There were few buyers for the market as the new week got underway, a combination of a muted macro and possibly the influence of the still high fund participation (last week’s COT showed a slightly higher spec long at 161,063 lots) discouraging any fresh buying interest. This led prices to drift along in the 19.40’s for most of the morning on another low volume, harsh to say when we are only at 12th December but the market was providing a feeling that many have written off the rest of the year already. There was a small spark of activity in line with the US day commencing which saw a jump to 19.54 closely followed by a new low at 19.31, though rather than inspire some fresh impetus it was merely disregarded with the market settling into another tight sideways band just ahead of session lows. UNICA numbers for the second half Nov’22 were published and came in slightly higher than expected showing Cane at 16.227mmt / Sugar 1.030mmt / Mix 47.64% / ATR 139.87 and this seemed to kill any thoughts of recovery, the sentiment of a stronger than expected tail keeping prices under pressure. March’23 remained in the 19.30’s right the way through to the close, settling at 19.38 with a little of last weeks positive sentiment removed but still entrenched within the recent 19.05/19.94 band.

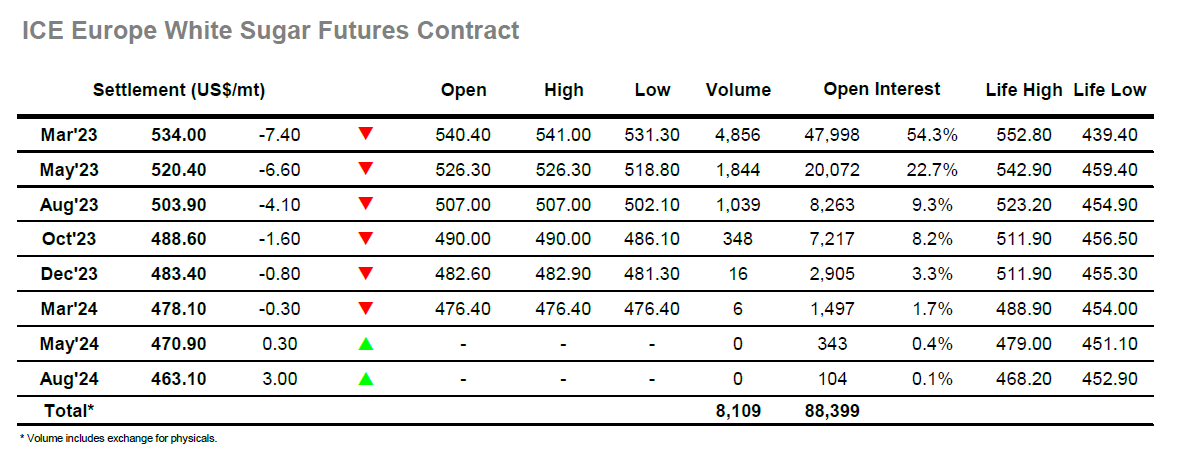

The lack of any macro spark and maybe a sense of fatigue from recent failures to punch up out of the range seemed to have shattered confidence this morning with initial losses soon starting to mount up. There were few buyers to be found and so following a pause in the $537.00 area March’23 continued its decline for the rest of the morning, light spec long liquidation noted on route to a low at $531.30. This weakness also narrowed the nearby spreads and premiums with March/May’23 trading down to $11/20 and the March/March’23 premium nudging $103.00 as it retreated down through its own range before some stability returned. The lower levels drew out a little consumer pricing interest which enabled the market to pull back up slightly through the early afternoon, though in quiet trading the gains proved to be limited and prices became encased within an increasingly tight band. Some light end of day buying from day traders pulled March’23 from the lows to settle at $534.00, ending the day calmly to the lower end of the current band.