest from both sides to confine to a narrow band. This area centred around 18.90 and only widened during the last hour as small trader choppiness led the market to experience greater fluctuation ahead of a close in the 18.70’s. Small trader buying ahead of the close enlivened another slow session, and the day ended with Jul’24 to the centre of the days range at 18.79, leaving the wider technical parameters unchanged into tomorrow as technical parameters provide scope for potentially insignificant near term movements.

Yesterday’s movements had clearly suppressed the white’s market and a morning spent back within a tight band basis the mid $540s was not the antidote to the predicament in which we currently find ourselves. A nudge higher ahead of noon proved to be a token change and it was only during the early afternoon than the market showed some additional resilience with an extra print higher. The early afternoon period drew some significant volatility as Aug’24 pouched ahead to a $553.00 high, though whatever the motivation behind the buying the move was flawed and prices quickly flipped back to the centre of the range. Things calmed through the closing stages with Aug’24 ticking along to a close at $546.50. This leaves Aug’24 exposed to moves in both directions given the lack of nearby liquidity, and for several dollars either way the movement will have limited impact having rejected the rally and returned to the recent range.