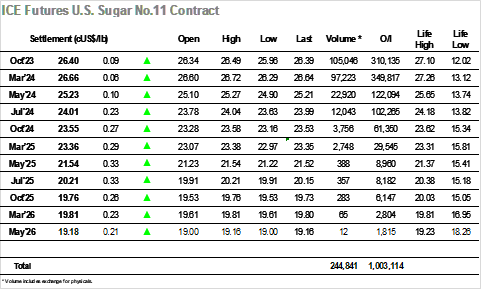

Having seen plenty of volatility between 26/27c last week the market opened rather more calmly this morning, focus remaining on the Oct’23 index spread roll which was entering its second day. Recent activities have seen the fund/spec long positions increase as anticipated with the latest COT report showing a net long at 187,694 lots (+33,074), though the trading patterns across the ensuing three sessions suggest that the larger funds have currently reined in their buying activities. Having been trading calmly either side of unchanged during the early morning the market became more volatile with some sharp drops during the late morning / early afternoon which saw the market trade as low as 25.96. In keeping with the recent trend these dips drew out some buying interest and from the base the market was able to recover, this time aided by day trader / system buying which took the price all the way back to 26.49. In line with the flat price recovery the Oct’23/March’24 spread was trading more firmly, and though it saw a substantial 76,000 lots screen volume it was trading at -0.26 as we ended the day. Oct’23 meanwhile ended positively at 26.40 having spent the rest of the afternoon holding the upper half of the range, a steady close that leave the market still entrenched within the 26/27c band.

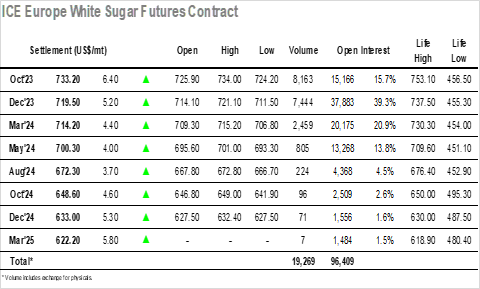

The market chopped around during early trading with Dec’23 seeing a $6 range either side of unchanged during the first couple of hours, albeit against mainly spread driven activity. By later morning things started to pick up with nearby prompts garnering support from specs, enabling Dec’23 to reach new daily highs at $721.10, while white premium values also re-gained some ground having haemorrhaged during the back end of last week. These higher levels proved to be unsustainable with the flat price support still lacking, and as the Oct/Dec’23 roll continued at around $14 so the flat price eased back down into the morning range. Daily lows were recorded early in the afternoon at $711.50 though they were seen on briefly and buying returned to ensure a firm conclusion to the day as steadier trading led to a $719.50 close, though with the range representing an inside day this merely suggests a continuation of recent parameters. White premiums also maintained a good proportion of the early gains to close at $151.20 for Oct/Oct’23 and $126.50 for March/March’24.