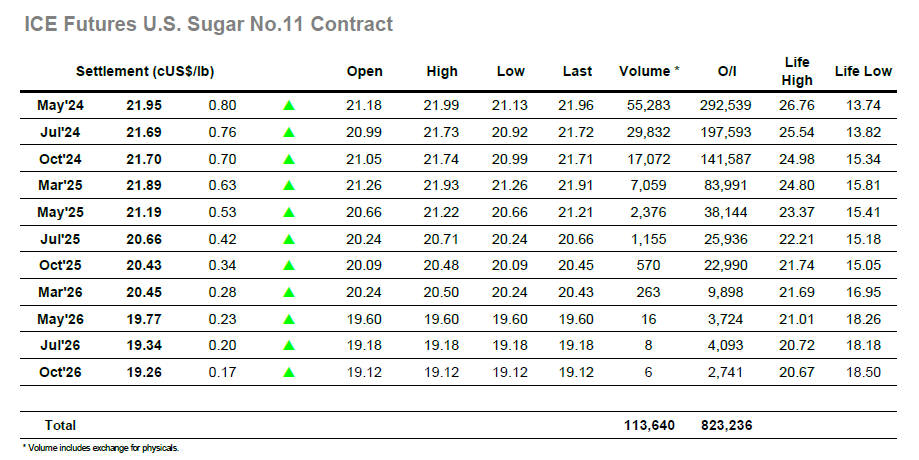

Having opened either side of unchanged the market quickly found some light buying which had a remarkable impact with the price pushing higher through a vacuum of selling to reach 21.58 just 45-minutes into the day. Friday’s COT report could aptly be described as neutral as it showed the speculative sector to be just 88 lots net long, and despite the gains this morning the volume suggested that very little had been added to this number. The rest of the morning saw prices track sideways near to the top of the range, though there was a sense that the movement would provide a platform for the specs to drive ahead during the afternoon and take values further from the recent lows. This duly occurred, with some steady spec led buying sending May’24 onward into the 21.80’s, and while this merely brought us back to the highs from 1st March there was some selling interest starting to filter in which slowed the progress. Spreads were only making mild gains despite the flat price strength with intra-day highs at 0.40 points for May/Jul’24 and 0.01 points for Jul/Oct’24, however this did not hinder the flat price with progress maintaining steadily. Maybe it is the lack of position being held by specs presently but there was hardly any profit taking seen ahead of the final hour when buyers returned with a little more interest to ensure a strong conclusion. May’24 recorded an eventual high at 21.99 in the final stages and with settlement made at 21,95 there is technical scope to take values back above 22c in the near term.

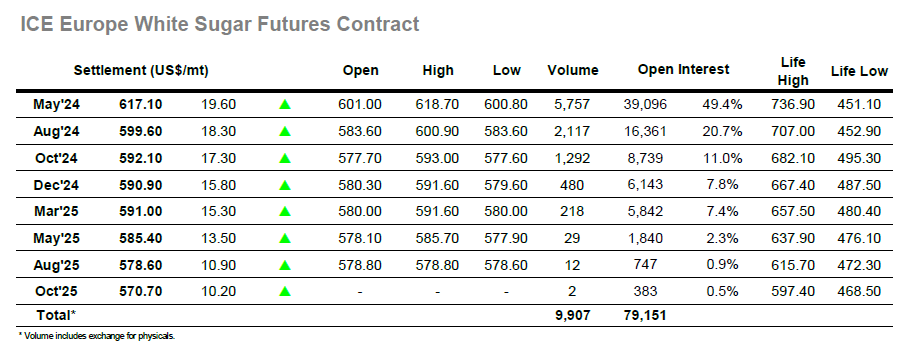

No.11 values were already working higher, and the whites reacted with a gap opening for the intra-day chart followed by a rapid price rise to $613.30 for May’24, almost $16 above Fridays closing value. This took the white premium values back up by a few dollars and having traded at yearly lows on Friday the May/May’24 was valued back above $135.00 while Aug/Jul’24 returned to $123.00. Such rapid progress could not continue, particularly given that it was being made against low volumes, however the market did look to consolidate the ground recovered with prices holding above $607.00 for the duration of the morning. Buying returned during the afternoon with US specs bringing fresh impetus, and this enabled May’24 to work above last weeks $614.00 mark and generate some technical impetus into the first noteworthy selling we had seen. The gains became more gradual but aside from a brief corrective dip the market moved on to a high at $618.70 to show gains of more than $20. These were maintained through the final hour, during which time we twice matched the high, and with a strong settlement recorded at $617.10 the specs will likely look to continue this progress across the coming days.