A quiet opening saw March’25 trading wither ide of unchanged, however it was not long before prices started to work their way upwards with yesterday’s performance having sufficiently enthused the spec sector to platy from the long side again. Selling was limited and so by the middle of the morning we saw the market trading up to 22.58 with the mood far more positive. Another push was to follow which extended the gains to 22.68 by noon, though at this stage the progress stalled with mild selling emerging and capping things off. A gradual retreat into the range followed with volume light as traders awaited the latest set of UNICA data. It revealed second half September numbers as cane 38.828 mmt / Sugar 2.829 mmt / Mix 47.79% / ATR 160.01 kg/t / Ethanol 2.235 mlt, down on last year as expected and also marginally below estimates. Despite this there was no positive interpretation from the market and instead the market simply continued to meander along within the range, All was quiet until the final hour when the price collapsed to 21.91 against around 6,000 lots, though whether long liquidation or otherwise its impact was brief and March’25 rallied to sit comfortably back above 22c heading into the close. Settlement was reached at 22.24 to show a mild gain, and after such a slow day many will be hoping that the London Sugar week gathering may inspire some fresh impetus next week.

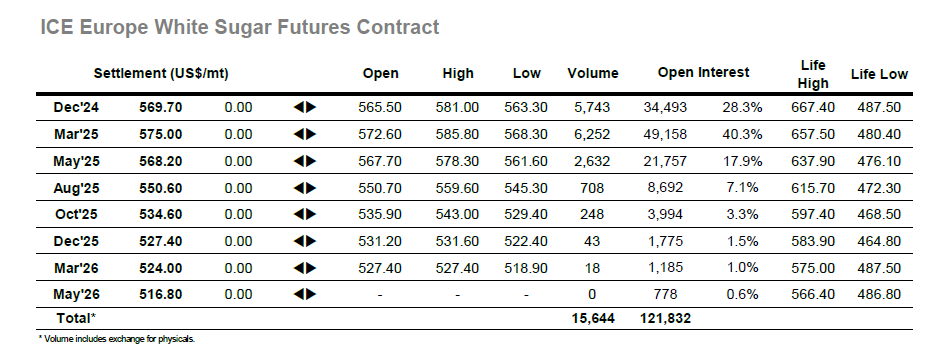

Small opening losses were swiftly erased, and the market had a positive leaning about it as mild buying moved the price up into the mid $570’s with little more than an hour having elapsed. Traders were content playing the long side and keen to build upon the recovery and while the market was not able to continue pushing at the same pace it did make its way to a high at $581.00 early in the afternoon. This was still some way shy of the weekly highs and proved that despite the recovery it may prove tougher than some think to get the market punching higher again. Though the market slipped back to spend an extended period trading within the range through the afternoon there was some positive movement for the white premium where March/March’25 was trading above $85, however the spreads were flat as Dec’24 struggles to find support against the physical picture to leave Dec’24/March’25 still beneath -$5.00. All remained calm until the final 30 minutes at which stage some pre-weekend liquidation sent the price plunging to $563.30, although it bounced as this concluded and settled at $569.70. This represented a more modest gain than many would have been hoping for and sends the market into the weekend appearing rangebound.